Spot Bitcoin exchange-traded funds in the United States recorded their tenth consecutive day of inflows on Dec. 11, with $223.03 million entering the funds as Bitcoin climbed back above the $100,000 mark.

According to data from SoSoValue, the majority of inflows on Dec. 11 went into Fidelity’s FBTC, which saw $121.9 million in new investments, extending its inflow streak to ten days. ARK and 21Shares’ ARKB fund and Grayscale’s GBTC also contributed significantly, with inflows of $52.67 million and $20.13 million, respectively.

Additionally, Grayscale Bitcoin Mini Trust, Biwise’s BITB, and VanEck’s HODL funds received more modest inflows of $15.74 million, $12.16 million, and $2.87 million, respectively. However, Valkyrie’s BRRR fund was the only outlier, reporting outflows of $2.44 million on the day.

Other BTC ETFs, including BlackRock’s IBIT—which has recorded inflows of $35.06 billion since its launch—remained neutral on Dec. 11.

The total trading volume for Bitcoin investment products stood at $3.94 billion on Dec. 11, slightly lower than the $3.97 billion recorded the previous day. As of the report, total net inflows into the 12 BTC ETFs amounted to $34.58 billion.

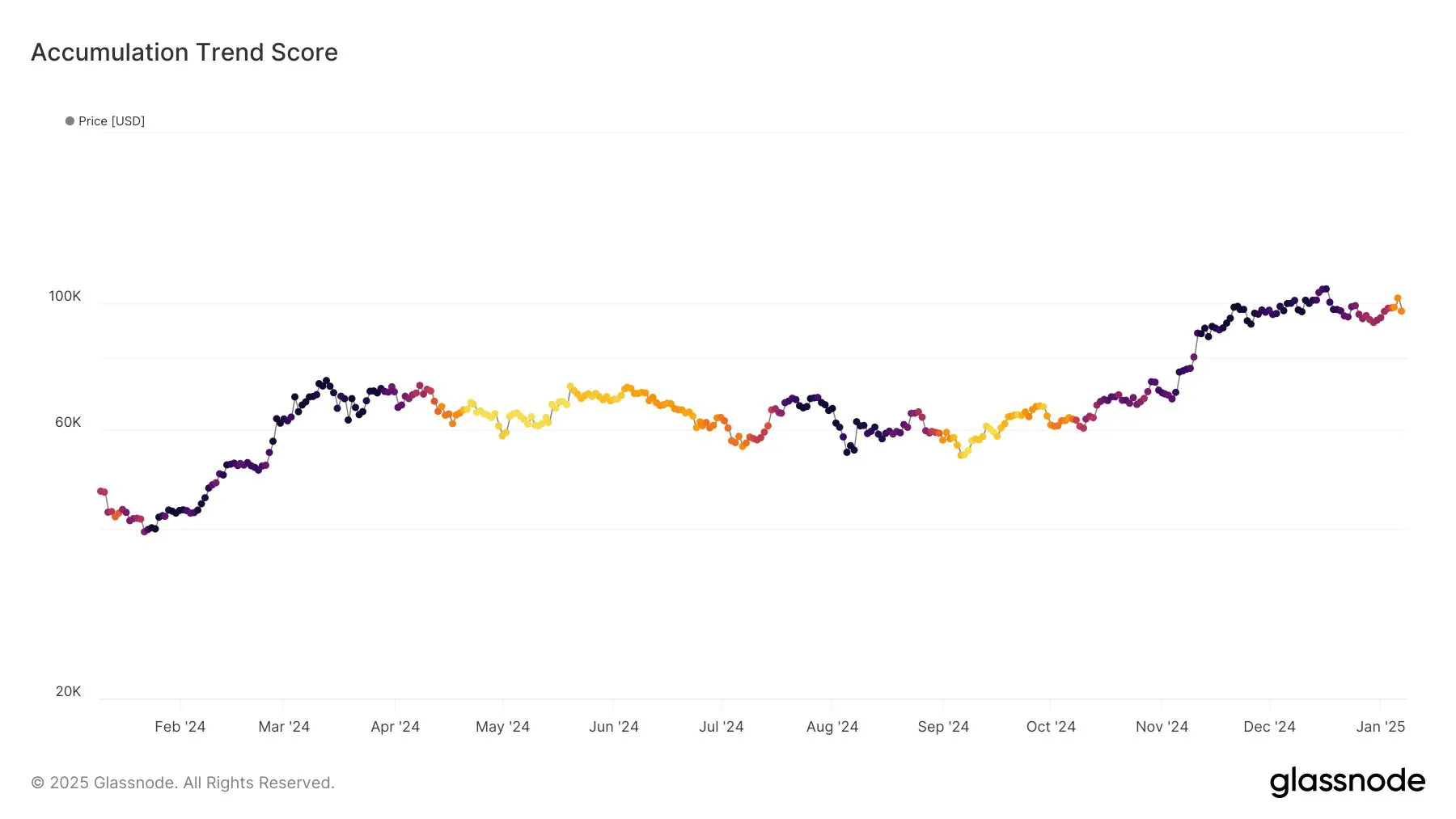

These inflows coincided with Bitcoin’s recent rally, which saw the crypto asset surpass $100,000, reaching a high of approximately $102,000. This increase came as recent U.S. inflation data raised expectations of a potential interest rate cut by the Federal Reserve.

At press time, Bitcoin (BTC) was trading at $100,769 per coin, up 3.3% over the past 24 hours.

Ether ETF inflows slow down

Spot Ethereum ETFs saw a slowdown in net inflows on Dec. 11, with $102.03 million recorded—a significant 66% drop from the $305.74 million seen the previous day.

According to data from SoSoValue, BlackRock’s ETHA fund attracted the majority of inflows, with $74.16 million entering the fund. Grayscale Ethereum Mini Trust followed, bringing in $13.38 million. Other contributors included Biwise’s ETHW, VanEck’s ETHV, and Franklin Templeton’s EZET, which saw inflows of $8.23 million, $5.6 million, and $2.91 million, respectively.

However, Grayscale’s ETHE fund reported outflows of $2.26 million on Dec. 11, bringing its total outflows since launch to $3.5 billion.

Cumulative net inflows for Ethereum ETFs stood at $1.97 billion at the time of reporting.

Ethereum (ETH) also experienced a price increase, trading at $3,916 per coin, up 7.2% over the past day. The broader cryptocurrency market was also on an upward trend, with total market capitalization rising 3.7% to $3.81 trillion.

Source: https://crypto.news/bitcoin-etfs-see-continued-inflows-as-btc-climbs-back-above-100k/

Leave a Comment