Bitcoin price has crashed this week amid ongoing jitters about the bond market and a relatively hawkish Federal Reserve.

Bitcoin (BTC) fell below $95,000, triggering a steeper sell-off among altcoins. However, there are signs that the coin may bounce back and possibly hit $122,000 in January.

Bitcoin balances on exchanges are falling

One key reason why BTC’s price may rebound in January is the ongoing imbalance between demand and supply. Demand has continued to rise this year, as evidenced by growing ETF inflows.

Spot Bitcoin ETFs have added a net $1.3 billion in assets this year, while companies like MicroStrategy have continued rising. Bitcoin whales have also continued to accumulate, adding 34,000 coins since December.

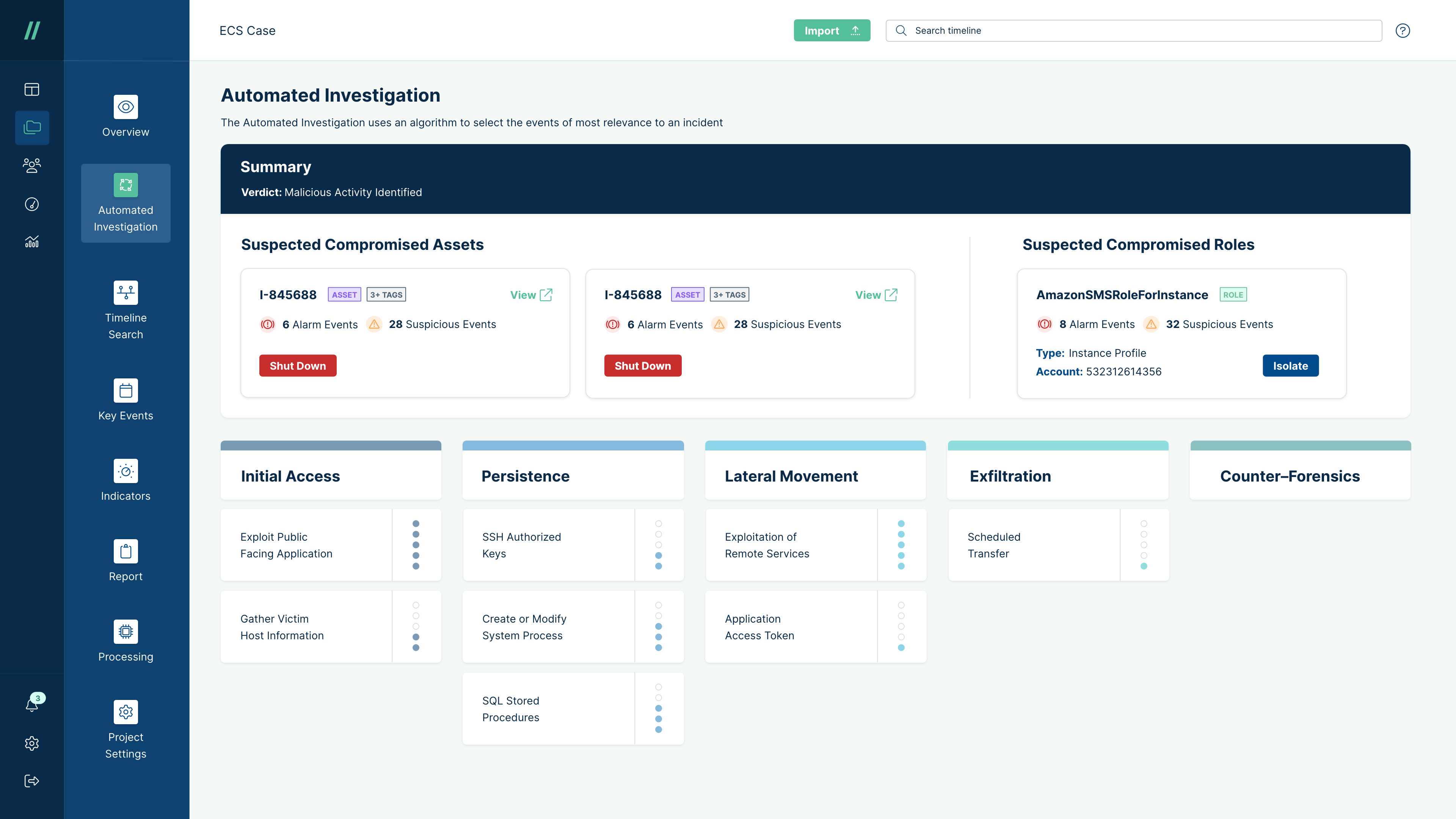

Supply is also shrinking, as seen in Bitcoin balances on exchanges. According to CoinGlass, the number of BTC coins held on exchanges has dropped to its lowest level in years. Balances now stand at 2.1 million, down from 2.72 million in January 2024. Therefore, this imbalance between demand and supply could soon benefit Bitcoin.

FTX distributions and Donald Trump inauguration

Another major Bitcoin price catalyst is the upcoming distribution of $16 billion from the FTX Estate to investors and creditors. Most of these funds are currently held in stablecoins like Tether (USDT) and USD coin (USDC). While some of the recipients will convert them into cash, some of the money will be changed into cryptocurrencies like Bitcoin.

Additionally, Donald Trump will be sworn in on January 20, ushering in a new era of crypto regulations. While much of this has already been priced in, there is a likelihood that BTC and other altcoins will rise ahead of the event and Gary Gensler’s resignation.

Bitcoin price has strong technicals

Bitcoin’s technical indicators also suggest the potential for further upside in January. On the weekly chart, BTC has formed a bullish pennant pattern, shown in blue. This pattern consists of a long vertical line followed by a triangle-shaped consolidation. The recent sideways movement is part of this pennant formation.

Bitcoin’s uptrend is being supported by the 50-week and 100-week Exponential Moving Averages, a sign that the bullish trend is intact. The Market Value and Relative Value indicator is moved to 2.4, meaning that it is still cheap.

Most importantly, Bitcoin has yet to reach the target of its cup-and-handle pattern. The cup formation has a depth of 75%. Measuring the same distance from the upper side of the cup points to a target of $123,000.

Source: https://crypto.news/3-reasons-why-bitcoin-price-may-surge-to-123k-in-january/

Leave a Comment