- PostFinance is expanding its service to include a “staking” function

- Worth addressing the implications of staking on cryptocurrencies and crypto holders

PostFinance, a Swiss state-owned bank, took a significant step by integrating a “staking” service into its cryptocurrency management options. This addition comes about a year after PostFinance first offered trading and custody of cryptocurrencies, in collaboration with Sygnum Bank.

Now, clients can earn passive income by staking their Ethereum directly through PostFinance’s platforms, with plans to expand to other cryptocurrencies soon.

Staking allows users to support blockchain security and operations by locking up their cryptocurrencies, earning them “staking rewards” in return.

This service by PostFinance operates directly on the Ethereum blockchain, ensuring maximum security and transparency for its users. Starting with as little as 0.1 ETH, customers can participate in staking and view their rewards, alongside their other crypto holdings within the bank’s digital assets interface.

This attempt to embrace and enhance cryptocurrency functionalities for its clients is a key step towards driving more TradFi players into crypto. What this development also does is fuel the asset class’s increasing market legitimacy.

Staking popularity and its impact on the market

Such a significant shift towards staking, with platforms like PostFinance introducing staking options for Ethereum, highlight the trend’s mainstream acceptance. Staking allows investors to earn rewards by locking their crypto assets, supporting blockchain operations.

Ethereum, with its transition to Proof-of-Stake (PoS) in 2022, has become a prime candidate for staking, alongside Cardano and Solana. In fact, some boast high staking ratios of as high as 70% of the circulating supply.

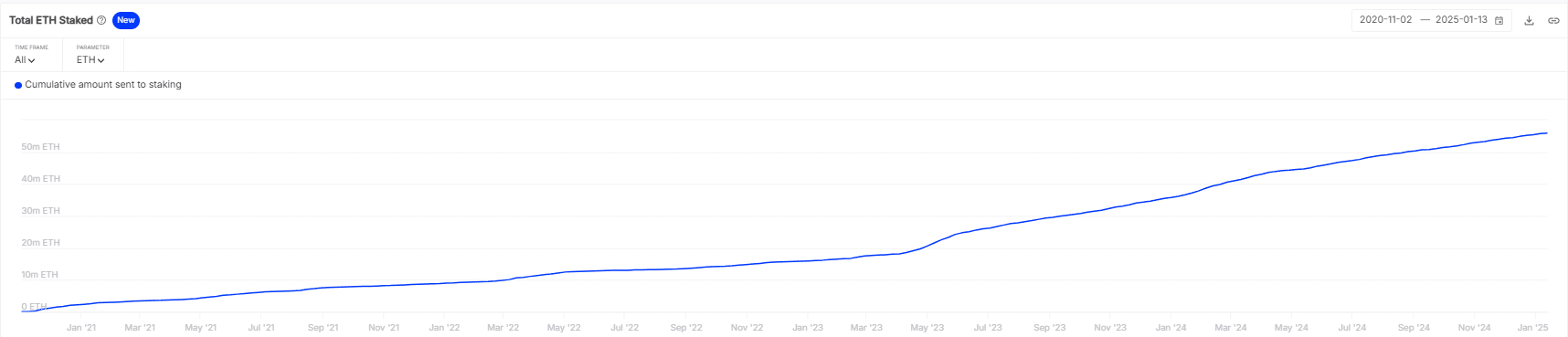

This shift can be evidenced by the high in total value locked (TVL) across these networks – A sign of investor interest in staking for passive income.

Source: IntoTheBlock

Staking’s rise not only aids in securing networks by incentivizing honest behavior, but also affects market liquidity. With more assets staked, there’s less immediate selling pressure, potentially stabilizing or even increasing asset prices over time.

However, this also introduces new considerations for market dynamics. Especially since staked assets might not be immediately available for trading, affecting market depth and volatility.

Implications on fortunes of holders

Staking fundamentally changes holder behavior by providing a passive income stream, which encourages long-term holding over speculative trading. For holders, this means potentially higher returns over time without the need for active trading.

On-chain data showed a significant portion of ETH being staked since the merge. Therefore, supply available on exchanges for short-term trading has fallen. This lock-in effect could lead to an appreciation in asset value as fewer coins chase the same market cap.

These staking service could further this trend by offering an accessible entry point for less tech-savvy investors to participate in staking. This could broaden the staking community and potentially enhance the fortunes of those who commit to long-term holding Ethereum.

Source: https://ambcrypto.com/swiss-state-owned-postfinance-bank-now-offers-eth-staking-heres-what-it-means/

Leave a Comment