Bitcoin’s price momentum has slowed, struggling to sustain the bullish energy generated in recent weeks. Currently priced at $98,166, the crypto king is hovering just below the psychological $100,000 resistance level.

This stagnation, coupled with investor liquidations, raises concerns about a potential sharp decline in BTC’s value.

Bitcoin Investors Are Uncertain

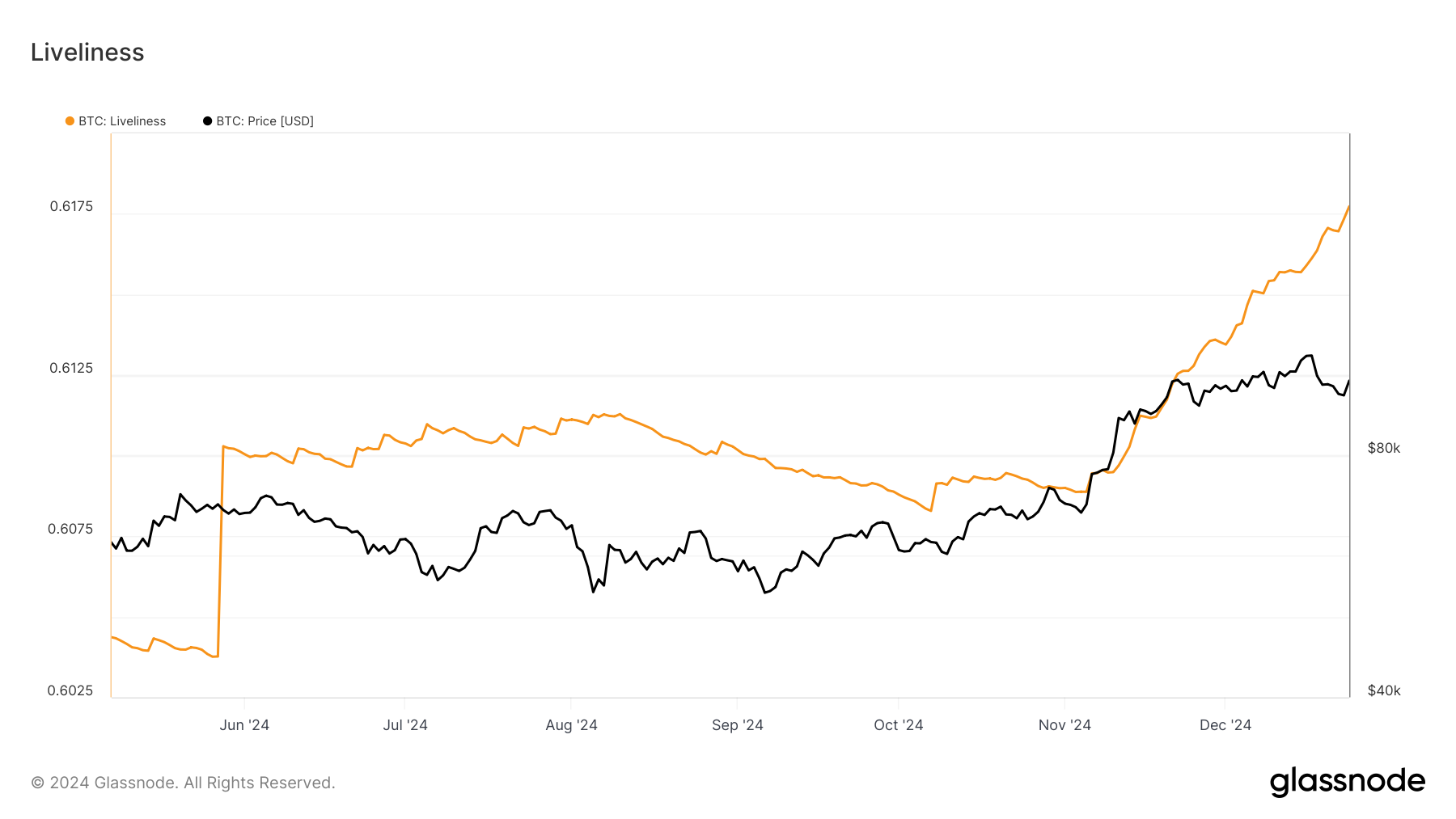

Bitcoin’s Liveliness metric continues to rise despite the recent price plateau. This indicates that long-term holders (LTHs) are increasingly liquidating their positions. LTHs, often considered the backbone of Bitcoin’s stability, are offloading their assets to mitigate potential losses from a looming price drop.

If this trend persists, heavy selling by long-term holders could exacerbate bearish pressures. As LTHs are crucial for maintaining confidence in Bitcoin’s value, their exit from the market suggests a lack of faith in a sustained bullish recovery. This shift in sentiment could accelerate BTC’s downward trajectory.

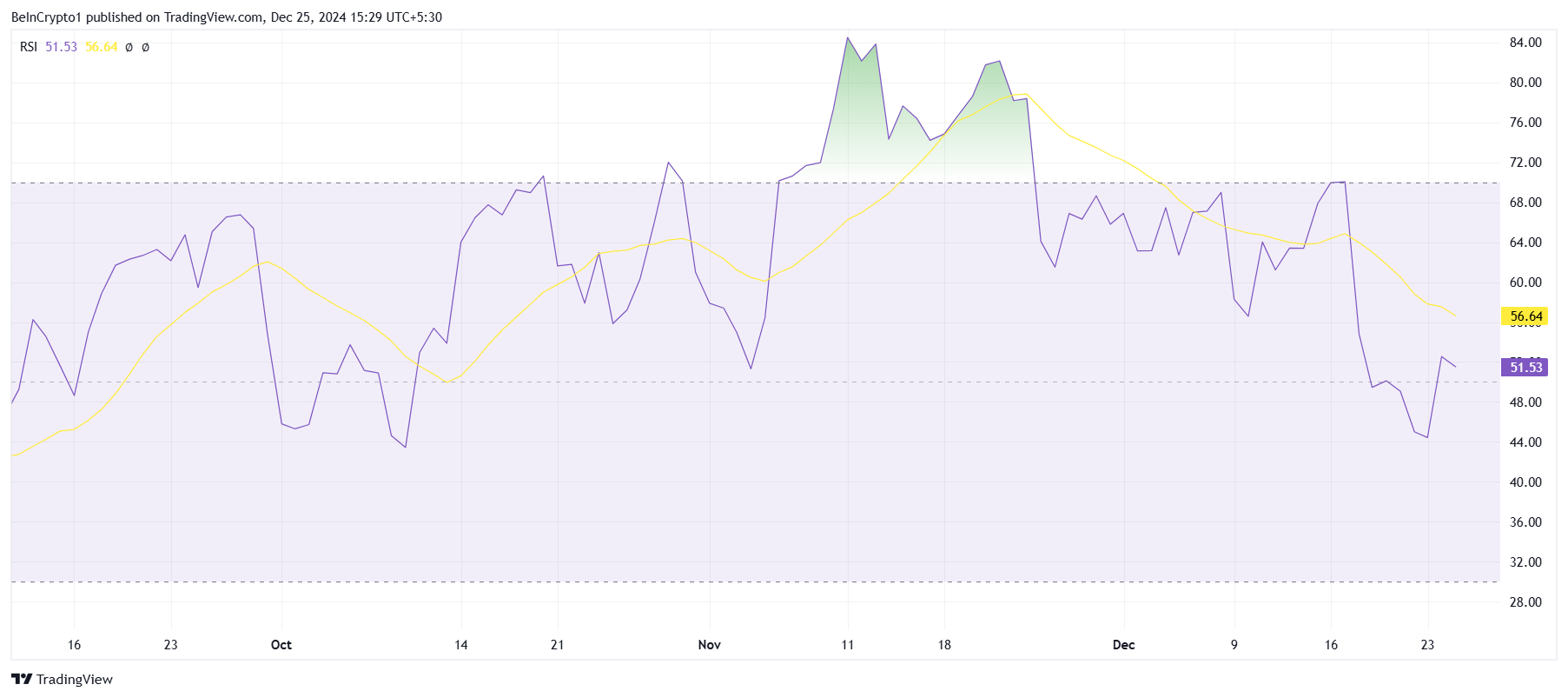

Bitcoin’s macro momentum also reflects bearish tendencies. The Relative Strength Index (RSI) has dipped lower, struggling to stay above the neutral 50.0 mark. This technical indicator’s weakening performance highlights a loss of bullish strength in recent trading sessions.

A declining RSI suggests that Bitcoin is at risk of losing its upward momentum. If this trend continues, it could further dampen market optimism and push prices lower. Traders and investors are closely monitoring the RSI for signs of a potential reversal or continued downturn.

BTC Price Prediction: Breaching Key Resistance

Bitcoin price is currently trading at $98,166, just shy of the $100,000 resistance level that is critical for further growth. Flipping this level into support is essential for BTC to maintain its bullish trajectory and reach new heights. However, the cryptocurrency has yet to demonstrate the buying pressure needed to achieve this.

On the downside, the aforementioned bearish factors suggest Bitcoin could drop to $95,668. Losing this key support level might open the doors to a deeper decline, with $89,800 emerging as a potential target. This scenario would mark a significant setback for BTC investors.

Conversely, if Bitcoin can reclaim $100,000 as support, it could rise toward $105,000. Achieving this milestone would strengthen BTC’s position and set the stage for a potential return to its all-time high (ATH) of $108,384. Such a recovery would require renewed market confidence and strong buying activity.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source: https://beincrypto.com/bitcoin-price-dying-momentum-needs-christmas-miracle/

Leave a Comment