In a bid to bring down the cost of deposits, banks are taking a slew of measures to increase the share of Current Accounts and Saving Accounts (CASA) in the total domestic deposits. The focus is more on tapping the current accounts, the proportion of which is comparatively lower than the savings accounts in CASA segment.

SBI Data

State Bank of India (SBI), for instance, is trying to reduce dependence on current accounts of government departments and increase share of private business accounts by opening Transaction Banking Hubs across the country.

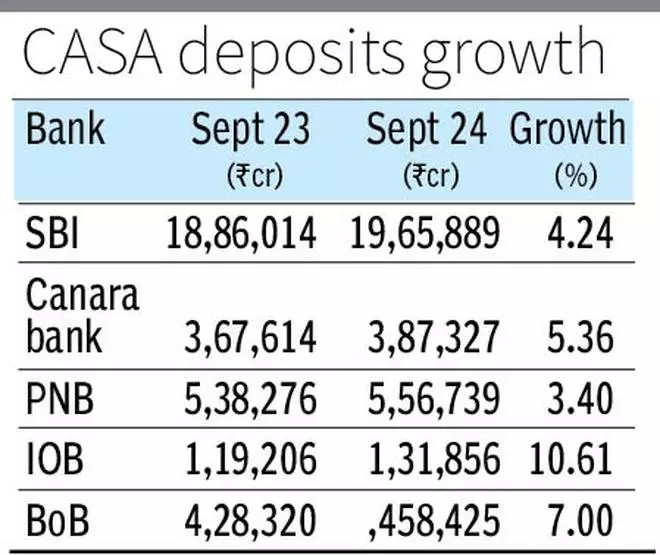

For SBI, CASA accounts grew at 4.24 per cent in the second quarter of the current financial year ended September 2024 at ₹19,65899 crore compared to ₹18,86,014 crore in the same period last year. According to its Chairman, C S Setty, its current account deposits have grown by 10 per cent year-on-year and the bank has maintained a CASA ratio of more than 40 per cent.

With current accounts registering a double digit growth, SBI is now targeting to increase its Saving Bank deposit growth.

First time in the last three quarters, CASA for Canara Bank has shown an uptick in growth compared to sequentially the quarter-on-quarter. June quarter to now it has improved by almost 28 basis points. It was 30.98 per cent and now it is 31.27 per cent. In absolute numbers also, quarter-on-quarter it improved CASA of ₹8,000 crore.

Other banks, including Punjab National Bank (PNB), also witnessed an increase in CASA deposits. For PNB, the year-on-year growth in this segment was 3.4 per cent in the second quarter of FY25.

“Our cost of deposits is comparatively higher than the other peer banks. The reason behind is our CASA is at 31 per cent. That is why our focus is more on CASA growth. We have almost launched more than 10 section-focused targets in the products of this segment,” said Satyanarayana Raju, MD & CEO, Canara Bank.

Leave a Comment