I have bought Bombay Dyeing & Manufacturing Company at ₹206. Can the stock go back to my purchase price? What is the outlook?

T Raveendran, Chennai

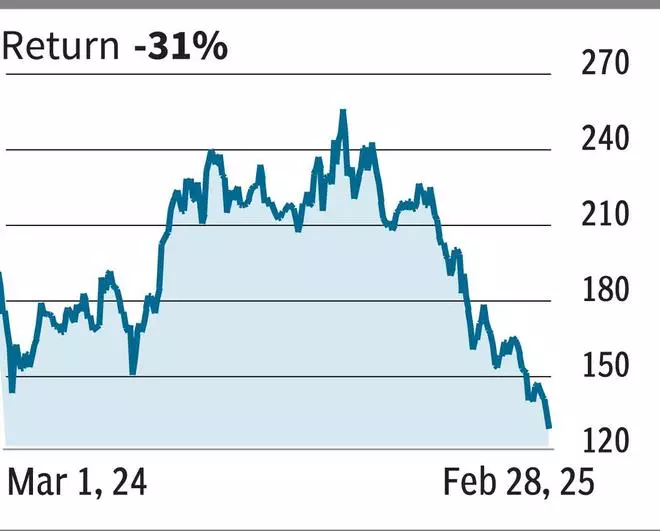

Bombay Dyeing (₹126.70): The stock has been in a strong downtrend since November last year. Recently the stock has declined well below a key support level of ₹143. That leaves the danger high of the share price declining towards ₹100-95 initially. An eventual break below ₹95 can see the stock tumbling towards ₹60 and even ₹40 in the coming months.

A sustained rise above ₹143 is needed to get some relief and turn the outlook bullish. But such a rise looks unlikely. Also, looking at the historical price movement, the chances are high to see a fall to ₹60-40 in the coming months. So, you may have to accept the loss and exit the stock now.

I have shares of Tube Investments of India. My purchase price is ₹3,640. Can I hold the stock for long-term, say three years? Please advise.

Viswanathan

Tube Investments of India (₹2,467): The long-term uptrend that was in place since 2020 has been clearly broken. Immediate support is at ₹2,400. A corrective bounce from this support to ₹3,000 is a possibility. But a rise above ₹3,000 might not be easy. A reversal from ₹3,000 can drag the share price down to ₹2,000-1,980 in the coming months where it may find a bottom.

However, it might take a long time for the stock to regain strength and go back above ₹3,000. So, you can keep a stop-loss at ₹2,380 for now. Make use of the corrective bounce to exit the stock at ₹2,980. If the stock does not bounce from ₹2,400, then adhere to the stop-loss and exit at ₹2,380.

What is the outlook for Radico Khaitan?

Amol

Radico Khaitan (₹2,051.75): The stock is in a corrective fall now. Immediate resistance is in the ₹2,200-2,300 region. There is room for a fall to ₹1,750-1,650. A bounce from the ₹1,750-1,650 region and a subsequent rise above ₹2,300 will bring back the bullish momentum. That leg of rally will have the potential to take Radico Khaitan share price up to ₹3,000-3,500 over the long term.

Wait for dips to enter the stock. You can buy at ₹1,750 and at ₹1,680. Keep a stop-loss at ₹1,420. Trail the stop-loss up to ₹1,880 when the price goes up to ₹2,220. Move the stop-loss further up to ₹2,550 when the price touches ₹2,900. Revise the stop-loss up to ₹3,000 when the price goes up to ₹3,200. Exit at ₹3,400.

Is this a good time to buy Apollo Hospitals Enterprise?

Rakshitha, Ahmedabad

Apollo Hospitals Enterprise (₹6,052): The stock touched a high of ₹7,543 in January and has come down sharply from there. Immediate support is at ₹6,000. Below that ₹5,700 is the next crucial support. A bounce from either of these two supports can take the share price up to ₹6,600 or even ₹7,000. However, a strong rise above ₹7,000 is needed to bring back the bullishness and take the price up to ₹8,000 and higher.

In case the stock declines below ₹5,700, then ₹5,200-5,000 can be seen. If you want to play the stock in the short term, buy at ₹5,800. Keep the stop-loss at ₹5,600. Trail the stop-loss up to ₹6,000 when the price goes up to ₹6,200. Move the stop-loss further up to ₹6,300 when the price touches ₹6,400. Exit the stock at ₹6,600.

Send your questions to techtrail@thehindu.co.in

Leave a Comment