Physically-backed gold exchange-traded funds (ETFs) reported a net loss globally for the first time in seven months during November, the World Gold Council (WGC) said.

However, Indian gold ETFs recorded inflows for the eighth consecutive month, attracting $175 million in November. This was likely driven by rising equity market volatility and general bullish sentiment towards gold, the WGC said.

China tops selloff

Overall, Asian funds lost $145 million in November, which halted a 20-month inflows. The selloff was higher in China as a drop in the gold price affected investor interest.

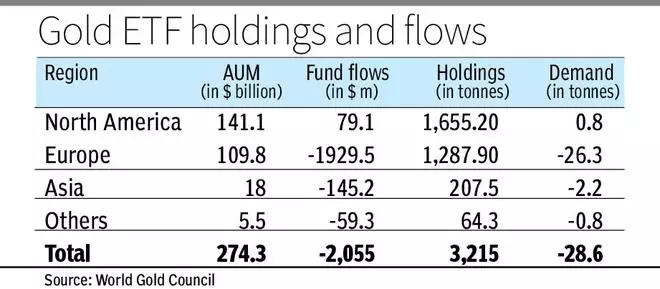

WGC said globally, collective outflows in November were $2.1 billion with most regions barring North America witnessing outflows – the first time after April this year. Europe accounted for a major share of the outflows, while North America reported a monthly flow for the fifth month in a row. The inflow was, however, small.

- Also read: Gold price: What will influence market trends in 2025?

The November outflow and lower gold price dragged gold ETF assets under management (AUM) by four per cent to $274 billion. Collective holdings in volume dropped by 29 tonnes to 3,215 tonnes.

Despite the outflows in November, the inflows into gold ETFs globally were up at $2.6 billion between January and November. WGC said during January-November, Asia and North America drove global inflows while Europe was the region that witnessed outflows.

Concerns over Trump govt

The November outflows led to ETF demand drop by 11 tonnes. European funds had begun reporting outflows since October. Selloffs were reported at $1.9 billion.

The outflows were across all major markets in Europe, which is going through a tough period due to a weaker economy, concerns over the incoming Trump administration in the US imposing higher tariffs and uncertainty over central banks’ interest rate policies and financial market behaviour.

- Also read: IPO boom: India Inc taps ₹1.33 lakh crore in record fundraising

“Additionally, the euro and pound continue to experience weakness in tandem with poor economic data and the dollar reaching a new year-to-date high. Similar to trends observed in prior months, this dynamic has led to outflows related to foreign exchange hedging products,” the WGC said.

In contrast, funds in North America saw the inflows into ETFs increase by $79 million in November. The inflow was due to demand from Canada despite the outcome of the US presidential elections raising concerns over global trade.

Gold down 2.5% MoM

The US inflow trend was in contrast to a major selloff witnessed in North America in the first week of November. The WGC estimated that outflows in the first week at $809 million. Strong Asian inflows partially offset the outflows then.

“The US faced outflows through the first half of the month but experienced a rebound of inflows towards the month-end as the market started pricing in a weaker dollar and lower yields following Scott Bessent’s nomination as US Treasury Secretary,” the WGC said.

Gold ended at $2,632.50 an ounce during the weekend in the spot market. Gold February futures on COMEX ended at $2,659.60 an ounce. Gold prices have dropped over 2.5 per cent in the past month. However, they are up over 27 per cent since the beginning of this year.

Leave a Comment