Active funds or active investing relies on leveraging available information to outperform the index. This should imply that large and mid-cap (L&M) space with higher information availability, should perform better. But the same is not reflected in the performance of active funds in the L&M space compared to small-cap funds. The latter have delivered comparable or better returns on an absolute basis and outperformed in beating the index (alpha). We measure the gap in performance between the two and the reason for outperformance.

Right to win

A stock in the L&M space can sometime be covered by 10-15 analysts which should significantly lower any information asymmetry. On the other hand, small cap stocks are undercovered and can sometimes have no analyst coverage. The access to management and regular investor meetings (disclosed on stock exchange websites) also favours L&M stocks though small-cap stocks are improving investor access recently. The access and reduced information gap should power active investing in L&M space to beat the index. But the higher research focus on a small group of stocks could be leading to diminishing return on research, leading to negative alphas in most cases.

Macro readthroughs are much more impactful on the top end of the market compared to the bottom end. This should allow an additional lever for L&M fund managers to outperform the index compared to small-cap universe. A higher government capex outlay, a cut in repo rate, policy shifts in energy, export/imports and PLI announcements have a higher impact on L&M stocks with their conglomerate backing than on small-cap ecosystem. But this too has failed to elevate alpha performance.

With diminishing return on research and inability to leverage macroeconomic indicators, the management fees paid in L&M space ranging from 100-250 bps per year has been a bearing on investor returns.

Absolute performance

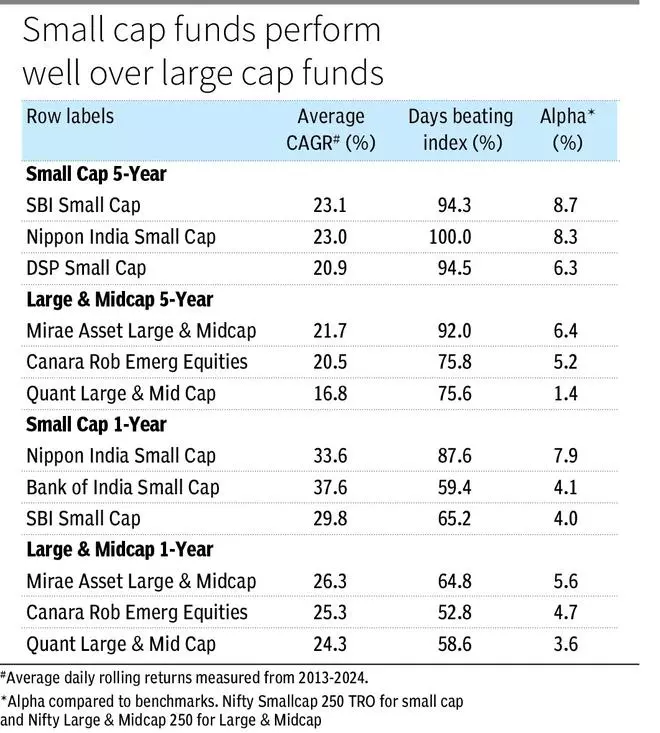

Small-cap stocks are expected to fare well on absolute return metric, which is shown in the table as well.

Small-cap universe is wider than L&M universe. This limits the number of positions taken in L&M funds, limit return potential. The sector selection is also wider in the small-cap space. Shifts in textile industry, evolving trade flows in chemicals and life sciences sector, growth tailwinds in electronics manufacturing, or renewable or alternate energy solutions find more resonance in small-cap space than in L&M sectors which are populated by mature sectors.

Earlier small-cap stocks were disproportionally impacted by corporate governance discounts. The situation is gradually improving as well. With periodic investor/conference calls, the management is regularly answerable to their strategies which should limit governance related discounts. The recent incidence of CE Info Systems (MapmyIndia) where announced plans of new company were modified under investor scrutiny is an example.

Gap in performance

We have considered active funds with more than five years of operations for analysis.

The 13 small-cap funds have delivered an average alpha of 380 bps over Nifty Smallcap 250 – TRI measured as average daily five-year rolling return CAGR for the last 10 years. In the L&M space with 19 funds, the alpha is a negative 80 bps over NIFTY LargeMidcap 250 – TRI index in the same measure. In fact only one fund in the small-cap space failed to outperform the index while only four of the 19 in L&M have managed to better the index. Nine of the small-cap active funds have beaten the index more the 75 per cent of the days on a 5-year CAGR basis while the large-cap counterpart has only three funds doing the same.

SBI Small Cap Fund has delivered an average 5-year CAGR of 23.1 per cent in the last 10 years compared to index return of 14.7 per cent. The top performer in the large-cap space is Mirae Asset Large & Midcap with average returns of 21.7 per cent compared to index returns of 15.4 per cent.

In the short timeframe of 1-year average returns in the last decade, volatility has impacted small-cap funds’ alpha performance. The alpha shrinks to 80 bps for small-cap funds but remains firmly at -100 bps in the large-cap space. The average Nifty Smallcap 250 – TRI returns over 1 year at 25.7 per cent though outperforms NIFTY LargeMidcap 250 – TRI average returns of 20.6 per cent.

Small-caps have delivered comparable or better returns on an absolute basis and outperformed in beating the index (alpha)

Small-cap stocks are expected to fare well on absolute return metric

Small-cap universe is wider than L&M universe. This limits the number of positions taken in L&M funds limit return potential

Leave a Comment