Have you ever wondered why so many people are obsessed with making money from the stock market or other similar investments? It’s because of an investor’s treasure known as compounding passive interest.

If you want in on this treasure, you should become acquainted with the power of continuously compounded interest, or compounding income.

Compounded income and compounded interest can make your money to grow beyond any sum you could ever hope to achieve yourself. Here’s how.

The Wonder of Compound Interest and its Brainchild, Compounding Income

Albert Einstein has been credited with calling compound interest “the greatest mathematical discovery of all time”. And he is absolutely right when it comes to practical applications; especially regarding your finances.

Compounding interest is a phenomenon that occurs when the earnings from your investments combine with your original investments (called the principal) to build up larger and larger earnings as time goes on.

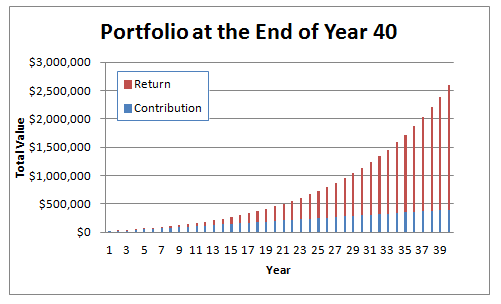

As you’ll see in the example below, eventually the earnings growth becomes so large that they surpass the original principal contributions and begin to explode at an exceptional rate.

This is why successful investors say that gaining the first $100,000 in investing is the hardest. After you’ve saved and gained interest to accumulate your first $100k, compounding interest makes your money grow MUCH faster.

What does this mean for you? Compounding income (i.e. MORE MONEY) – with little to no work on your part.

Compound Interest: the 8th Wonder of the World

Compound interest is a financial benefit you absolutely want in your passive income portfolio. In fact, Albert Einstein called it the eighth wonder of the world.

Compound interest income provides a very unique opportunity for you because once your portfolio reaches a certain threshold, you could theoretically live off of the residual income that your money earns each year–indefinitely.

Unlike some other strategies for building passive income, living off the earnings from your investments can be a 100% passive process if you choose to use a good investment such as a stock market index fund.

2 Options – Which One Makes More Money?

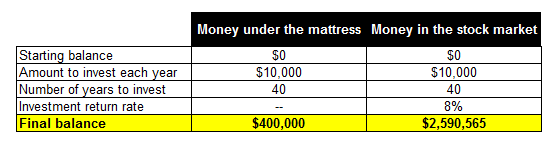

To really illustrate the benefits of compound interest, let me start by asking you a question. How much money would you make if you were to invest $10,000 every year for 40 years using one of two options for investing:

A) Under your mattress?

B) In a stock market index fund?

The result:

The second option results in almost 6.5X more money than the first? Why is that? That’s the beauty of continuously compounded interest over time.

It can result in the potential for ridiculously more money over longer and longer periods of time.

A Closer Look at How Continuously Compounded Interest Works:

So to understand how we were able to get such a higher number harnessing the power of compound interest, let’s dissect this process just a little bit to see how it works and benefits our efforts at becoming rich.

Option A is easy to understand. You simply take $10,000 each year and put it under your mattress literally (just like they used to during the Great Depression).

Because your investment earns absolutely no interest (since your mattress is not the same as bank and doesn’t pay you interest), the math for this scenario is very simple to understand:

- $10,000 x 40 years = $400K

Even though mathematically that’s what you’d have, the truth is that your money would be worth even less than that. This is due to the losses from inflation over that time.

In fact, using the rule of 72 and an inflation rate of 3%, your money would be worth half as much after 72 / 3 = 24 years. So after approximately 40 years, the money you chose to keep “safe” by stuffing it under a mattress would be worth about a quarter of the purchasing power it has today! Yikes!

That’s a massive hit to your portfolio!

Option B is best understood using an illustrative process.

For the sake of simplicity with this example, let’s assume that your investment earns a straight 8% every year. (This of course never really happens in reality but it will help show how compound interest works in this lesson).

Also, the average return of the S&P 500 from 1957 to 2018 is actually 8%. Okay, on to the example.

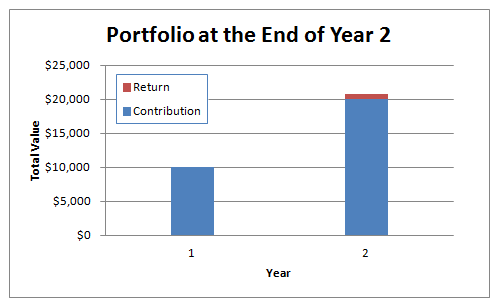

To begin at the end of Year 1, we invest $10,000 and earn no interest.

At the end of Year 2, we invest another $10,000 to have a total of $20,000. The 8% return on our $10,000 is $800 (red), and so that gets put on top of our principal investment (blue).

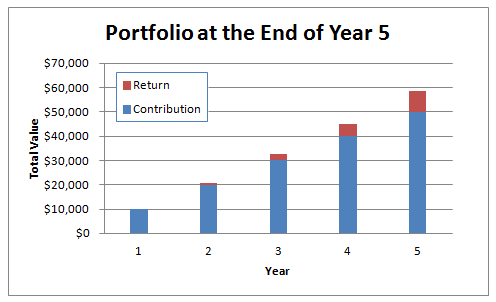

Now continue this process for 3 more years and we come to the end of Year 5. We’ve invested $50,000 (5 x $10,000) and return on investment has grown to $8,666 ($800 + $2,464 + $5,061).

Notice how as our total portfolio amount increases, so does our return on that investment.

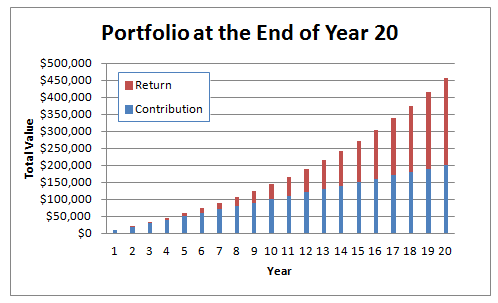

Now fast forward to the end of 20 years. Now the amount of money we earn from our total investment (red) actually starts to surpass the total amount of money we initially invested each year (blue).

By the end of Year 40, the power of continuous compound interest has resulted in the returns actually contributing more into the total portfolio way beyond what we originally put into it.

WOW! That’s freaking amazing, don’t you agree?

So How Does This Result in Big Passive Income?

How does a portfolio of almost $2.6M help you financially? How about by allowing you living passively off of just over $100,000 each year?

Most people could easily live off $100,000 a year–a life quite well lived, I might add.

If you follow the traditional financial planning suggestion of using the 4 percent withdrawal rule for retirement, you could allow yourself to take out 4% from your portfolio each year (and then adjust for inflation each year after that).

$100K each year in passive income is no small accomplishment!

To contrast this point, how much money could you withdraw each year using the “under the mattress” saving technique? $16,000 each year – a number that qualifies you for poverty. Which option would you have rather gone with?

Smart Investors Always Take Advantage of Compound Interest

Every successful investor, from Warren Buffett to Peter Lynch to John Bogle, relies heavily on the power of compound interest.

The successful investor knows that this type of passive interest earning is key to maximum wealth growth.

This is why smart financial planners almost always recommend starting your retirement savings early and investing as much as you can afford.

How You Invest is Important Too

Note that it does matter how you invest. Nearly all investing involves some level of risk. However, successful investors don’t take unnecessary risks.

For example, it’s common for smart investors to invest in blue chip stocks that pay dividends. Blue chip stocks are stocks in tried-and-true companies with a long track record of success and sustainability.

Think Coca Cola, 3M, Walmart, Johnson & Johnson, McDonald’s, etc. It’s not like those companies can’t lose money.

But they’ve proven over time that they’ve got solid staying power.

While smart investors choose investments that gain slowly and steadily over time, , they stay away from riskier investment options like day trading, where very few investors make money.

The percentage of investors that make decent money with the riskier options such as day trading is incredibly small compared to those who go for smaller but more steady returns.

Do Your Research

As someone who’s searching for passive income via investing, it’s vitally important to educate yourself. Read books from experts like John C. Bogle who share investing tips and secrets.

Use their successes – and failures – to get more information to help you make investment decisions that work for you.

The better your investments perform, the more compound interest you’ll earn.

Here are some ideas you could consider if you’re looking to make your money grow faster via compounding interest.

*Note that all investments listed here–and all investment in general– do have the potential to lose money.

1. Invest in Dividend Paying Stocks

Dividend-paying stocks are stocks that pay you money simply for holding shares in the stocks. Every quarter or so (depending on the stock) you’ll get a small percentage of the value of your shares as sort of a cash bonus.

Some people take this cash “bonus” as a source of passive income to help them pay the bills. In fact, if you’ve got a large enough amount of money invested, you could potentially live off of your dividend income.

However, if you don’t need the income, you’d be wise to choose to reinvest your dividend payments so you can help your stock shares earn more compounding interest.

Reinvesting your dividend payment will help your portfolio balance grow even faster.

2. Invest in Peer-to-Peer Lending

Peer-to-peer lending is when you lend money to borrowers, and the borrowers pay you the interest on the loan instead of paying banks the interest they pay.

Lending Club is an example of a company that offers peer-to-peer lending for investors. As an investor, you are shown a list of loans potential borrowers are asking for.

You can see all of the loan factors, such as the amount they’re requesting, interest rate, term and grade of the loan. The grade reflects the credit standing of the borrower.

Then you choose which loans you want to fund, and how much of the loan you want to fund.

As the loan gets paid back, you get paid back with interest. And you can reinvest those funds to earn more interest.

Truly, it’s a revolutionary way to invest your money. Why allow banks to have all of the fun when you can take some of the profits for yourself?

3. Invest in Real Estate (Affordably)

Traditional real estate investing can be profitable, but also costly to get into. However, there are several companies that offer crowdfunded real estate investing options.

In other words, they buy real estate investment properties (commercial and residential properties) with money from a pool of investors. When the investments make profits, investors get a cut of those profits.

And as with other types of investments, you can take your profits as cash, or reinvest them into your fund, depending on the investment company’s model.

For instance, companies such as Fundrise invest in commercial and residential properties. They do so using crowdfunded monies from investors like you and me.

Then the profits are split with the investors. You can invest with Fundrise for as little as $500, making it affordable for almost everyone.

As you can see, there are several options for earning more compounding interest on your investments.

4. Invest in a Mutual Fund With a Good Track Record

Some investors simply invest in mutual stock or bond funds with great track records. One such popular fund is the Vanguard Total Stock Market Index Fund (VTSAX).

This fund was created in 1992, and has a ten year average return of over 10%. The fees are low too, which is another reason it’s a favorite among investors.

The mutual fund you choose to invest in depends on your risk tolerance level and other factors. Look to popular investing books such as The Intelligent Investor by Benjamin Graham for more in-depth investing advice.

While good mutual funds usually provide steady positive returns over time, it is–just like with any investment–possible to lose money when investing with mutual funds.

This is why researching and choosing the right mutual fund investment is so important.

Summary

The powerful results of continuously compounded interest and returns can help you increase your portfolio by a great deal more than you would be able to without it.

An essential part of discovering the best passive income sources for yourself is seriously considering the power of compound interest. Personally, I use it as a primary source of my passive income portfolio.

My crowdfunded real estate account with Rich Uncles is one of my best performing passive income accounts. And compound interest (since I currently reinvest my dividends) is a big part of that performance success.

Take advantage of compound interest for your passive income portfolio. Use it to create a lot more money for you to passively live off of.

Are you using the wonder of compound interest to grow your personal wealth?

Leave a Comment