Launched in December 2024 with a ₹1,000-crore corpus, the Credit Guarantee Scheme for electronic Negotiable Warehouse Receipt (eNWR)-based pledge financing is a welcome move to insure eligible financial institutions’ credit risk.

Warehouse service providers (WSPs) and collateral (commodity) management agencies (CMAs) enable pledge lending as they perform a slew of activities, namely, commodity inspection, commodity valuation, stock preservation and management, clearing and settlement — that eventually manage banks’ credit risks.

The regulatory environment is the most important enabler to boost pledge finance. For example, agri-warehousing business and physical delivery of agri-commodities came under regulatory oversight after the Warehousing (Development and Regulation) Act was passed in 2007 — the Act set up the Warehousing Development and Regulatory Authority (WDRA) as a statutory body to oversee warehousing business.

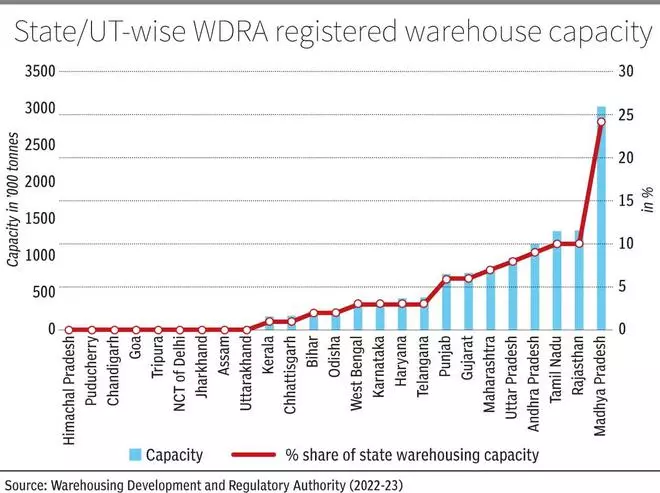

However, WDRA-registered warehouses remain 8-10 per cent of the State-wise warehousing capacities reported at 367.49 lakh tonnes in March 2024 (see Chart). Therefore, there is a need to increase WDRA-registered warehouses to boost pledge lending.

The latest scheme includes a pledge-loan cap of ₹75 lakh and ₹2 crore for agri and non-agri commodities, respectively. The scheme will extend 85-80 per cent guarantee cover for ₹3 lakh to ₹75 lakh of pledge loans for agri commodities and 75 per cent for non-agri commodities, and eligible lenders have to pay an annual guarantee fee of 0.40 per cent for farmers and 1 per cent for non-farmers to cover credit risk. However, how this scheme will insure warehouseman risk is unclear. Despite the promises of the scheme, how will the scheme boost pledge lending quantum from ₹4,000 crore in 2023-24 to a whopping ₹5.5 lakh crore in 2033-34?

Negotiable warehouse receipt as collateral is a critical enabler in pledge finance. However, the spread of eNWR has been skewed to a few States, producing and trading high-value commodities.

Way forward

First, pledge finance as a short-term loan meets farmers’ and agri-value chain actors’ liquidity needs and helps them fetch a remunerative price, selling commodities at an opportune time and, thereby, repay loans, too. Thus, the government should promote a vibrant warehousing ecosystem as enabler of pledge financing. The WDRA can work out security deposit, registration and renewal fees for lower-capacity (500-1,000 tonne) warehouses utilised by farmer collectives (FPOs). Repositories can also reduce eNWR charges to increase farmers’ access to pledge loans.

Second, banks often prefer to lend to traders or resource-rich farmers. However, priority sector lending targets would compel banks to onboard smallholder farmers or their agencies, FPOs, as potential and repeat borrowers for a pledge loan of at least ₹3 lakh. Interest subvention and prompt repayment incentives like crop loans or KCC would improve FPOs’ bankability and timely credit access.

Third, the scheme can attract cooperative banks and new lenders to venture into agri-commodity lending. e-Kisan Upaj Nidhi, an online platform, will reduce transaction costs of lending as the platform will facilitate discovery, matching, and transactions between borrowers and lenders.

Fourth, the government should set up an independent agency or incorporate a trust for effective implementation and management of the scheme.

Although the corpus is small relative to the ₹60,000 crore market size of pledge finance reported in 2023-24, the scheme would push bankers to lend more for agri-commodities.

Dey is an Associate Professor at IIM Lucknow, and Banerjee is an Academic Associate at IIM Ahmedabad. Views are personal

Leave a Comment