In a late filing made on Wednesday, the US Securities and Exchange Commission has formally begun its appeal in its legal battle against Ripple Labs. However, this move has not dampened investor enthusiasm for Ripple’s XRP, whose value has broken above the $3 price mark for the first time since 2018.

Still trading above $3 with a significant bullish bias at press time, XRP appears poised to extend its gains in the short term.

SEC Files Its Opening Brief

In its January 15 filing to the Second Circuit Appeals Court, the SEC seeks to overturn Judge Analisa Torres’ July 2023 ruling and reclassify XRP sales to retail investors as unregistered securities. The regulator contended that the New York District Court erred in its decision that XRP sold to retail investors did not constitute an unregistered securities offering.

The SEC cited the Howey Test and claimed that Ripple’s promotional activities fostered an expectation of profit among investors, thereby classifying XRP as an investment contract.

The ongoing legal battle began in December 2020, when the SEC filed a suit against Ripple, alleging that the payment services provider used its XRP token as an unregistered security to raise funds.

XRP Is Not Troubled

The SEC’s opening brief marks a formal step in the appellate process wherein the regulator hopes to challenge the court’s earlier decision. Despite this, XRP remains unperturbed as it continues its uptrend. Trading at $3.13 at press time, the altcoin’s value has risen by 9% in the past 24 hours.

During Wednesday’s intraday trading session, XRP surged above the $3 mark for the first time since 2018. While the SEC’s filing might have been expected to prompt a selloff that would push the token’s price back below $3, the opposite occurred. Instead, market participants have increased their accumulation of the asset.

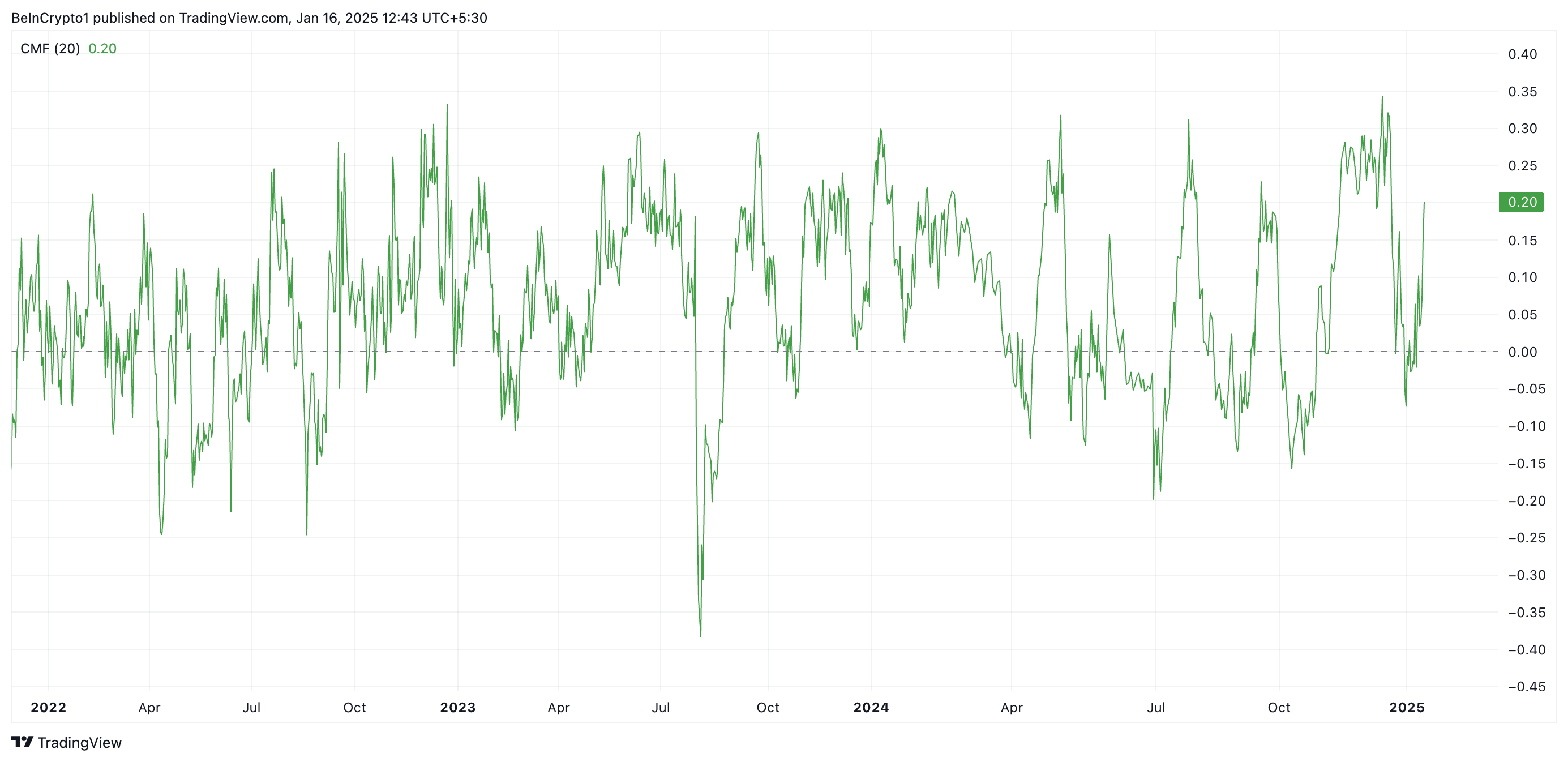

This is evidenced by XRP’s rising Chaikin Money Flow (CMF). As of this writing, this momentum indicator is in an upward trend at 0.20.

This indicator measures the amount of money flowing into or out of an asset over a specific period, considering its price and volume. When it is positive during a price rally, it suggests strong buying pressure, indicating that the rally is supported by substantial demand and likely to continue.

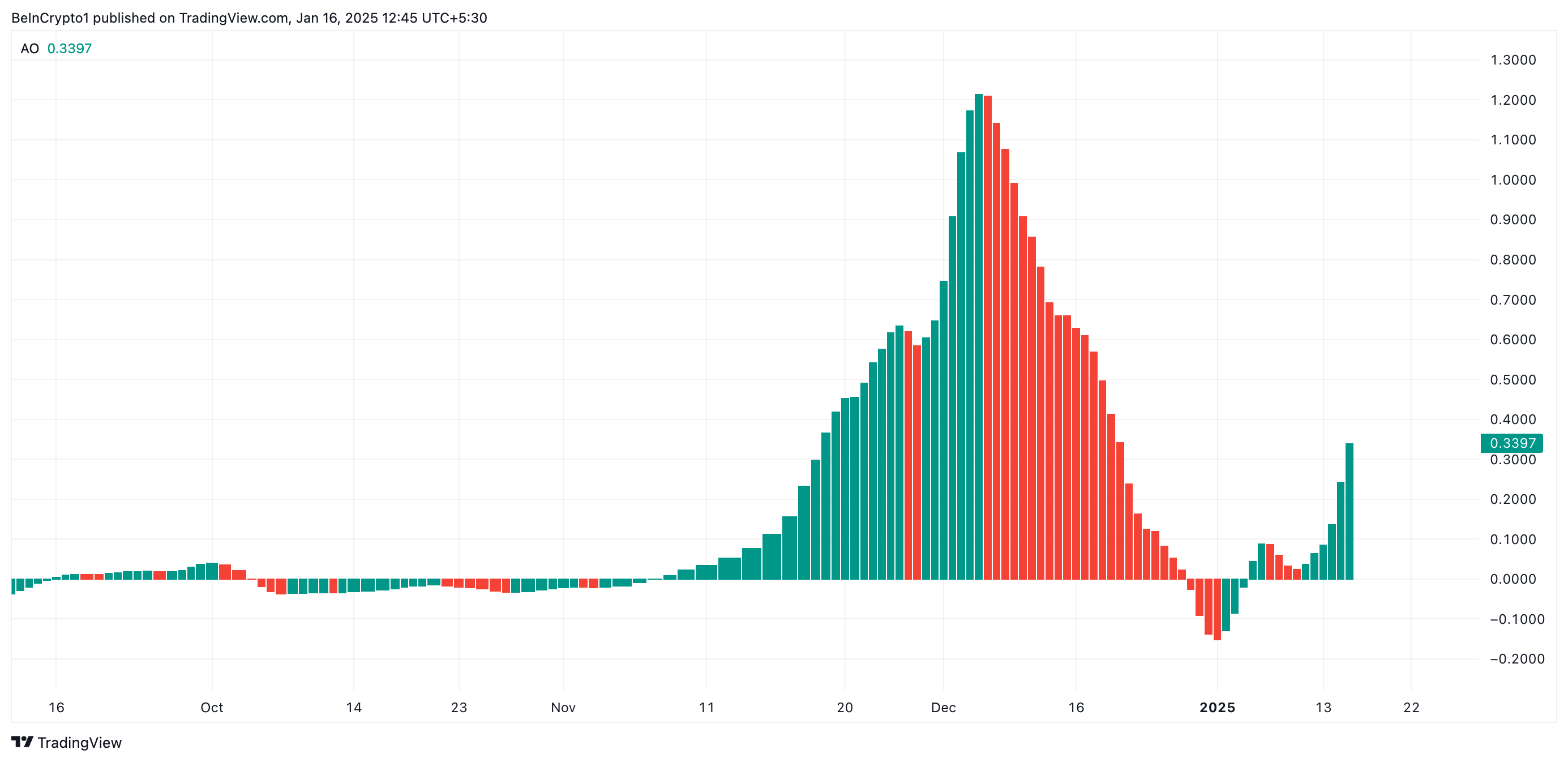

XRP’s Awesome Oscillator reflects the token’s increased accumulation. At press time, the indicator returns a green upward-facing histogram bar, with its value at 0.33.

This indicator measures market momentum by comparing the short-term and long-term moving averages of an asset’s price. When it returns a green upward-facing bar, it signals increasing bullish momentum, indicating that the market is gaining upward strength and may continue to rise.

XRP Price Prediction: All-Time High Within Reach

If the current accumulation trend persists, XRP’s price could rise toward its all-time high of $3.28, which was last reached in January 2018.

However, a reversal in market sentiment could undermine this bullish outlook; if selling pressure intensifies, XRP may lose its recent gains and fall below $3 to potentially trade around $2.60.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Leave a Comment