The election-hit H1 FY25 saw the Central government and State government capex decline 15.4 per cent and 10.5 per cent year on year, meeting just 37 per cent and 28 per cent of their budgeted annual target respectively. But the slack is expected to be picked up from Q3 FY25. While it is old news that the Central Electricity Authority has estimated investments around ₹9.1-lakh crore in transmission and distribution (T&D) during FY22-32, with sustained and regular tendering in renewable energy projects, power infrastructure is the need of the hour as the steep power capacity targets need to be backed by efficient power evacuation.

In our Big Story dated October 21, 2024, we had covered the renewable energy (RE) twist to the power story, and how the structural thesis is not just limited to the gencos but spread wide across the ecosystem. Here, we take a step down and cover the beneficiaries from the ancillary segments to the power sector.

Ambitious targets

India’s power transmission grid is one of the world’s largest synchronous interconnected electricity grids. The gap between power supply and demand has decreased consistently, from over 10 per cent in FY10 to 0.5 per cent in FY23, thanks to the One Nation-One Grid-One Frequency initiative, which helped solve regional disparities by integrating the five regional networks, apart from the obvious investments into expanding the generation capacity. Now, with a faster increase in demand expected over the coming decades, the integration of RE into the grid and the One Sun-One World-One Grid initiative, the T&D industry is back in the mix with huge capex planned, after a brief drop since Covid-19.

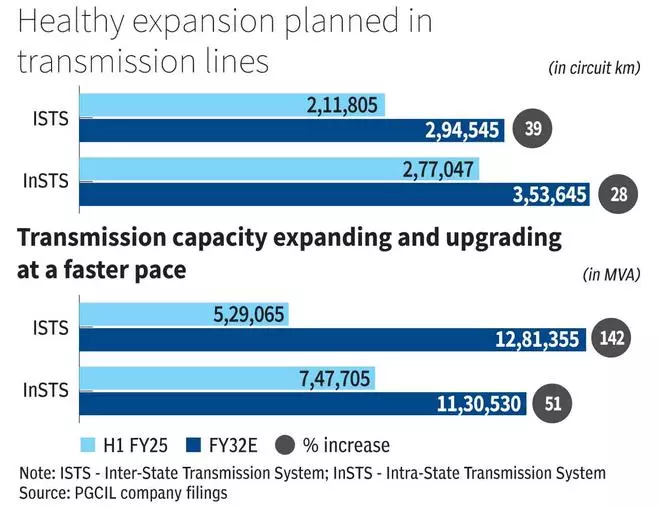

Targets for 2032, set via the National Electricity Plan (NEP) for FY22-32, call for integration of renewable energy into the grid, with specific numbers for various segments of T&D. The length of transmission lines, an indicator of connectivity, in the inter-State transmission system (ISTS) and intra-State transmission system (InSTS) segments are set to be extended by around 39 per cent and 28 per cent respectively to 2,94,545 circuit kilometres (ckm) and 3,20,182 ckm by 2032. The transmission capacity, on the other hand, determining how much power can be transferred across the transmission lines, is expected to almost triple in the ISTS segment to 12,81,355 mega volt ampere (MVA) and improve 51 per cent in InSTS to 11,30,530 MVA by FY32.

Renewables (solar, wind, biomass, hydro, green hydrogen, ocean) add up to an installed capacity of around 203 GW (out of total installed capacity of 454 GW) as of October 2024; this number could reach 500 GW by 2030. Solar and wind, currently, constitute around 31 per cent of the total installed capacity although their contribution to power generation is about 11-13 per cent. As per a SBI Capital Markets report, 20 per cent supply into the grid, predominantly from solar energy, could frequently disturb the stability of the grid and at 30 per cent, the grid could become unstable on account of uneven loading, with supply bludgeoning during sunlight hours, come 2032. This calls for energy storage systems, apart from stable gridlines, to handle the fluctuations, another space where enormous technological innovation is at play.

The transmission play

The first line of beneficiaries are the transmission players, led by the bellwether Power Grid Corporation of India (PGCIL) and followed by Adani Energy Solutions, Sterlite Power, Tata Power Transmission, ReNew Power and GR Infra.

Tenders via tariff-based competitive bidding (TBCB) route account for around 90 per cent of the total ISTS projects awarded, thus ensuring and promoting private participation. Critical projects (like the recent Leh Ladakh Green Energy Corridor), however, are still awarded to PGCIL, under regulated tariff mechanism (RTM), where projects are offered at cost-plus margin ensuring recovery of all costs and a fixed return on the project cost.

While the asset developers are allotted these projects, the developers further sub-tender for various components, systems, EPC and installation, amidst others.

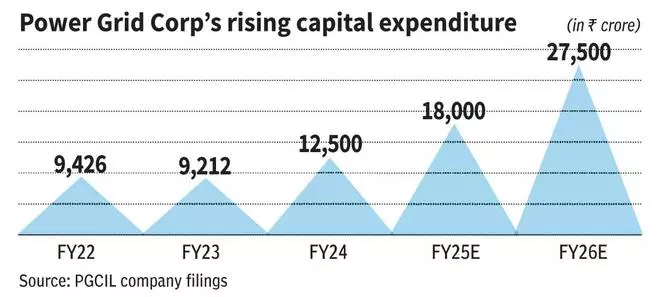

Since the advent of TBCB, PGCIL had won around 40 per cent of bids till FY23, while private players filled in the rest. But in the last two years, PGCIL’s win ratio has improved and as per the management, the same is at over 50 per cent currently. After a capex slowdown resulting in ₹9,000-odd crore of capex each in FY22 and FY23, PGCIL ramped up capex in FY24 to ₹12,500 crore in FY24. While it is still lower than the ₹25,000-odd crore capex spree in FY18 and FY19 each, H1 FY25 saw a strong ₹10,002-crore capex, showing signs of revival.

The players

PGCIL will remain the key beneficiary in this space. While Adani Energy Solutions is the only other listed core transmission player (largest private player at it) in India, it is trading at significantly high valuations. Tata Power Transmission, on the other hand, is housed under Tata Power Company (TPCL), and hence only a consolidated exposure can be taken here. The revenue for these asset developers is in the form of tariffs received from long-term (typically 35 years) transmission service agreements, based on the availability of the transmission lines.

Infrastructure Investment Trusts (InvITs) offer a stable, defensive and proxy play on T&D. These are transmission assets hived off into separate investment vehicles by asset developers to mobilise funds. Powergrid InvIT, promoted by PGCIL, and India Grid Trust (Indigrid), promoted by Sterlite Power and KKR, are the only two listed players in this space. The revenue model for InvITs is akin to those of the asset developers; but they must distribute at least 90 per cent of their net distributable cash flows (in simple terms, earnings less expenses).

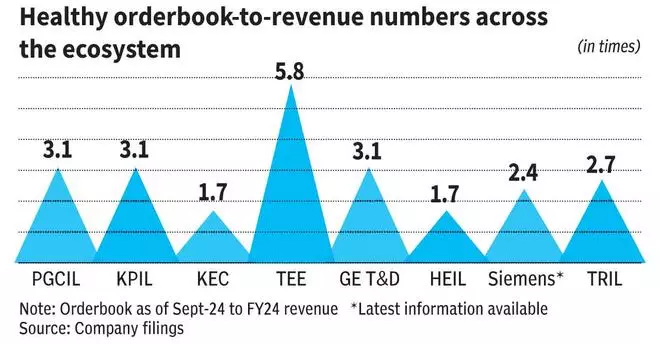

Engineering procurement and construction (EPC) players, specifically KEC International, Kalpataru Projects International (KPI) and Techno Electric & Engineering (TEE), are downstream beneficiaries in this space. Though KEC and KPI are diversified into civil, railways and water projects, and TEE into smart metering and data centres, they remain key contractors in the T&D space, and T&D still contributes to around 40-50 per cent of their topline. While they have diversified since FY20, all these companies are sitting on record order-backlog as of H1 FY25, powered by T&D orders since FY24.

The transformation play

Losses during electricity transmission are inescapable. However, substations help reduce them. Substations, through transformers, help in stepping up and down the voltage in the grid, to efficiently transport electricity, route, re-route and deliver at the appropriate voltage levels. With around 40 per cent of the grid infrastructure aged over 20 years, as per a recent Nomura report, the demand is backed by targets to also upgrade and improve efficiency, apart from expansion.

About 14 GW of high-voltage direct current (HVDC) lines were added during FY17-22, bringing the existing HVDC transmission network capacity to 33.5 GW. NEP proposes to add around 33.3 GW of this HVDC — doubling down by FY32. HVDC power transmission systems use direct current (DC) for electric power transmission system and not the common alternating current (AC) as in HVAC. While AC is cheaper and easier on voltage control, DC is more efficient over long distances and lower on technical losses.

In the past, HVDC lines that came up for tender were scarce — around once in four years — mainly because of the complexity and longer gestation period. But in the current FY, three projects are out for tender. PGCIL has been awarded one, while the remaining two are still under bidding. While being complicated, HVDC projects are ideal for underwater or underground cables and connecting remote RE sources amidst others, thus more appropriate at this juncture of power landscape in India.

The players

Siemens, Hitachi Energy India (HEIL) and GE Vernova T&D India (GE T&D) are prominent players in the supply chain leading to HVDC projects (around 50-60 per cent of the HVDC capex). All the companies, supported by the technological expertise of their parent companies, offer a comprehensive portfolio of products in HVDC technology, voltage-sourced converter technology, grid stability and modernisation, such as switchgears, transformers, SVCs and STATCOMs for grid stability, amidst others.

GE T&D’s order inflows grew 333 per cent year on year in Q2 FY25. Order backlog as of September 2024 has tripled from March 2023 and is now at 3.1 times FY24 revenue. HEIL, which diversified into railways, data centres, renewables and industrials, too had a strong rebound starting from FY24. HEIL also offers end-to-end battery energy storage solutions with a recent acquisition by its MNC parent in this space. Orderbook to FY24 revenue is 1.7 times for HEIL. Siemens, similarly, has a healthy orderbook to September 2023 revenue (latest data available) of 2.4 times. Siemens follows October-September as its reporting period. All the companies boast of record order backlog.

Transformers & Rectifiers (TRIL), also operating in the transformation space, manufactures transformers and reactors, for various applications. One of the very few Indian companies with capabilities to manufacture high-voltage transformers, matching that of competitors like Siemens and ABB in India, it is also expanding its portfolio to RE-specific transformers. TRIL recently acquired a leading manufacturer of a key raw material — cold rolled grain oriented (CRGO) steel (which accounts for around 35 per cent of the overall cost) — in line with its plan to be significantly backward integrated.

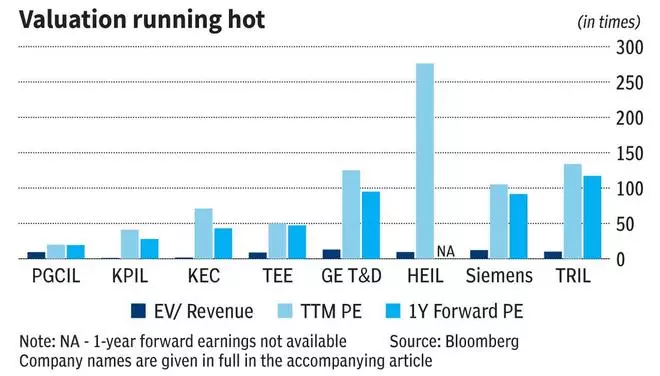

The strong business trend is well captured with all the above companies trading at exorbitant triple-digit TTM PE. This T&D cycle, both within India and outside, has revived the slump and is now pushing for new investments by these companies to meet the accelerated demand.

Our take

We had recommended investors to partially exit PGCIL and TPCL in June and May 2024 respectively, purely on valuation concerns. Both stocks have remained flat since our last recommendation. Since our last call to accumulate on both the InvITs, Indigrid has returned 10 per cent while Powergrid has stayed flat. Powergrid is eating into its reserves to retain the stable yields, while leverage is more than sufficient to add assets to its portfolio but is yet to. Meanwhile, Indigrid has been able to add assets consistently and its yields on an actual basis have been on the rise accordingly.

Transmission developers, especially PGCIL, offer a direct play on this huge capex runway. InvITs offer the defensive and annuity-style investment option. EPC players, while sitting on record orderbooks, still face execution risks and have to navigate through raw material volatility concerns. Their balance sheets are very close to the strongest they have ever been, if not the strongest, with all – KEC, KPI and TEE — recently concluding fund raisers through QIP. GE T&D, HEIL, Siemens and TRIL, like the EPC players, are also sitting on record order backlogs. And H1 FY25 has seen some of these companies bettering their FY24 performance.

Investors should understand and remind themselves of the lull leading upto FY22, and how these players performed during the slowdown in capex. While a few diversified to insulate themselves from the cyclicality prevalent in the T&D sector, T&D continues to be the largest operating segment for most of the players discussed above. Although current valuations deter immediate buying, keeping these companies on your radar could allow for strategic accumulation during better entry points.

Leave a Comment