Cryptocurrency analytics firm Alphractal has released a new market update, highlighting notable trends in the Bitcoin and altcoin markets while also shedding light on potential volatility ahead.

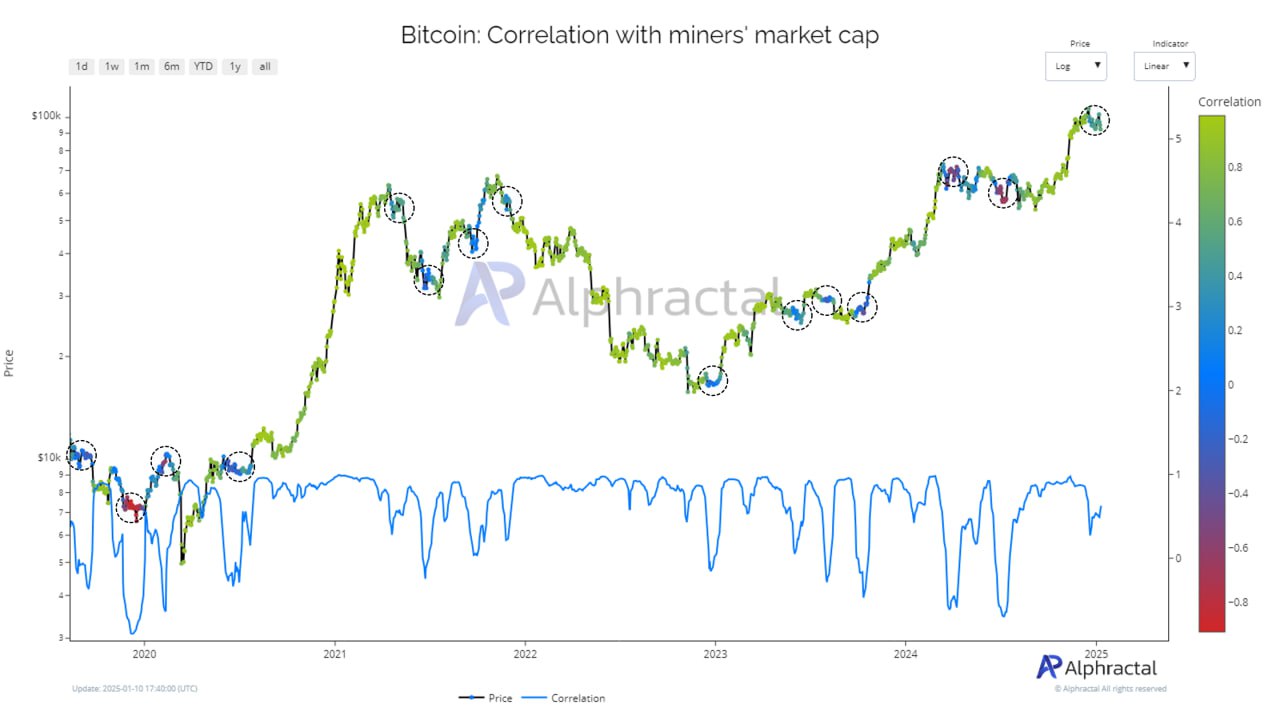

Alphractal noted that cryptocurrency mining stocks, which have historically shown a strong correlation with the price of Bitcoin, have experienced a recent short-term decline. However, the firm highlighted an interesting dynamic:

Correlation Shift: When the typically strong correlation between Bitcoin and mining stocks weakens, this has historically preceded significant swings in Bitcoin price.

Market Influence: Mining companies, which often hold significant Bitcoin reserves, act as influential market players. Deviations from Bitcoin’s price movements can signal market disruptions or trend reversals.

The report also shed light on the broader altcoin market, hinting at bearish conditions:

Moving Averages: Around 80% of altcoins are trading below their 50-day moving averages, suggesting weakening momentum.

Bollinger Bands: A significant portion of altcoins are trading below the lower Bollinger Bands on the daily charts, indicating potential oversold conditions.

*This is not investment advice.

Leave a Comment