President Donald Trump’s tariff threats once again lifted the dollar last week, but a growing group of investors is betting against the greenback amid signs the US economy is cooling and on concern a trade war will weaken it further.

Article content

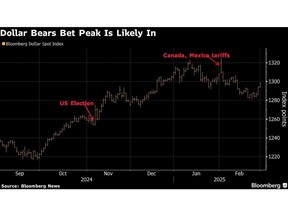

(Bloomberg) — President Donald Trump’s tariff threats once again lifted the dollar last week, but a growing group of investors is betting against the greenback amid signs the US economy is cooling and on concern a trade war will weaken it further.

Article content

Article content

The expanding chorus of greenback bears includes asset managers Invesco and Columbia Threadneedle and hedge fund Mount Lucas Management. On Wall Street, Morgan Stanley and Societe Generale are warning clients that going long the dollar is an overcrowded trade that may not hold up.

Advertisement 2

Article content

They’re looking past the daily gyrations sparked by tariff announcements, and as they see it, the narrative around the greenback is only darkening. Instead of deriving support from the prospect that import levies could reignite inflation and keep interest rates elevated, there’s now concern that all the uncertainty around tariffs risks undermining an economy that already shows signs of cooling.

The result is that market expectations for Federal Reserve interest-rate cuts have intensified, diminishing the greenback’s appeal. And the aura of US economic exceptionalism that underpinned the dollar’s 7.1% surge last quarter is dimming as investors ponder Trump’s domestic and foreign policies, that include efforts to slash federal expenses and broke a peace deal between Russia and Ukraine.

“I don’t think he can send the dollar much higher, because it’s really expensive,” said Kit Juckes, head of currency strategy at SocGen in London. “But can he send it lower? He absolutely can, if he damages the US economy.”

Market Peril

The world’s primary reserve currency is now almost 2% below the post-election peak it reached before Trump’s inauguration, amid a risk-on wave that also boosted stocks and Treasury yields.

Article content

Advertisement 3

Article content

Last week drove home the peril of going short the dollar in the current environment. The greenback surged on Thursday, paring its February decline, after Trump said that 25% tariffs on Mexico and Canada would take effect March 4. He also said he would impose an additional 10% tax on Chinese imports.

The US currency extended gains on Friday in the aftermath of a heated exchange between President Trump and Ukraine’s Volodymyr Zelenskiy, leading to the collapse of a peace agreement with Russia and a potential deal on critical minerals. In an interview after the Oval Office bustup, Treasury Secretary Scott Bessent reiterated that tariffs are likely to generate substantial revenue.

Fading Enthusiasm

Headlines on tariffs have tended to help the dollar because generally speaking they make imports more costly, potentially hurting demand for those goods and reducing the need for the currencies to buy them.

At the same time, investors got a reminder last week of the headwinds the economy is facing, as pending home sales slumped to a record low and jobless claims rose to the highest this year, partly due to job-cut announcements at federal agencies.

Advertisement 4

Article content

It’s that backdrop that has bears convinced they’re leaning in the right direction.

“For a period of time the market priced only the positive side” of the administration’s policies, said David Aspell, co-chief investment officer at Mount Lucas, which has $1.7 billion under management. “You also need to fully price things that they’re trying to do that are going to be growth-negative.”

The fund is short the dollar versus peers including the pound and the Mexican peso as the post-election enthusiasm over US growth fades.

Invesco, meanwhile, flipped to underweight the dollar from overweight a few weeks ago on better-than-forecast data out of Europe.

At Columbia Threadneedle, Ed Al-Hussainy says he’s been shorting the dollar against emerging-market currencies since December. When bullish-dollar positioning increased after the Fed signaled it would slow its easing, his thought was that he may not be able to get much more out of the trade. The rates strategist said he plans to keep the short position for at least six months.

The US currency’s pullback from its recent peak is reminding Morgan Stanley strategists of the start of Trump’s first term in 2017. Back then, the currency slumped after he took office, reversing a rally that followed his November 2016 election win.

Advertisement 5

Article content

Bonds Too

The shift in sentiment is rippling through the Treasury market too. Traders have driven two-year yields to the lowest since October as expectations build for deeper Fed easing.

A break lower in yields on additional signs of economic weakness is “the dollar bear case,” said George Catrambone, head of fixed income at DWS Americas. “For a meaningful decline in the dollar you need to see the market price in more cuts, but it will ultimately also depend on what other central banks are doing.”

For now, traders see around nearly 0.70 percentage points of Fed rate reductions by year-end, compared with about 0.85 percentage points for the European Central Bank.

That differential helps explain why the market, overall, still has a bias toward greenback strength. In futures, for example, speculators such as hedge funds are still leaning toward dollar gains even after trimming bullish bets to the lowest since late October.

But the great unknown, of course, is how tariffs will play out.

Goldman Sachs Group Inc. strategists expect more dollar gains should sweeping levies ultimately come to pass, and they said in a Wednesday note that the market was underpricing that risk. Meanwhile, Morgan Stanley, argued last week that the dollar’s major peers have become less sensitive to tariff announcements in recent weeks, which could extend the dollar’s slide.

Advertisement 6

Article content

Investors, for their part, don’t seem to see tariff-fueled turbulence ending any time soon.

“Volatility is likely to increase, but it is not clear to me that the US dollar comes out winning,” said Alessio de Longis at Invesco.

What to Watch

- Economic data:

- March 3: S&P Global US manufacturing PMI; construction spending; ISM manufacturing and prices paid; new orders and employment

- March 5: MBA mortgage applications; ADP employment change; S&P Global US services and composite PMIs; factory and durable goods orders; ISM Services index; Federal Reserve Beige Book

- March 6: Trade balance; initial and continuing jobless claims; wholesale inventories

- March 7: Change in nonfarm payrolls; unemployment rate; average hourly earnings

- Fed calendar:

- March 3: St. Louis Fed President Alberto Musalem

- March 4: New York Fed President John Williams

- March 6: Atlanta Fed President Raphael Bostic; Fed Governor Christopher Waller; Philadelphia Fed President Patrick Harker

- March 7: Fed Chair Jerome Powell speaks on the economic outlook; Williams; Fed Governor Michelle Bowman; Fed Governor Adriana Kugler

- March 8: Fed blackout period begins

- Auction calendar:

- March 3: 13-, 26-week bills

- March 4: 6-week bills, 12-day CMB

- March 5: 17-week bills

- March 6: 4-, 8-week bills

—With assistance from Michael Mackenzie.

Article content

Leave a Comment