Ahead of the next meeting of the RBI’s Monetary Policy Committee (MPC), a weakening rupee poses a new threat to inflation. Economists believe that any rise in the import bill of pulses, edible oils, inputs for electronic goods and crude oil is likely to impact inflation which, in turn, could have a bearing on rate review deliberations by the MPC.

Though the rupee closed at 86.36 against the US dollar, up by 0.3 per cent on Wednesday, its best single-day percentage rise since June 3, 2024, it has weakened about 3 per cent since Donald Trump’s victory in the US Presidential elections in November.

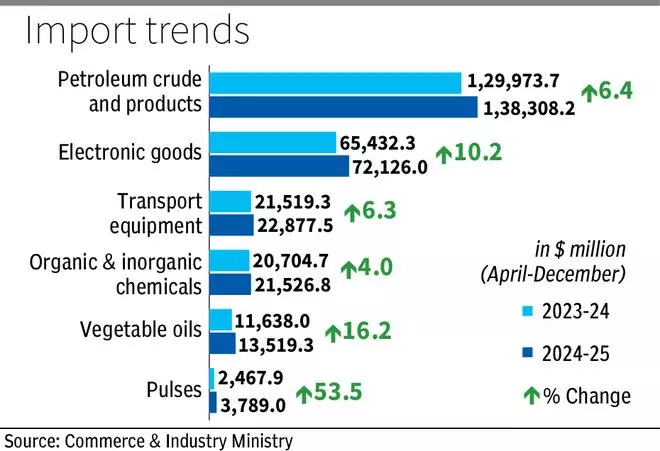

The fall in the rupee has an impact on the import bill of various commodities. Data released by the Commerce Ministry showed that import (in value terms) of crude increased by over 6 per cent in the April-December period while that for electronic goods (significant share of inputs) saw a rise of 10 per cent. Imports of pulses and vegetables rose by over 53 per cent and 16 per cent respectively in the April-December period of 2024 against the corresponding period of 2023.

- Also read: US-India Tax Forum proposes bold reforms ahead of Union Budget 2025-26

According to DK Pant, Chief Economist with India Ratings & Research (Ind-Ra), the Indian currency has weakened while the US economic data has been better than expected which means the rate cut cycle could be slower than expected there. “All these factors will further strengthen the dollar which, in turn, will affect India’s import bill especially that related with edible oil, pulses, crude oil and input for electronic items. This could also have a bearing on retail inflation,” he said.

Many economists felt that rate setting body will wait for one more set of inflation data before going for rate revision.

“Deliberation on rate review in the next meeting of Monetary Policy Committee will hinge upon inflationary expectations,” said Pant.

Yuvika Singhal, Economist with Quanteco, saw an impact on Wholesale Price Inflation (WPI) to begin with. “The swift depreciation in Rupee is likely to translate into imported inflation, with immediate impact on WPI in comparison to CPI inflation. This is largely because of WPI basket composition, which includes items such as non-subsidised fuel, intermediate goods as well as raw materials – a larger share of which are typically imported,” she said.

“The impacted sectors could thus be electronics, chemicals, transport and energy among others that could see a compression of margins due to higher input costs. This would eventually get passed on output prices (i.e., CPI) with a lag,” she said.

- Also read: Gold imports moderate in December as government gets alert following November spike

WPI-based inflation rose to 2.37 per cent in December as against 1.9 per cent in November. During the same period, retail inflation, based on Consumer Price Index, moderated to 5.2 per cent in December 2024 against 5.5 per cent in November.

According to Singhal, since most of the CPI basket composition is weighted by domestic goods as well as services, the sensitivity of CPI inflation is relatively muted to Rupee depreciation. Having said that, there could be some minor immediate impact of pass-through via consumer commodities that are typically imported such as oilseeds, pulses and, more importantly, gold.

“We do not expect any upward adjustment to retail fuel prices, as past downside in global crude oil prices were not passed onto consumers,” she said.

Leave a Comment