The Department of Financial Services (DFS) under the Ministry of Finance on Wednesday urged the microfinance sector to chart a roadmap aimed at enhancing its strength and long-term viability.

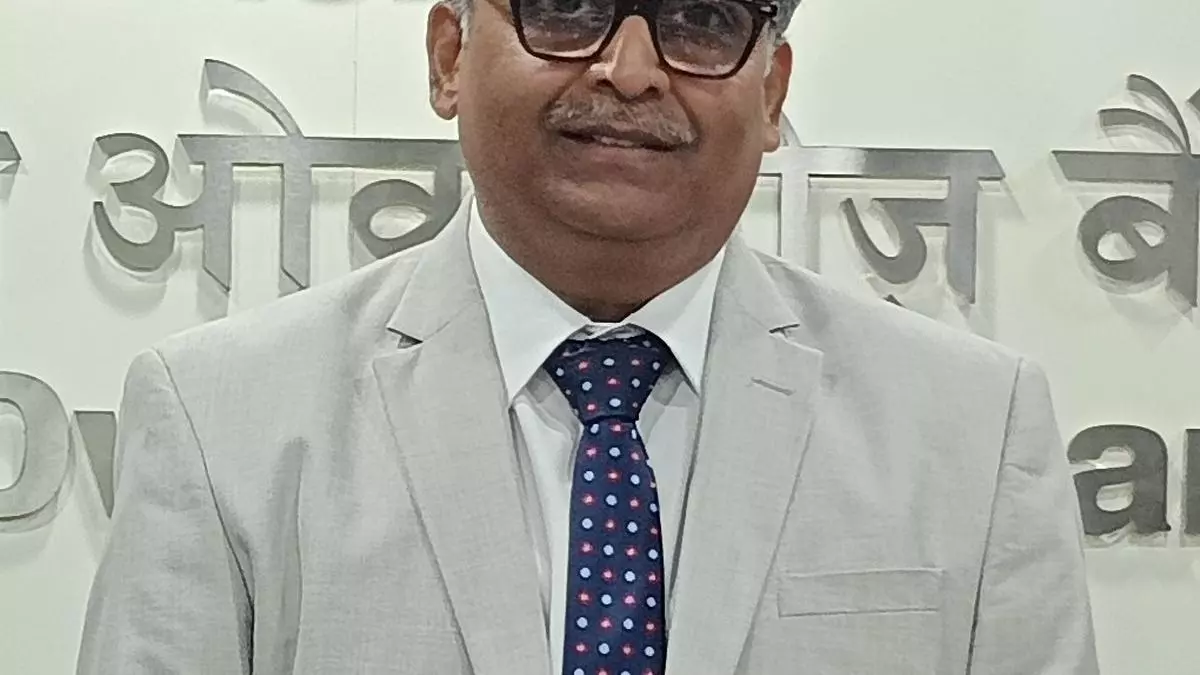

Chairing a meeting with microfinance institutions (MFIs) in the capital, DFS Secretary M Nagaraju emphasised that MFIs in India need to be more robust, vibrant and financially sound, catering to the needs of rural masses.

It was also pointed out that like digital disbursements, MFIs should encourage repayment of loans digitally while at the same time focus on cybersecurity and resilient IT infrastructure. They should also strengthen their governance standards.

Impacting lives of people

During the meeting, DFS Secretary recognised the work done by MFIs in impacting the lives of people in rural areas. He stated that DFS values the efforts put in by MFIs in supporting financial inclusion.

The meeting was also attended by senior officials of DFS including industry bodies namely MFIN and Sa-Dhan.

Jiji Mammen, Executive Director and CEO of Sa-Dhan said that the MFIs requested for formulating credit guarantee scheme(s) suiting MFIs/borrowers, creation of special fund/facility for MFIs operating in North East region and relaxation in qualifying assets norms applicable to MFIs so that their risk can be diversified to other lending avenues.

During the meeting, challenges and issues being faced by MFIs were also discussed. It was informed that MFIs are facing difficulties in raising low-cost long term funds. The quality of MFI portfolio is being impacted on account of various issues including reduction in lending to the sector, it was submitted.

Participating MFIs apprised that the business of MFI industry has risen from ₹ 17,264 crores in March’12 to ₹3.93 lakh crore as on November’24. The industry operates in over 723 districts including 111 aspirational districts across 28 states and eight Union Territories. They also cater to the financial needs of almost eight crore borrowers. MFIs contributes 2.03 per cent of the gross value added to GDP and supports 1.3 crore jobs.

The engagement with MFIs was designed to foster an open exchange of ideas aimed at elevating the MFI sector. The emphasis was on reaching the low-income households in villages and uplifting their lives by providing them hassle-free financial assistance, if needed.

Leave a Comment