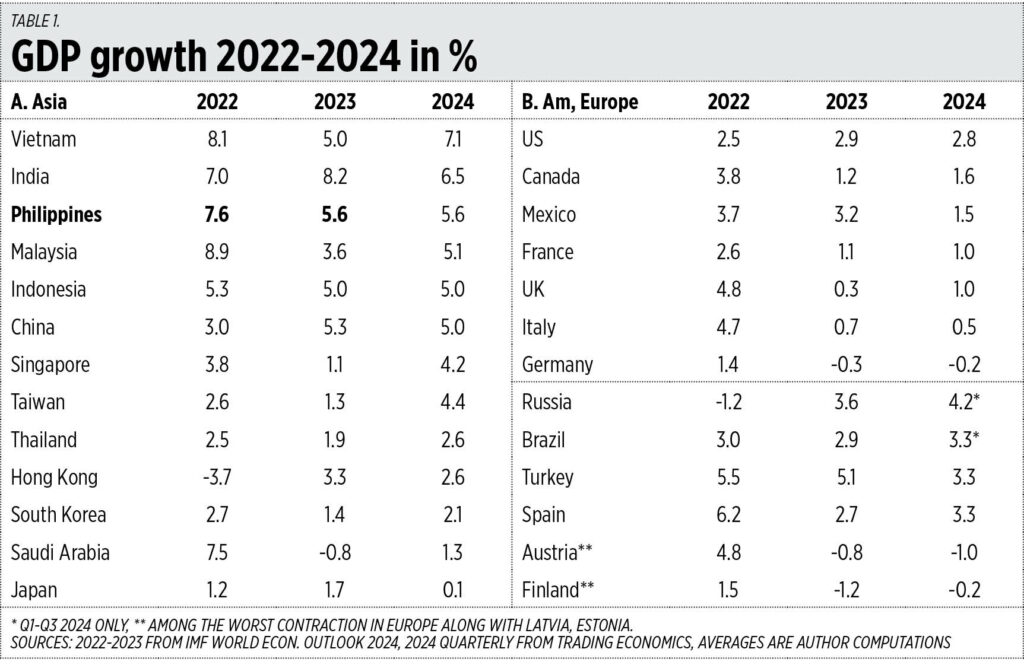

Last week Canada and India released their fourth quarter (Q4) 2024 GDP data. So, the top 15 largest economies in the world have now provided their full year 2024 data (except Brazil and Russia). Extending the list to encompass the top 60 medium and large economies in the world, one sees that the fastest growing economies last year were Vietnam, India, and the Philippines. Kudos to Philippine businesses and workers, and the government economic and infrastructure teams.

The European nations and Japan remain laggards economically. The largest economy of Europe, Germany, has been contracting for the last two years straight, a clear case of deindustrialization. As has Austria too, and Russia’s three neighbors — Finland, Latvia, and Estonia (see Table 1).

Growth of nearly 6% is good, but we need to grow 7-8% yearly if we are to significantly reduce poverty and create more jobs. From 1982 to 2011, China grew by an average of 10.3% per year. From 1992 to 2019, Vietnam grew by an average of 7.1% per year.

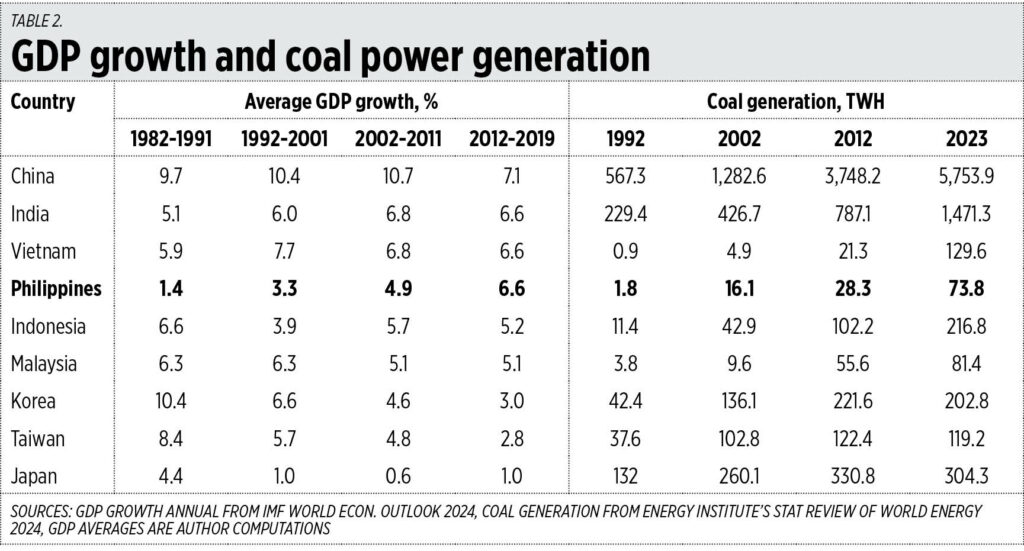

Aside from having had a low economic base up to the early 1980s, both China and Vietnam grew fast on the back of electricity generation which was heavily dependent on coal. India and Indonesia did so too. Their big manufacturing capacity, their huge hotels, resorts, and malls, their airports and seaports were all powered mostly from their coal plants which give cheap, reliable, and dependable electricity.

Meanwhile, the Philippines’ coal generation is the smallest among developed and emerging Asian countries except for those that rely more on natural gas like Thailand and Singapore. Even developed and “greenie” Korea and Japan have high coal generation (see Table 2).

I believe that the Philippines can grow by 7-8% per year for a decade — provided we discard growth-braking climate-related regulations and restrictions, plus if we have improvements in rule of law and a drastic reduction in the annual budget deficit and borrowings.

Last week, on Feb. 24, CNN’s Richard Quest interviewed Finance Secretary Ralph G. Recto about trade and investments, asking if the Philippines is in danger of US President Donald Trump’s “protectionist” policies. I liked the practical reply of Secretary Recto.

He said: “Our economy is 70% to 75% domestic driven. Unlike China and Vietnam, or even our neighbors in Southeast Asia, [which are] more export-oriented driven. We earn foreign exchange from OFW remittances. We have a trade deficit when it comes to goods. We have a robust BPO industry… FDIs, hopefully, maybe Apple… Western companies [that] invested in China will probably move also to the Philippines. And we have a new law CREATE MORE, for that purpose… [we are] now working on a free trade agreement with the European Union… [we are] open to a free trade agreement with the United States. And I will bat for a reduction in tariffs on US vehicles.”

Mr. Recto was referring to the Implementing Rules and Regulations (IRR) of the Corporate Recovery and Tax Incentives for Enterprises to Maximize Opportunities for Reinvigorating the Economy (CREATE MORE) Act or RA 12066 that he signed on Feb. 21 as the Chair of the Fiscal Incentives Review Board (FIRB), along with his FIRB Co-Chair, Trade Secretary Ma. Cristina Aldeguer-Roque.

Last Friday, Feb. 28, the Bureau of the Treasury released the December and hence full year 2024 cash operations report. The budget deficit was P1.51 trillion. But the revenues data is still incomplete, with no breakdown yet for income tax, excise tax, VAT, and other domestic taxes. I think when these are fully accounted, the deficit can go down to probably P1.3 trillion only.

The budget deficits in previous years were: P1.37 trillion in 2020, P1.67 trillion in 2021, P1.61 trillion in 2022, and P1.51 trillion in 2023.

Meanwhile, financing or net borrowing is declining: P2.50 trillion in 2020, P2.25 trillion in 2021, P1.97 trillion in 2022, P2.07 trillion in 2023, and P1.31 trillion in 2024.

Budget Secretary Amenah F. Pangandaman, in a press release, hailed that the budget deficit for 2024 has “gone down to 5.7% of GDP, better than expected… the lowest rate recorded since the pandemic in 2020… a marked improvement compared to the 6.2% deficit in 2023… also well within the fiscal outlook of the Development Budget Coordination Committee (DBCC) at our last meeting.”

While I share Ms. Pangandaman’s exuberance, I still wish that spending, the deficit, and borrowing decline significantly. The interest payments for our public debt in 2024 was P763 billion, or an average of P2.1 billion per day. This is huge and wasteful.

Also last week, on Feb. 26, I attended the BusinessWorld Stock Market Outlook 2025, held at the Dusit Hotel in Makati. The finance speakers expressed an overall business optimism for the country this year, coming from 2024’s “high-interest rate environment,” the “tug of war between low-risk premiums and elevated bond yields,” “foreign fund outflows of $442 million or three times higher than 2023,” and saying that “PSEi still significantly undervalued.”

The CREATE MORE law and its IRR, especially the corporate income tax cut from 25% to 20% to start this year, should help attract those foreign equities and FDIs back to Philippine soil and companies.

Bienvenido S. Oplas, Jr. is the president of Bienvenido S. Oplas, Jr. Research Consultancy Services, and Minimal Government Thinkers. He is an international fellow of the Tholos Foundation.

minimalgovernment@gmail.com

Leave a Comment