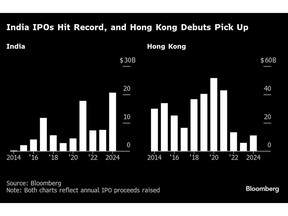

Dealmakers are eyeing a revival in Asia’s initial public offerings in 2025 as India’s pipeline remains robust and a recovery in Hong Kong takes hold.

Article content

(Bloomberg) — Dealmakers are eyeing a revival in Asia’s initial public offerings in 2025 as India’s pipeline remains robust and a recovery in Hong Kong takes hold.

Article content

Article content

New-share sales in India are expected to surpass last year’s record of $20.7 billion, as a resilient economy and strong demand from mutual funds buoy a stock boom. Meanwhile, mainland-listed companies’ share offerings in Hong Kong will likely boost the city’s IPO market as onshore deals, which once dominated the region’s volumes, lag.

Advertisement 2

Article content

“We are starting to see a lot of activity around requests for proposal for 2025,” with many of the deals related to the mainland-to-Hong Kong theme, said Aaron Oh, head of Asia-Pacific equity capital markets at UBS Group AG.

Here are some of the potentially large new-share sales to watch in Asia this year.

Hong Kong Deals

- Contemporary Amperex Technology Co.: The world’s top electric-vehicle battery maker, commonly known as CATL, is preparing for a second listing in Hong Kong that could raise at least $5 billion, making it the city’s biggest since early 2021.

- Jiangsu Hengrui Pharmaceuticals Co.: The company is said to consider a Hong Kong listing that might raise at least $2 billion.

- Foshan Haitian Flavouring & Food Co.: The second listing of Haitian, one of China’s biggest condiment makers, could raise at least $1.5 billion.

- Seres Group Co.: Huawei Technologies Co.’s electric-vehicle partner is said to mull a Hong Kong listing that could raise more than $1 billion.

- Eastroc Beverage Group Co.: The Chinese energy-drink maker is said to weigh a listing in Hong Kong that could raise as much as $1 billion, after a previous plan for a Swiss share sale didn’t materialize.

Advertisement 3

Article content

India IPOs

- HDB Financial Services Ltd.: The unit of HDFC Bank Ltd., India’s largest private-sector lender, plans to raise as much as 125 billion rupees ($1.5 billion) through an IPO.

- LG Electronics India: South Korean company LG Electronics Inc. is said to consider a valuation of as much as $15 billion for its Indian unit’s listing targeted for the first half of this year.

- Quest Global Services Pte: Carlyle Group Inc. is said to weigh an IPO of the engineering-services firm that could raise about $1 billion.

- Zetwerk Pvt Ltd.: The supply-chain startup is said to be considering fundraising options including an IPO that may help it raise as much as $1 billion.

- Mahle GmbH’s India business: The German car-parts maker is said to be mulling an IPO of its Indian business, with the deal potentially raising as much as $400 million.

Other Asian listings

- Shein Group: The online-fashion retailer could list shares in London as soon as early this year, in an IPO potentially valuing the company at £50 billion ($62 billion).

- JX Advanced Metals Corp.: Japanese oil refiner Eneos Holdings Inc. is said to consider selling as much as 70% of the chip-material maker in an initial share sale that may raise up to around ¥700 billion ($4.5 billion).

- Chery Automobile Co.: The automotive unit of Chery Holding Group Co. may seek a valuation of more than 100 billion yuan ($14 billion) in a Hong Kong IPO as soon as this year.

- MMC Port Holdings Sdn.: The port operator is said to weigh an IPO in Kuala Lumpur that could raise as much as 7 billion ringgit ($1.6 billion), potentially making it the biggest in Malaysia in more than a decade.

- GCash: The largest fintech platform in the Philippines is said to consider an IPO that could raise $1 billion to $1.5 billion in the second half of 2025, a size that would likely make the listing the biggest ever in the country.

—With assistance from Julia Fioretti and Manuel Baigorri.

Article content

Leave a Comment