FemTech has emerged in recent years as a catch-all term to describe technology-driven innovation in women’s health. It is a rapidly growing sector in health technology, yet where research funding flows and what actually gets commercialized often don’t align. While fertility solutions dominate across research grants, patents, and clinical trials, areas like menopause, sexual health, and non-hormonal contraception remain severely underfunded and underdeveloped.

This analysis is intended as a starting point for understanding where FemTech is growing and where major gaps remain. Using Dimensions AI data, I analyzed grant funding, patent filings, and clinical trials from the past 10 years. I assigned results to broad women’s health categories using keyword matching in titles and abstracts.

Some grants, patents, and trials may appear under multiple categories if they are relevant to more than one area (e.g., a menstruation tracking app could be tagged as relevant to fertility and PCOS management). As a result, category totals should not be summed together to avoid double-counting. Instead, the charts provide a relative comparison of activity across FemTech areas and show which topics receive more research, investment, and commercialization efforts. Additionally, while patents indicate where commercialization is happening, they do not guarantee market success or regulatory approval.

Where is FemTech Research Growing?

Fertility Innovation Leads Research and Commercialization

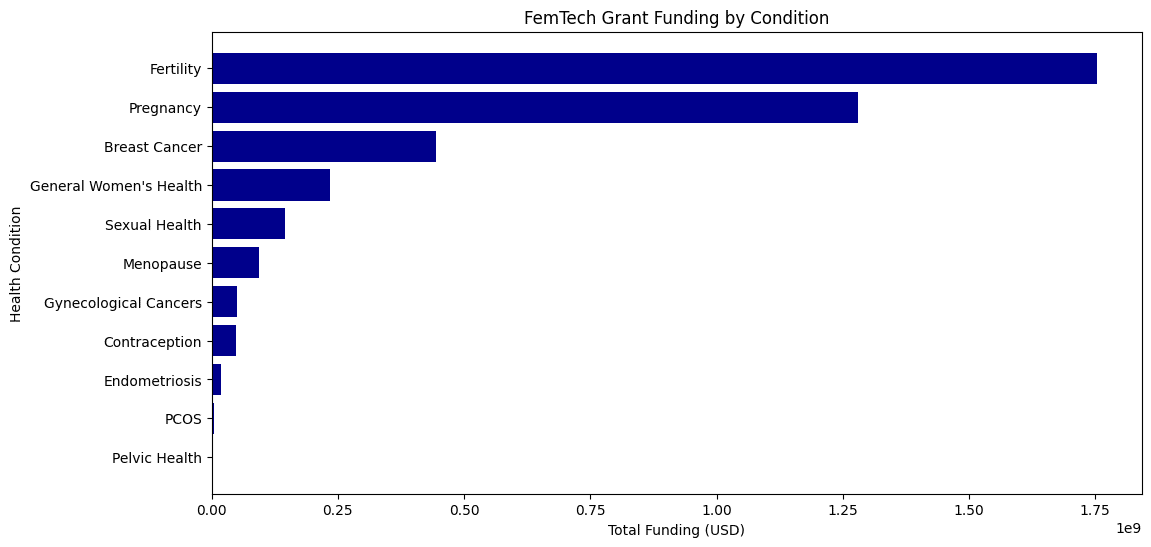

Over the past 10 years, global funding agencies such as NIH, the European Commission, and NIHR have awarded $1.06 billion in grants for FemTech-related research. The top-funded areas include:

- Fertility – 43.1% of total funding

- Pregnancy – 31.4% of total funding

- Breast cancer – 10.9% of total funding.

Notably, menopause remains an underfunded area, receiving just 0.55% of total research dollars. This pattern of underfunding in menopause research may reflect broader research biases in women’s health, which leads to non-reproductive aging conditions receiving less attention. Endometriosis and menopause remain starkly underrepresented, reinforcing the pattern of underinvestment in midlife women’s health.

Are We Seeing Innovation? (Patents & Clinical Trials Trends)

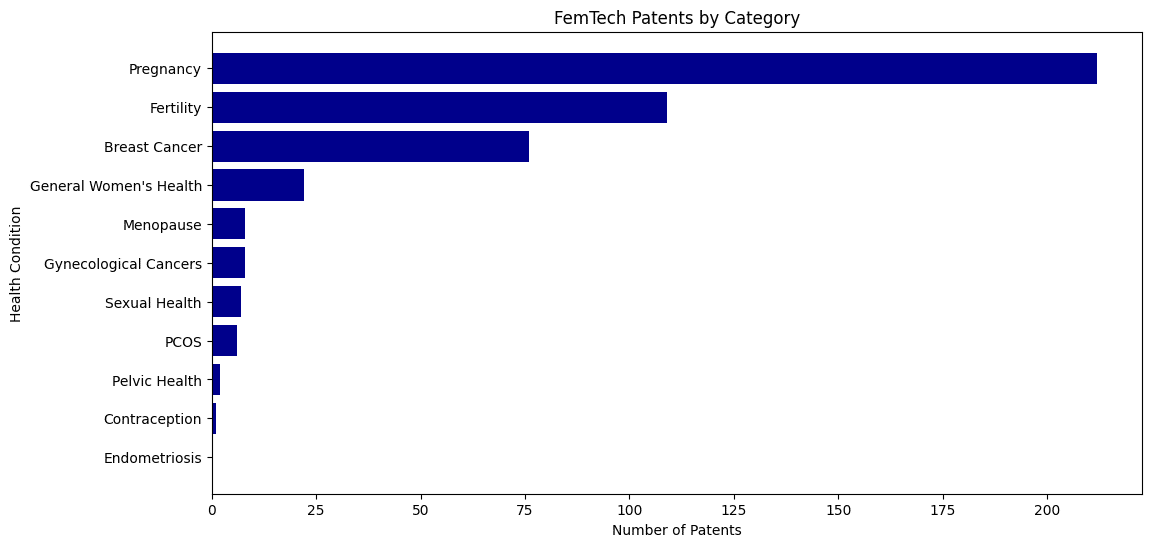

Patents Show Market Interest, But Only in Select Areas

While research funding drives exploration, patent filings can indicate where private sector innovation is happening. My analysis finds that like grant funding, FemTech patents are unevenly distributed across key areas of women’s health:

- Fertility – 48% of total patents. This reflects strong market demand, heavy private investment, and ongoing consumer interest in reproductive health solutions.

- Pregnancy – 32% of total patents, reinforcing continued industry attention on maternal health

- Breast cancer – 11.5% of total patents, indicating continued investment but less dominance compared to fertility and pregnancy-related innovations.

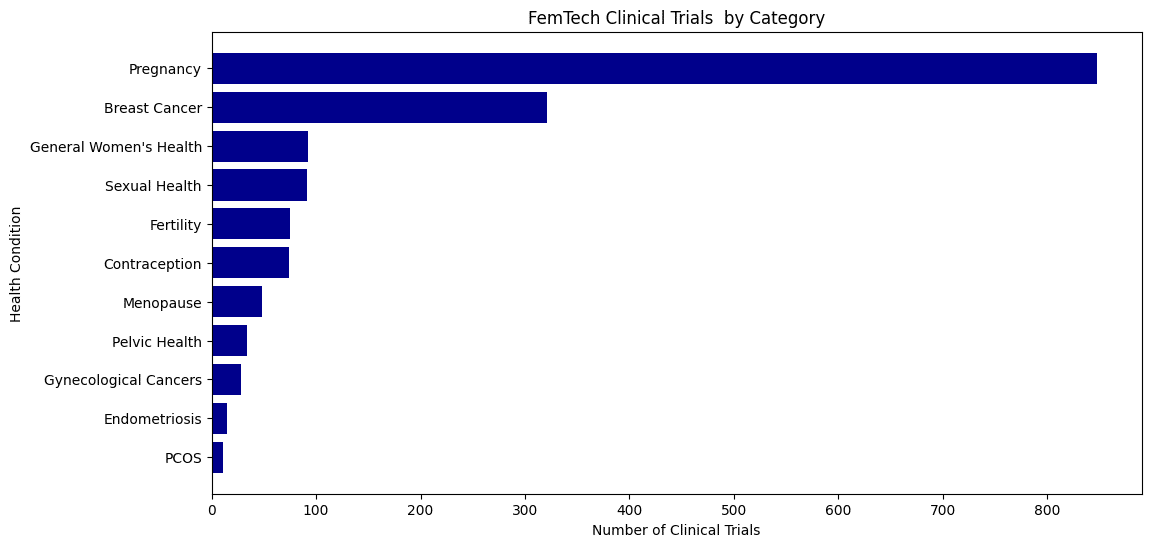

Clinical Trials Reveal an Innovation Gap

Clinical trials provide a window into what is actually being tested for real-world use, and the results show clear misalignments:

- Fertility – 41.8% of all clinical trials

- Pregnancy – 29.7% of clinical trials

- Breast cancer 11% of clinical trials

- Sexual health is significantly under-tested, representing only 3.4% of trials, despite strong consumer interest in solutions for sexual wellness.

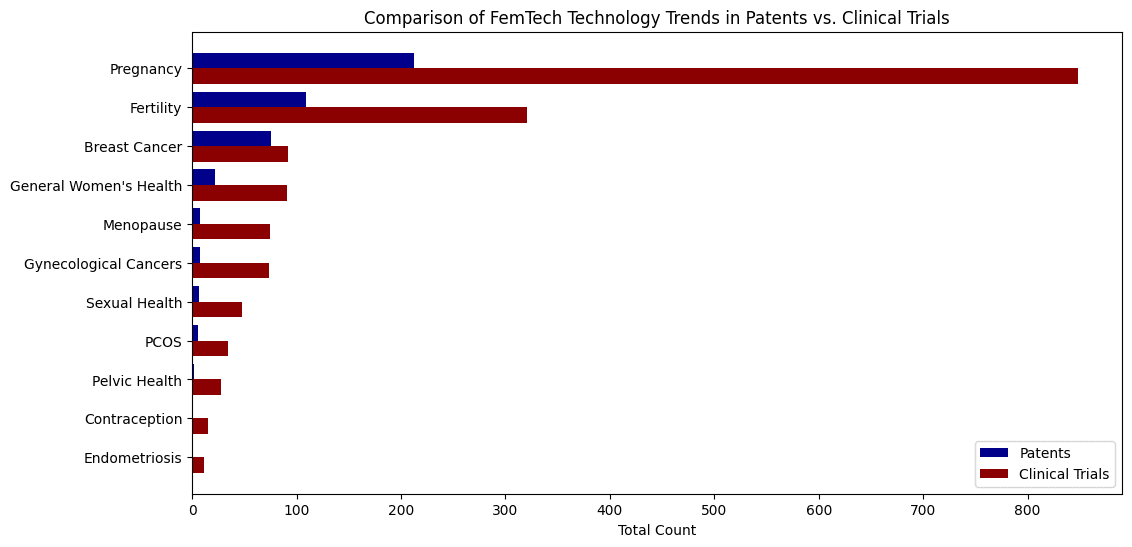

Bridging the Gap Between Research, Innovation, and Commercialization in FemTech

While research funding drives exploration, patent filings indicate where private sector innovation is happening. Our analysis finds that FemTech commercialization is highly concentrated, but there are some differences between innovation-heavy areas and those struggling to reach clinical validation.

- Fertility technology has a far higher ratio of patents to clinical trials than any other category (4.21 patents per trial). This patent volume reflects strong market demand, heavy private investment, and rapid technological advancements in assisted reproduction. However, the gap between patents and trials suggests companies may be prioritizing direct-to-consumer models over clinical validation, or facing regulatory hurdles in testing fertility innovations.

- Pregnancy-related innovation has a balanced ratio (0.25 patents per trial), indicating steady research and commercialization efforts moving in parallel.

- Breast cancer technology follows a similar trend (0.24 patents per trial), showing consistent investment across both innovation and clinical validation.

- Menopause (0.18 patents per trial) and gynecological cancers (0.16 patents per trial) see even less commercialization, reinforcing concerns that midlife women’s health remains a lower priority for investment.

- Sexual health and contraception have some of the lowest patent-to-trial ratios (0.07 and 0.03, respectively) which may indicate that commercialization is still lagging behind research.

- Endometriosis has clinical trials but almost no patents, confirming that diagnostic and treatment innovation remains stagnant.

Implications:

- Are regulatory pathways slowing down fertility tech adoption?

- Are companies prioritizing patents in high-demand markets (like fertility) while ignoring other health needs?

- Should funding agencies reallocate resources toward under-commercialized areas like endometriosis, menopause, and contraception, or will demographic trends inevitably increase commercial investment in some of these areas?

Technology Trends in FemTech: AI, Wearables, and Digital Health

Beyond funding and commercialization trends, an analysis of patents and clinical trials reveals which technologies are shaping FemTech innovation. Three key areas dominate:

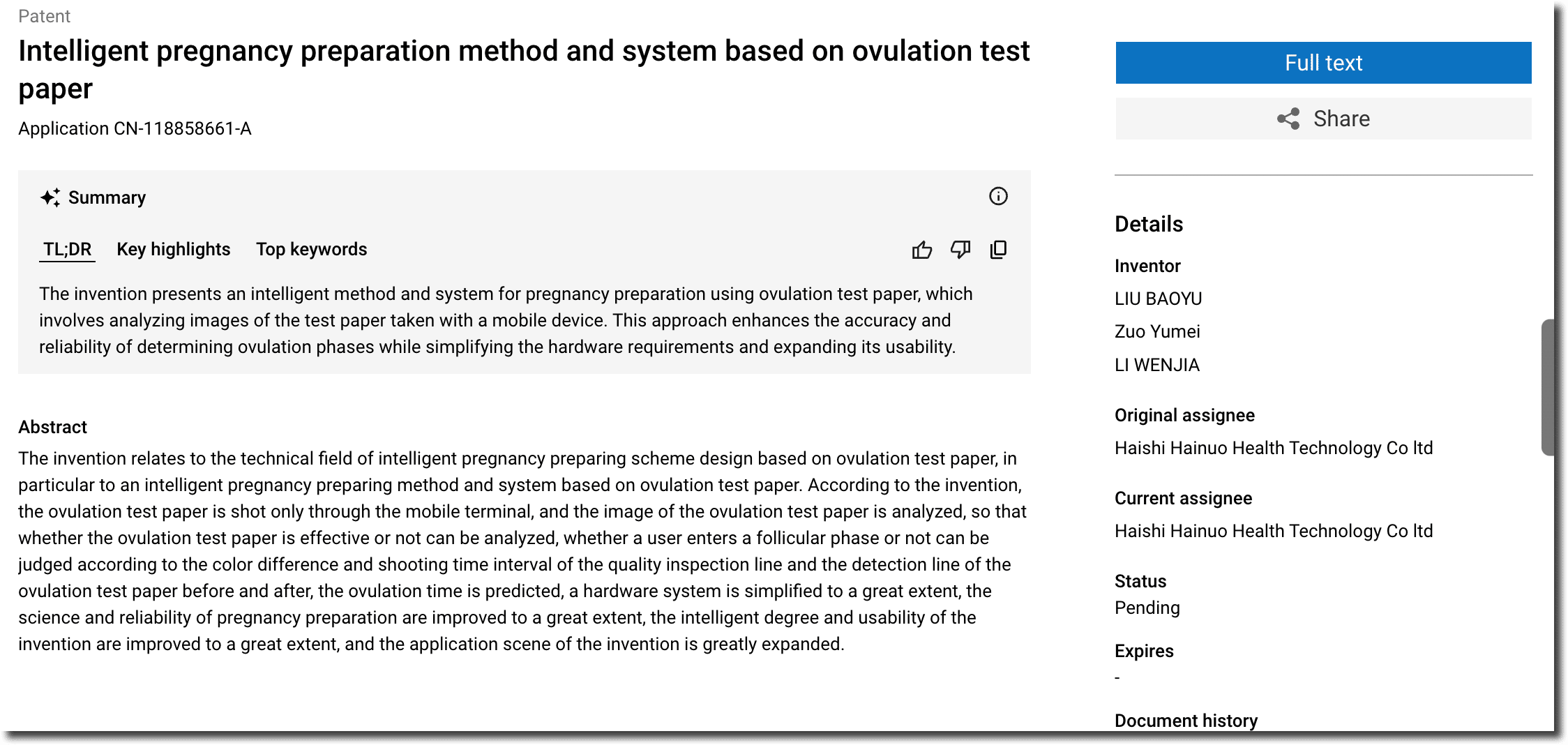

AI-Driven Diagnostics

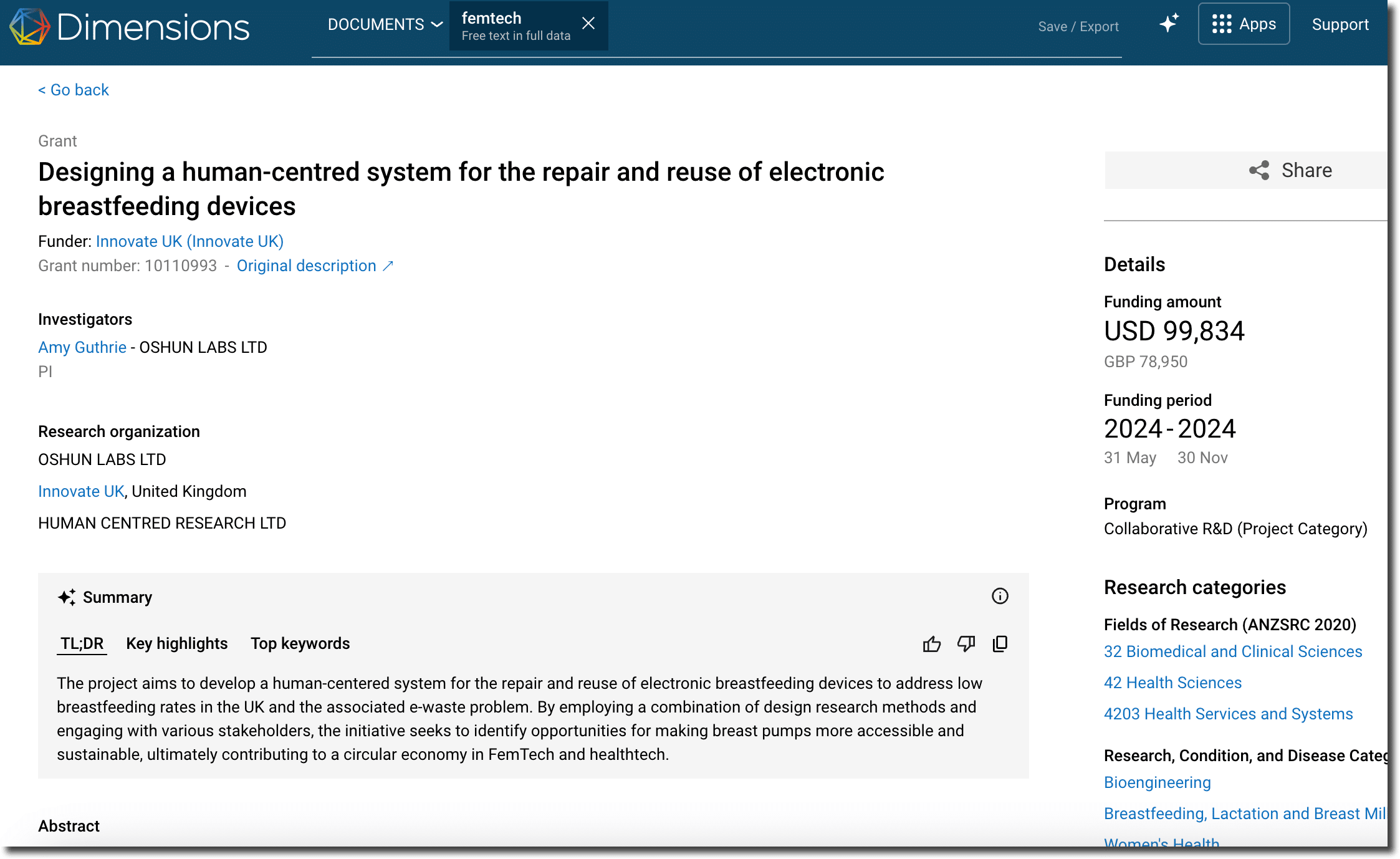

Machine learning and AI are being integrated into fertility tracking, ovulation prediction, and personalized reproductive health solutions. Patents in AI-based reproductive health are on the rise, reflecting growing interest in automated health insights. Breast cancer detection AI is another expanding area, with startups and researchers developing algorithmic screening tools.

Wearable Devices for Women’s Health

FemTech wearables can range from cycle-tracking smart rings to pelvic floor training sensors and are emerging as a major category in innovation. Key areas of innovation include fertility tracking, pregnancy monitoring, and menopause symptom management. While patents for wearable tech are increasing, clinical trials remain limited, indicating that many of these products have not yet reached large-scale medical validation.

Telemedicine & Digital Health

Telemedicine is playing an increasing role in FemTech commercialization, particularly in clinical research. Examples range from virtual genetic counseling, menopause support apps, and AI-powered health coaching for reproductive and sexual health.

Implications:

- AI-driven diagnostics and wearable devices are growing fast in patents but lagging in clinical trials, which may suggest regulatory or adoption challenges.

- Telemedicine is further along in implementation, likely due to faster regulatory pathways for software-based interventions compared to hardware or pharmaceuticals.

Regulatory, Privacy, and Access Challenges in FemTech

FemTech is advancing rapidly, but policy frameworks are not keeping pace. Many innovations in AI-driven diagnostics, wearable health devices, and digital therapeutics face fragmented regulatory approval pathways that differ by region.

Privacy Concerns are a key issue, as many FemTech solutions collect sensitive health data. This raises concerns about data ownership, consent, and third-party sharing. Access Disparities are also a concern. Low-income populations face significant barriers to accessing affordable, approved, and accessible FemTech solutions.

These issues have been explored in the broader mHealth research movement in recent years, and prior work in these areas may be useful for informing policy and regulatory issues in FemTech. Moving forward, policymakers, researchers, and industry leaders must work together to ensure that FemTech innovations are ethically developed, widely accessible, and properly regulated.

Conclusion & Call to Action

FemTech is at a high-visibility moment. Fertility solutions are flourishing, while other critical areas like menopause, sexual health, and non-hormonal contraception continue to be neglected. The imbalance in research funding, innovation, and clinical validation reflects both structural funding priorities and market incentives.

At the same time, women’s health funding in the U.S. is facing new uncertainties. It is clear that changes in public health funding priorities will impact the future of research and commercialization in the FemTech space as well as women’s health more broadly .

Ensuring sustained investment will be critical to keeping FemTech innovation moving forward. History has shown that fluctuations in funding can significantly impact the pace of innovation. As policymakers, researchers, and industry leaders navigate these changes, cross-sector collaboration will be key.

Request a demo or quote

About the Author

Emily Alagha, Senior Director of Research Analytics & Support | Digital Science

Emily Alagha is a Senior Director of Research Analytics & Support at Digital Science, where she leverages AI-powered platforms like Dimensions to support data-driven strategies to optimize research funding and enhance research management practices. With a background in medical librarianship, she is passionate about health literacy and ensuring research is accessible to all. She is also a neurodivergent self-advocate committed to amplifying autistic voices and increasing autistic representation in research.

Leave a Comment