This is a segment from the Empire newsletter. To read full editions, subscribe.

We all know it’s lame to live in the past.

It’s cringe when middle-aged dadbros bring up their high school football “careers,” and we shake our heads when our moms drone on about their college semesters abroad in Europe (it’s always Italy).

But now it’s my turn.

Lighting Network was the best thing that has ever happened to Bitcoin — until it wasn’t.

A refresher: Lightning is a proposed layer-2 solution for enabling super fast (almost instant) and cheap BTC transfers.

Usually, it takes about an hour on average for bitcoin transfers to be fully confirmed. Standard practice says that a transaction is only settled when it’s six blocks deep in the chain, and blocks arrive every 10 minutes or so.

Instead, Lightning Network allows two users to open a payments channel between them, and only the first and last transaction in that channel actually makes it to the Bitcoin blockchain.

Everything else in between then becomes just a matter for the two parties — so no need to wait for any confirmations at all, beyond the offchain tallies displayed by the Lightning app being used.

Anyone who’d entered crypto in the past three years might only really know Lightning from El Salvador’s monumental adoption of bitcoin as legal tender in September 2021.

The official government Chivo app and other payment processors like OpenNode used Lightning as their backbone. This meant many regular Salvadorans were suddenly converted into Lightning users, even if they didn’t fully know it.

The rollout was not without problems. And while Lightning capacity had been on the rise in the leadup to El Salvador’s adoption, the amount of bitcoin bouncing around channels still jumped almost 40% in the following three months, from under 2,400 BTC to 3,300 BTC.

These days, there’s closer to 5,000 BTC ($500 million with BTC at $100k), but growth has stagnated in the past two and a half years.

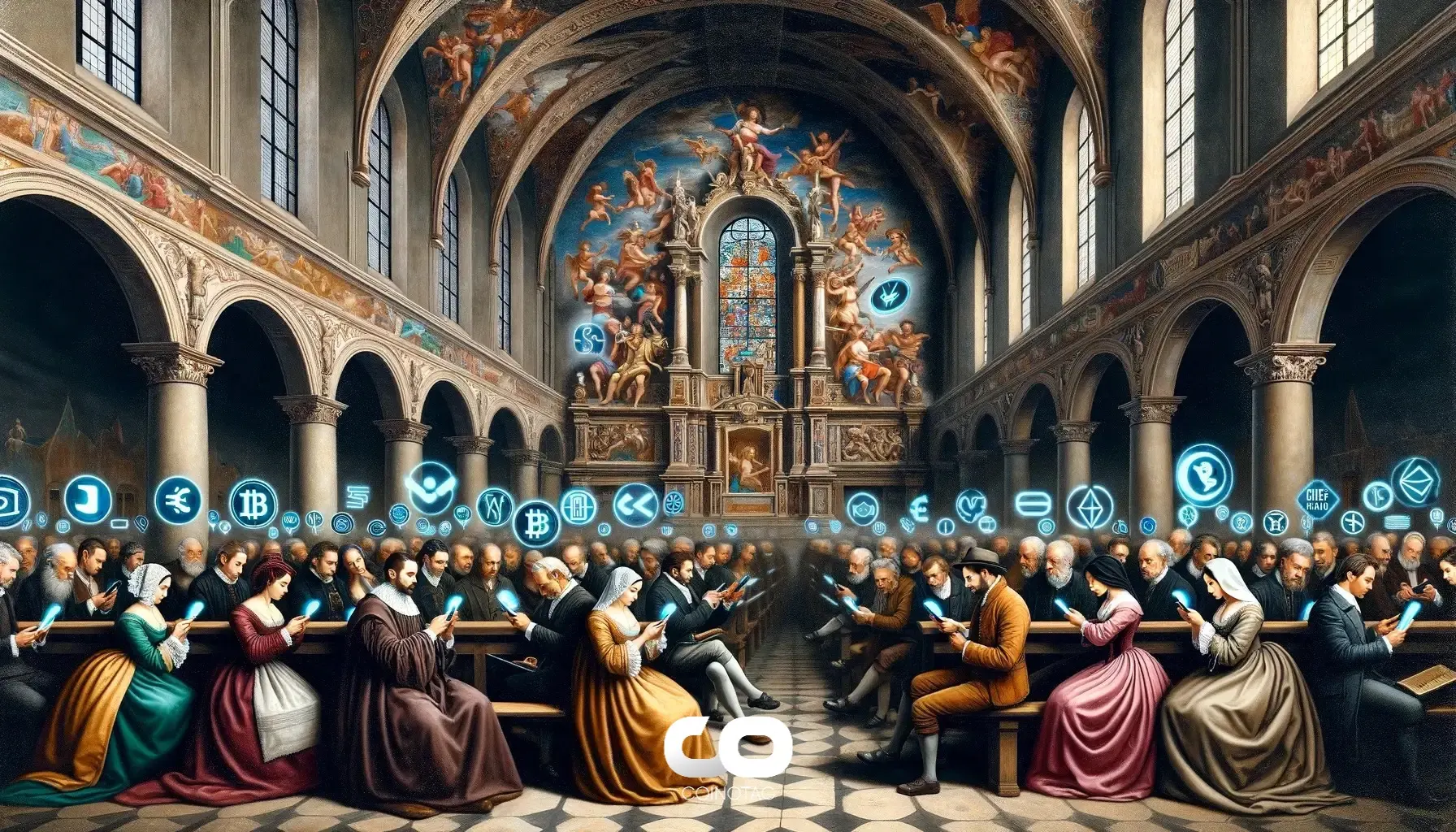

The real kicker is that Lightning was so much more fun and relevant when there was less than 1,000 BTC on the network. When silly micropayment gimmicks ran free.

Between late 2018 and early 2019, a proliferation of experimental apps captured imaginations. There were Miniclip-style gaming portals like Satoshi’s Games, as well as a Mario clone “Super Bro” that transformed every in-game coin into a collectible sat.

Those were great. But none held a candle (or even a Lightning Torch) to two in particular:

- Pollo.feed, which allowed you to feed actual live chickens remotely for just a few sats while you watched via livestream. Magic internet money was instantly physical.

- Satoshi’s World would let you traverse Google Earth, tagging it with whatever nonsense graffiti you’d like — and visible for all the other digital travelers to see (I tagged Amsterdam Central Station with “LONG BITCOIN, SHORT THE BANKERS”).

It’s okay that Bitcoin is more serious these days. But it’s also not.

The internet was absolutely better when we were all doing dumb stuff on the Lightning Network. Sadly, we’ll probably never make it back.

Now, who’s ready to hear about that time I hit a full-court touchdown?

Start your day with top crypto insights from David Canellis and Katherine Ross. Subscribe to the Empire newsletter.

Explore the growing intersection between crypto, macroeconomics, policy and finance with Ben Strack, Casey Wagner and Felix Jauvin. Subscribe to the Forward Guidance newsletter.

Get alpha directly in your inbox with the 0xResearch newsletter — market highlights, charts, degen trade ideas, governance updates, and more.

The Lightspeed newsletter is all things Solana, in your inbox, every day. Subscribe to daily Solana news from Jack Kubinec and Jeff Albus.

Leave a Comment