- BERA’s recent rise has been driven by increased transaction activity on its blockchain.

- Traders have responded positively, placing long bets on BERA.

Berachain [BERA] currently ranks among the top gainers in the market over the past 24 hours, with an 11% rise.

This surge has been influenced by growing trading activity, with its volume reaching $500 million during this phase.

Growth in on-chain activity influences BERA

There has been a notable surge in activity on BERA Chain, which could be linked to its recent rally.

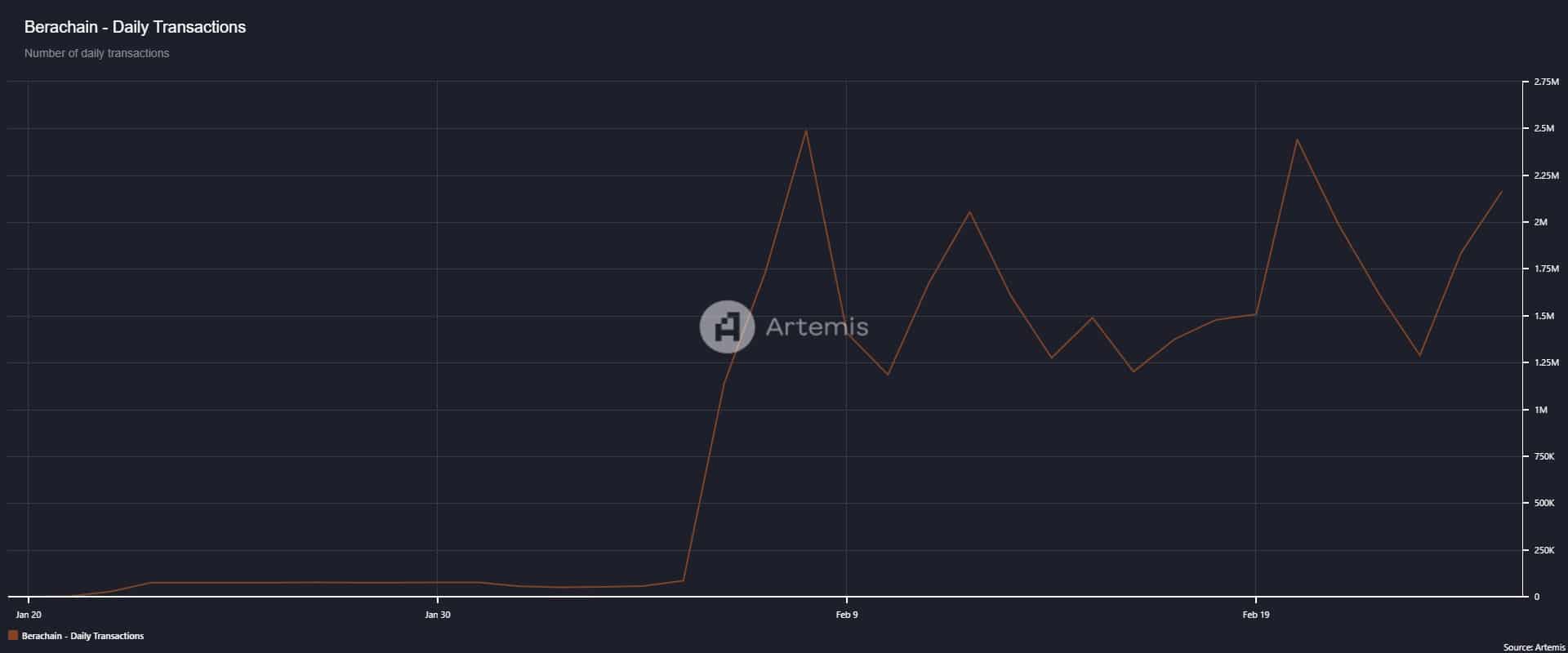

Artemis data indicates that daily transactions have climbed significantly.

The number of daily transactions, which records buying and selling activity on the chain, spiked from a low of 1.3 million on the 23rd February to a press time reading of 2.2 million.

Source: Artemis

During this period, the number of daily active addresses on BERA reached a new high of 29,600, its highest since the 21st of February, when it traded above 46,000.

This increase in active addresses suggests a renewed confidence in the asset and the possibility of further buying activity in the coming weeks.

When transaction and trading activity surge alongside price and volume, it typically signals strong market momentum.

A 95% rally could hold

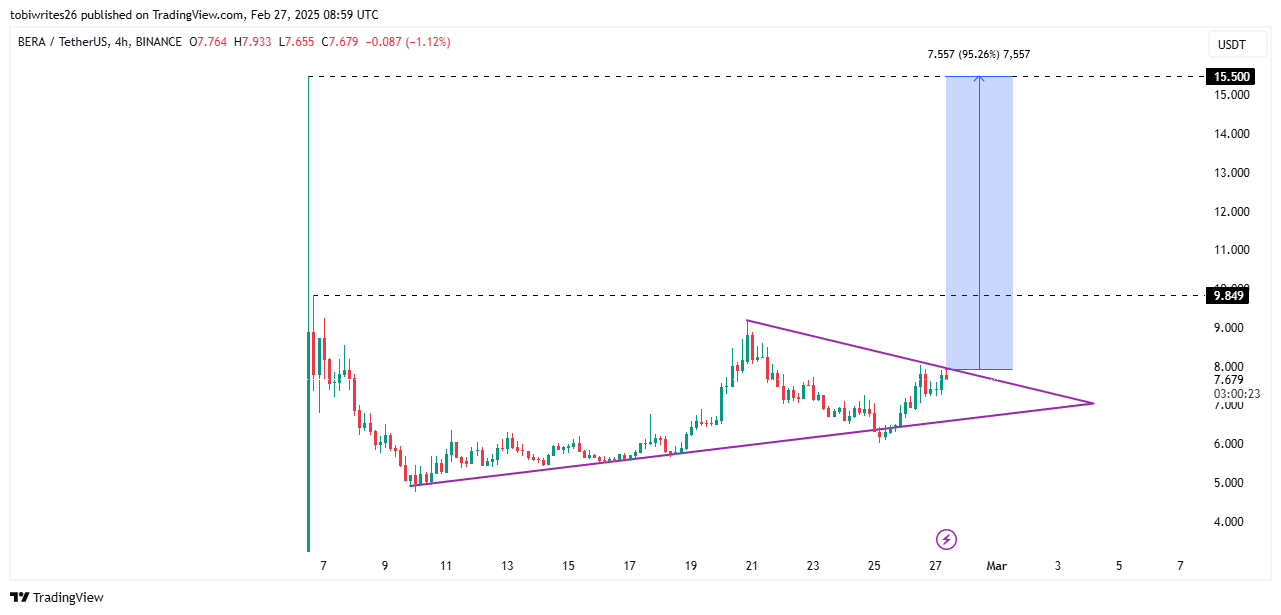

A zoom into the 4-hour timeframe showed that BERA was trading within a bullish symmetrical triangle pattern, which is often a precursor to a market rally.

As of this writing, BERA was trading at the resistance level of this pattern.

A successful breakout could trigger a rally, with two key targets: a short-term move to $9.80 and a long-term surge to $15.50, representing a 95.26% price increase.

Source: TradingView

If the breakout attempt fails, BERA could consolidate further within the symmetrical triangle, with market participants accumulating the asset at a lower cost ahead of the rally.

Speculation surges in BERA

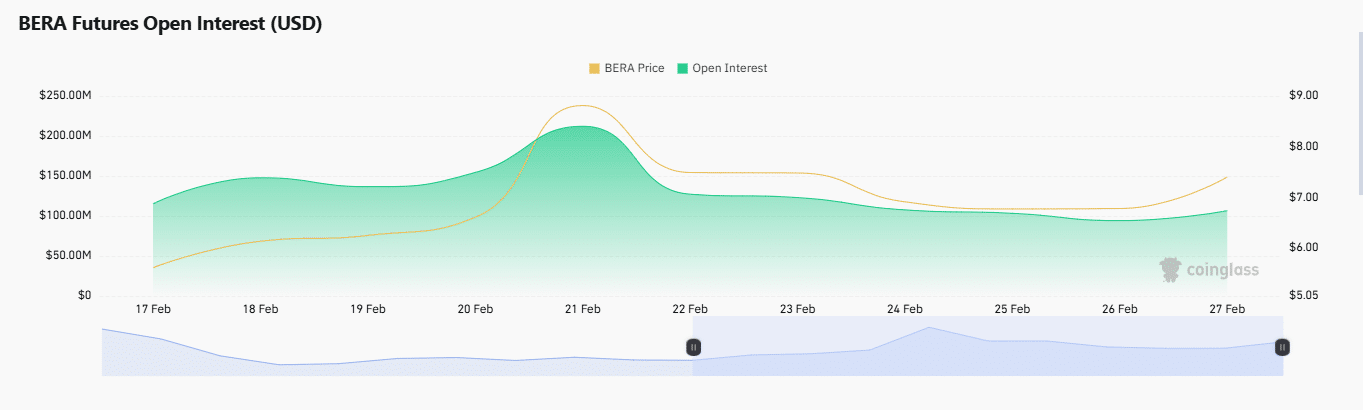

There has been a rise in speculation among derivatives traders. At the time of writing, both Open Interest and the Long-to-Short ratio reflect this trend.

Open Interest is rising, with more liquidity entering the market. In the past 24 hours, it has increased by 14.17%, from $94.26 million to $116.95 million—an additional $22.69 million.

Source: Coinglass

Also, the Long-to-Short ratio, which measures buying versus selling volume in the derivatives market, confirms this bullish sentiment as it remains above 1, indicating stronger buying activity.

Continued buying pressure in the derivatives market could help BERA break through the resistance level is currently limiting its rally.

Source: https://ambcrypto.com/bera-eyes-95-breakout-as-momentum-builds-is-15-50-next/

Leave a Comment