Bitcoin’s open interest surged 8.6% in the last 24 hours, reaching $11.7 billion, reflecting increased market activity.

The 30-day bull-bear indicator remains above its 365-day average, reinforcing a positive market cycle and bullish sentiment in the Bitcoin market.

Binance’s Open Interest Breaks an All-time High at $11.7B

Open interest on Bitcoin’s futures and derivatives markets has climbed to an all-time high of over $11.7 billion on Binance.

These are precise indicators that the participation of investors is growing, and thus confidence in Bitcoin’s future performance.

Open interest has been rising along with strong trading, with OI staying above the 50-day moving average on a regular basis, supporting the bullish strength of the current rally.

Open interest shown on the chart traces out an upward trajectory, reaffirming the impact speculation played on Bitcoin price movement.

– Advertisement –

Sharp price shifts are coincident with high levels of open interest, perhaps due to trader participation.

If we take this as an indication of how market participants are leveraging their position on Bitcoin, it may mean that price volatility will continue to increase in the near term.

The increase in open interest shows the importance of institutional and large trader involvement as the derivatives market becomes more important.

This rise in open interest also continues, which seems to add credence to the idea that these traders are also contributing to stabilizing and moving prices for Bitcoin.

It shows that this is a market where users are participating with a strong basis. If the momentum carries on and continues in that way, then it could go on to continue even increasing in value.

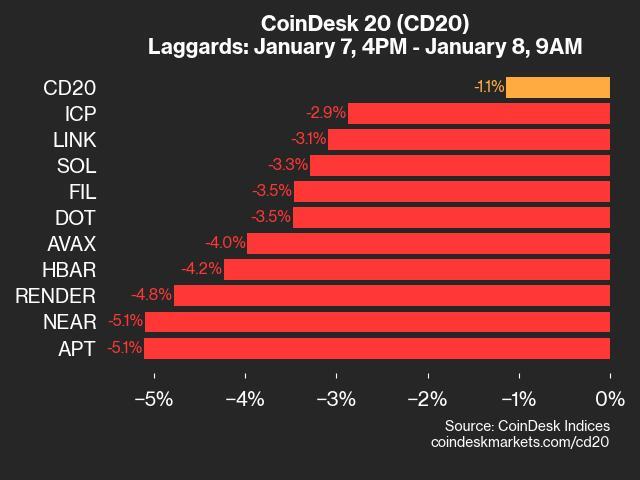

Bitcoin Open Interest Upticks 8.6%, Heightening Market Tension

Bitcoin’s open interest has risen by 8.6% over the past 24 hours as a sign of many leveraged positions entering the market.

The rise in OI often indicates growing market activity, as traders go long on larger positions, which in turn usually means increased volatility.

Indeed, an increase in open interest frequently presages that traders place larger bets on Bitcoin’s price swings, and that can move the short-term market by quite a bit.

Pressure is mounting🥵

Open Interest surged 8.6% in the last 24 hours. The markets love to test positions with high leverage.

Let’s see how this will end 🍿 pic.twitter.com/rmV1YzViC2

— Maartunn (@JA_Maartun) December 12, 2024

However, with this spike in OI, there is also more pressure on leveraged positions, and that creates an environment that is volatility-prone.

Margin calls (and liquidations) in the midst of speculative trades raise the risk of speculative players being forced to squeeze out their position further.

As positions become highly leveraged, the pressure builds until a market crash into a sharp price correction is likely to occur, particularly if they’re forced to unwind.

With open interest also rising, the market is on edge for coming volatility. With so many leveraged positions in the market, large price moves are only a matter of time and in either direction.

Any sudden market move could quickly translate into price change, which could challenge these levered positions, which investors are closely watching.

30-Day Bitcoin Indicator Surpasses 365 days, Still Bitcoin Market Cycle Remains Positive

The 30-day bullish indicator is still above the 365-day average line, indicating that Bitcoin’s market cycle is still bullish.

That’s definitely a positive trend and shows Bitcoin’s price performance in the future remains optimistic.

The chart demonstrates a few occasions when the 30-day average moved up above the longer-term moving average, opening up bullish scenarios.

The fact that the 30-day average remains above the 365-day average shows Bitcoin’s market cycle to be still productive.

In fact, historically, crossovers like these have preceded price rallies that confirm the positive sentiment behind Bitcoin.

If the 30-day indicator stays above the 365-day moving average, the overall market outlook for Bitcoin remains bullish.

Even though there are short-term rises and drops, the long-term strength of the 30-day indicator indicates bullish sentiment in the market.

The bull phases that preceded the great price rallies, so the Bitcoin price was expected to roll on. This sustained optimism was a big boost for traders who remained confident in Bitcoin long term.

Source: https://www.thecoinrepublic.com/2024/12/14/bitcoin-drives-binance-open-interest-to-a-record-11-7b/

Leave a Comment