Public sector lender UCO Bank is focussing on South India, Maharashtra and Gujarat to expand its footprint nationally.

The Kolkata-headquartered bank currently has a strong presence in East and North India. On the occasion of its 83rd Foundation Day, the lender has rolled out 40 branches across regions this week.

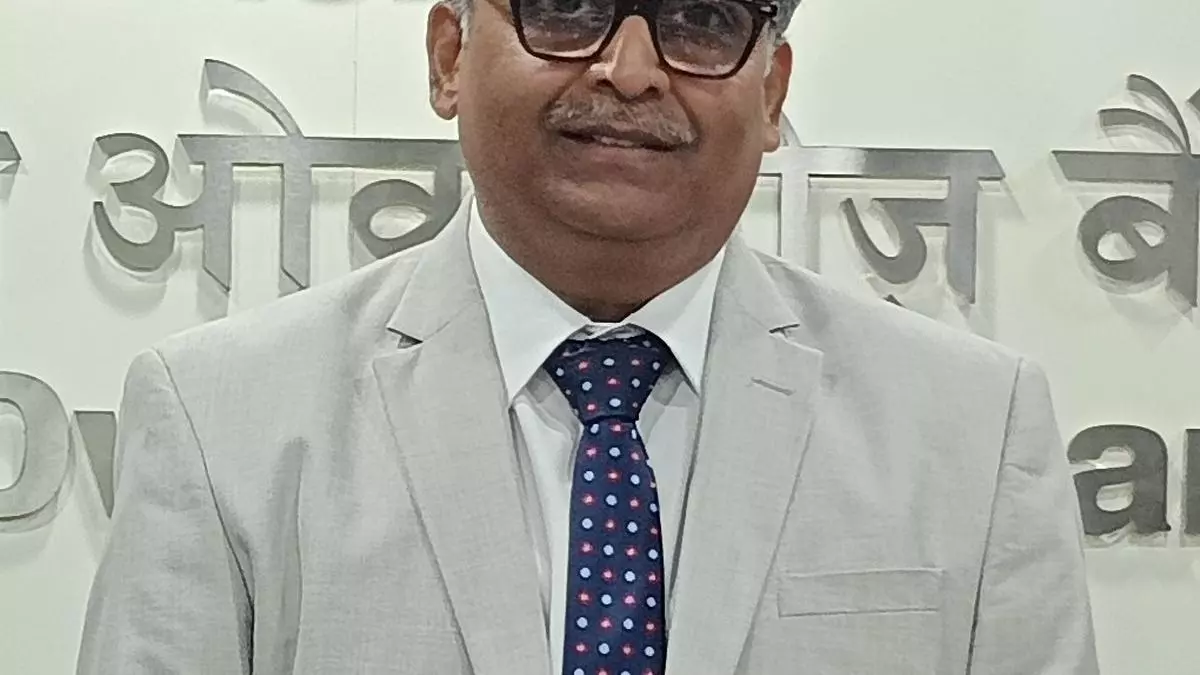

“These new branches have been opened in Tamil Nadu, Karnataka, Telangana, Kerala, Gujarat, Maharashtra, West Bengal and Uttar Pradesh. When we are opening the new branches, our focus is on South India, and Gujarat and Maharashtra,” UCO Bank Managing Director and Chief Executive Office Ashwani Kumar told businessline.

“From the last foundation day to this foundation day, the bank has opened 82 branches. The board had given approval for opening around 130 branches this fiscal. So, more branches are in the pipeline. We have started taking premises and servicing is going on. We will make sure that maximum branches are launched this fiscal. Around 20-30 new branches are likely to be opened,” Kumar said.

The bank expects to start reaping the benefits of the newly-opened branches, in terms of business, from the next financial year.

The lender had as many as 3,230 domestic branches as of March 31, 2024. It also has two overseas branches (one each in Singapore and Hong-Kong) and one representative office in Tehran, Iran.

Growth in advances

For the third quarter of the current financial year, the bank’s advances grew 16.20 per cent year-on-year, while deposits during the period rose 9.37 per cent y-o-y.

“Retail, MSME, agri and corporate–all the four segments witnessed good growth in Q3FY25. Within retail, housing and auto loans grew well. Credit growth was high for renewable energy, cement, ethanol and data centres within the corporate segment,” Kumar said, adding in the fourth quarter credit growth would be similar to that of the third quarter.

“The bank’s credit-deposit ratio was less than 64 per cent in the year before. Now, the ratio is around 74-75 per cent. And, this is the ideal CD ratio. From this quarter our focus will be on deposit growth as well, and for this we have come up with different schemes for deposit growth,” the MD added.

Leave a Comment