The crypto market and US dollar have been anything but stable since Donald Trump took the White House. His pro-crypto rhetoric and aggressive economic policies sparked waves of optimism, only to clash with price swings and looming economic unease.

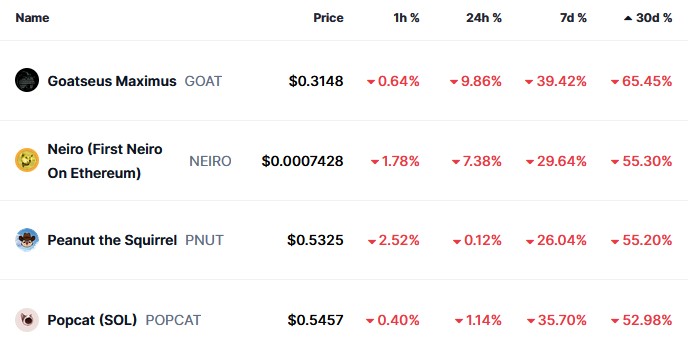

November treated crypto well, but now most of the market is almost in free. Imagine holding meme coins… we feel for you guys!

There’s a theory going around that some feel in their guts: 2025 will be the year of the financial clownery’s collapse.

Here’s a breakdown of how Trump’s leadership, the Fed, and global markets will shape Bitcoin in 2025.

US Dollar Crash, Or Does Nothing Ever Happen?

Trump’s win lit a fire under Bitcoin

.cwp-coin-chart svg path {

stroke: ;

stroke-width: ;

}

Price

Trading volume in 24h

<!–

?

–>

Last 7d price movement

, pushing it over the $100,000 mark as his pro-crypto promises electrified investors. But that surge burned out just as fast as it started.

The price has since dropped below $94,000, fueling speculation about an impending market correction.

“This feels like the downturn before the storm,” commented James Toledano, COO at Unity Wallet, noting the uncertainty ahead of Trump’s inauguration.

99Bitcoin’s analysts expect rates to drop back down to 0 faster than we can say it, especially because all those 5y corporate bonds that got composed during the academic are arriving at maturity and need to be reconducted…. but at 5% interest instead of 0.25% back in 2020.

Explore: RWA, AI, Meme Coins Broke Out in 2024: Best Crypto to Buy in 2025?

The Federal Reserve’s Role in Saving the US Dollar

Fed policy continues to whip the markets around. After slamming the brakes with steep rate hikes in 2022, they shifted gears and started cutting in late 2024. Stronger-than-expected economic data, though, has put further cuts on ice.

“Concerns over the Fed’s slower-than-expected rate cuts are weighing on speculative assets like Bitcoin,” Toledano explained.

Amidst the chaos of 2020, the U.S. Federal Reserve has printed 80% of all U.S. dollars in existence. This created a domino effect that left other nations with no choice but to devalue their own currencies.https://t.co/UrNVCRXIq6

— Isaiah McCall (@AfroReporter) April 18, 2023

If the Fed reduces rates further while inflation remains high, it risks creating stagflation. This could complicate the outlook for both traditional and digital assets, as capital availability dwindles.

DISCOVER: France To Block Access To Polymarket After Surge In Crypto Betting On US Election

Trump’s Economic Policies and Crypto Markets

Trump’s economic blueprint raises more questions than answers. Tariffs and tighter borders could stoke inflation, leaving the Fed with little wiggle room.

Yet, his loud support for crypto has sparked fresh hope that regulatory winds might shift in Bitcoin’s favor. Trump’s January 20, 2025, inauguration is a pressure point with potential ripples through the market. BitMEX’s Arthur Hayes expects an initial sell-off driven by jittery readjustments.

For now, 2025’s Bitcoin market feels like a storm brewing, caught between Trump’s economic plans, Fed maneuvers, and larger macro forces. Long-term stability hinges on its growing role as a hedge against chaos.

EXPLORE: FBI Raids Polymarket CEO Shayne Coplan’s Home, Seizes Electronics

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The post Is There a US Dollar Crisis at The Fed: Bitcoin in 2025 is Just Getting Started appeared first on 99Bitcoins.

Leave a Comment