- Bitcoin’s short-term holders held the market with a net position change value of +750k.

- BTC declined over the past week by 12.37%.

Since hitting $108k, Bitcoin [BTC] has struggled to maintain an upward momentum. As such, BTC has traded in a consolidation range between $92k and $97k.

At the time of writing, Bitcoin is trading at $93,905, marking a 2.18% decline on the daily charts. Additionally, the cryptocurrency has dropped by 12.37% on the weekly charts.

This dip has left most short-term holders at a loss, including those who bought Bitcoin in November. The widening loss margins among short-term holders have analysts deliberating over the next move.

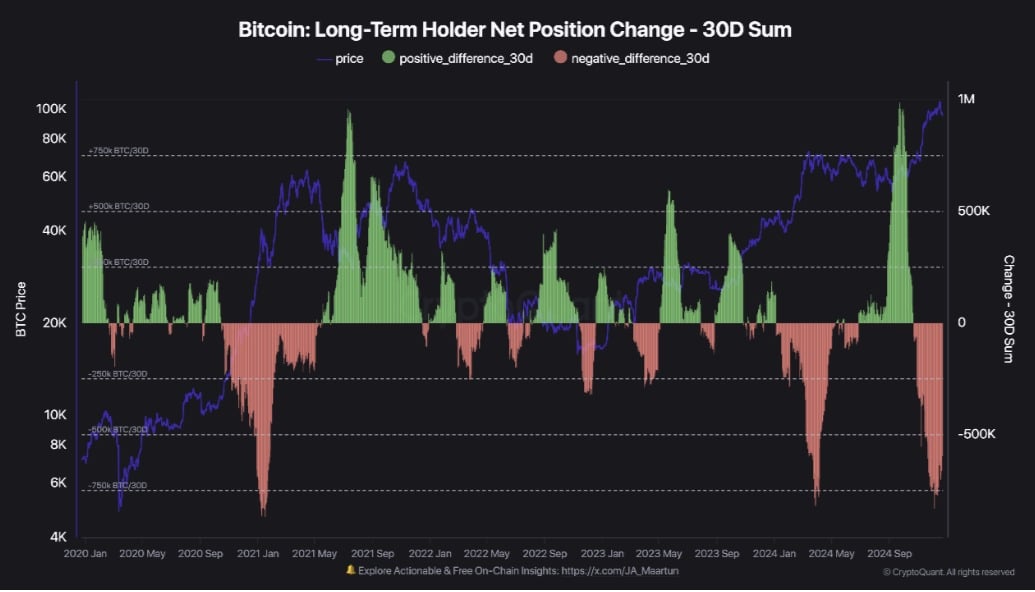

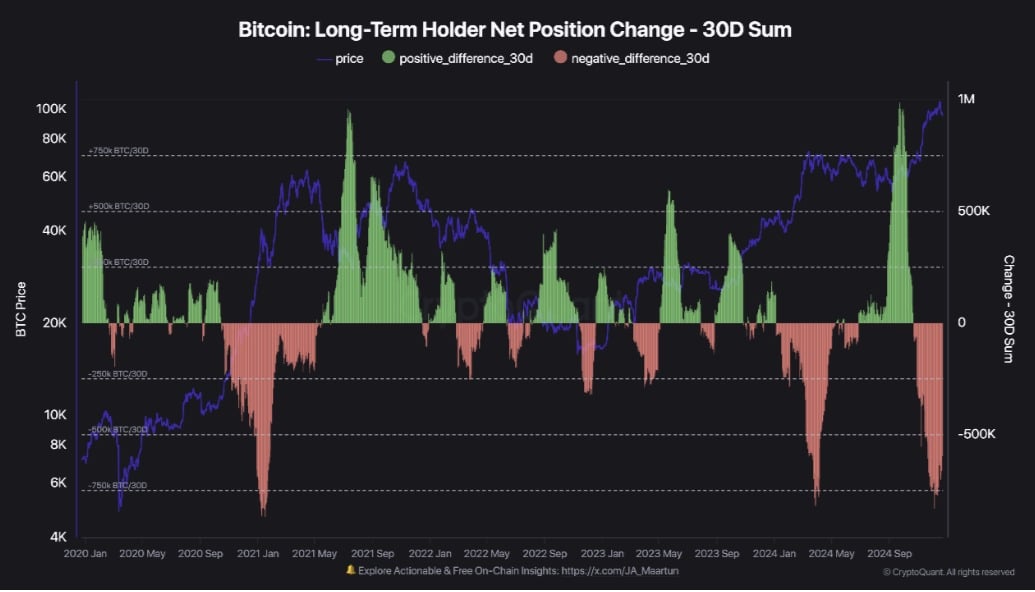

Bitcoin’s LTH vs STH net position change

According to Cryptoquant, the 30-day net position change for long-term holders (LTH) has turned negative hitting -750k BTC.

Source: CryptoQuant

Despite this change, Bitcoin prices have managed to hold strong and did not experience a strong drop. This is because short-term holders (STH) have continued to accumulate even as BTC rallied to a new ATH.

Source: CryptoQuant

The net position change for short-term holders (STH) surged to a positive value of +750k BTC.

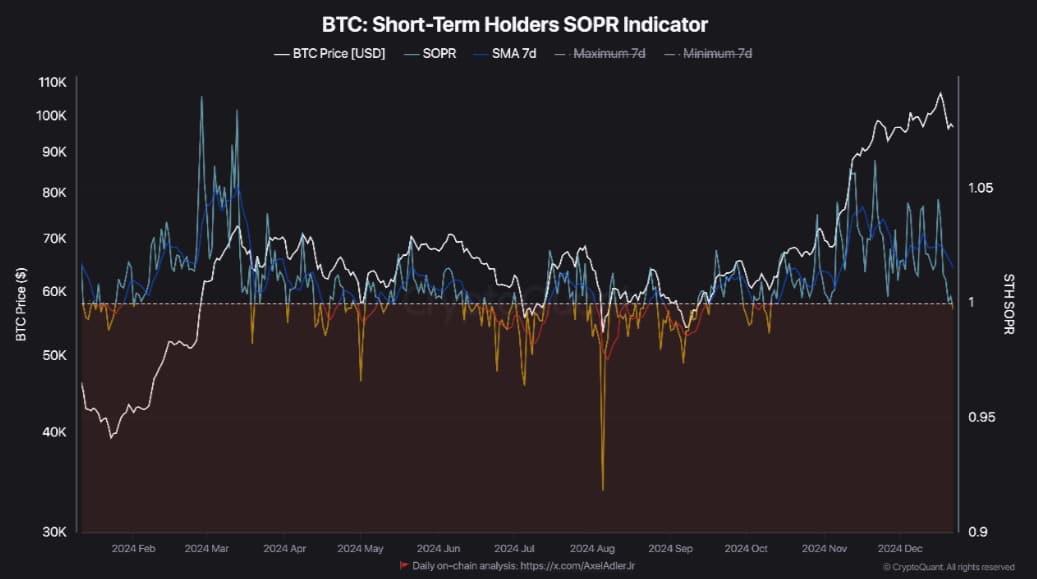

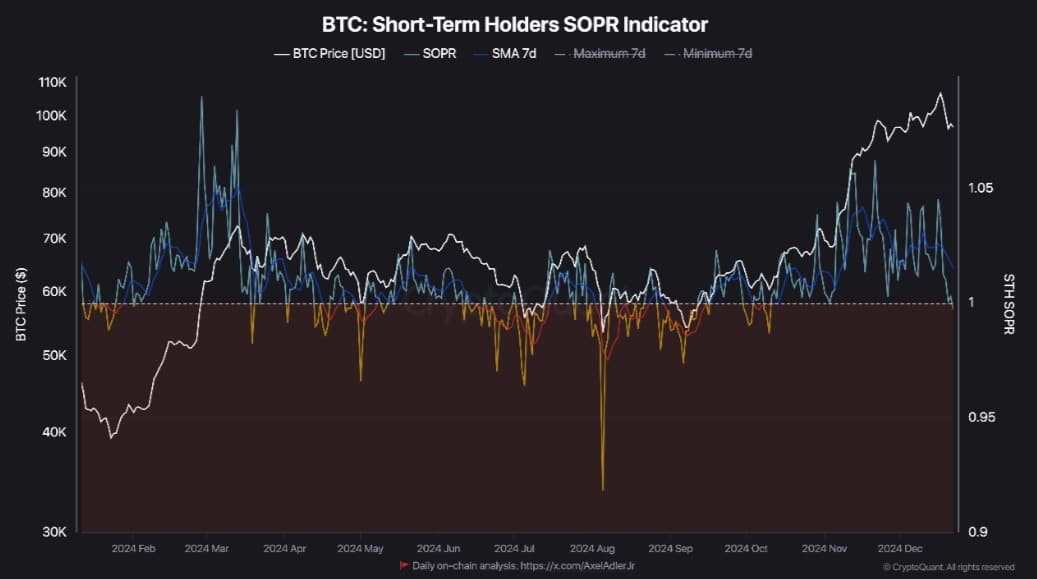

While short-term investors continued to accumulate as BTC prices surged, the STH SOPR turned negative. This indicates that STH holders are operating at a loss.

With short-term holders at a loss, they have two options: hold and wait for BTC prices to recover, or buy at lower prices. If STH demand remains strong and long-term holder (LTH) demand is neutral or positive, it could create positive momentum for BTC.

However, if STH decides to sell at a loss, it could create selling pressure and drive prices further down. The direction that short-term holders take will affect BTC’s price trajectory.

Source: CryptoQuant

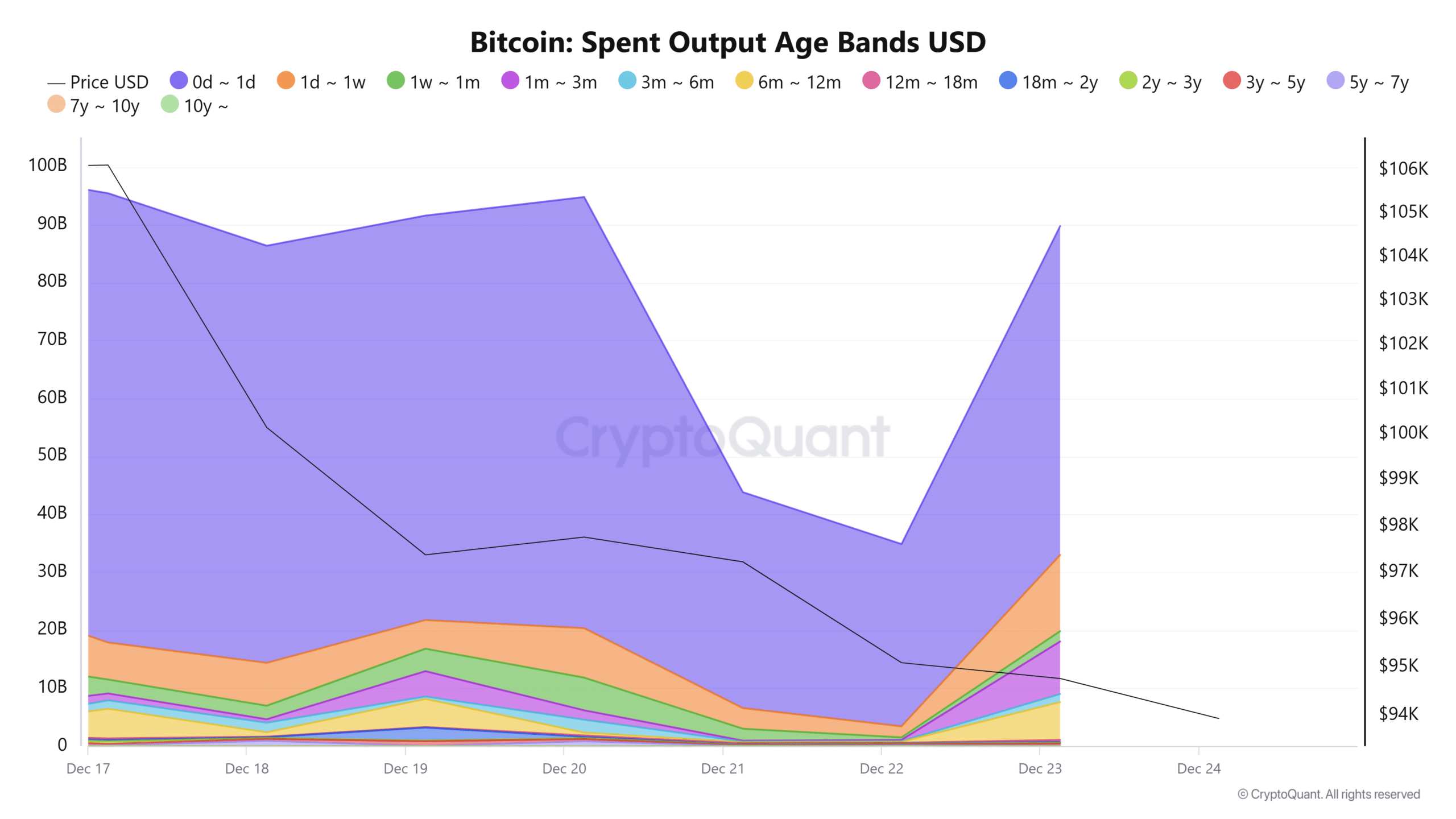

Through the output spent age bands, we can see short-term holders are actively selling. Thus short-term holders have spent more coins than LTH, with coins held for one day hitting 56 million and those held for a week reaching 9 million.

Source: CryptoQuant

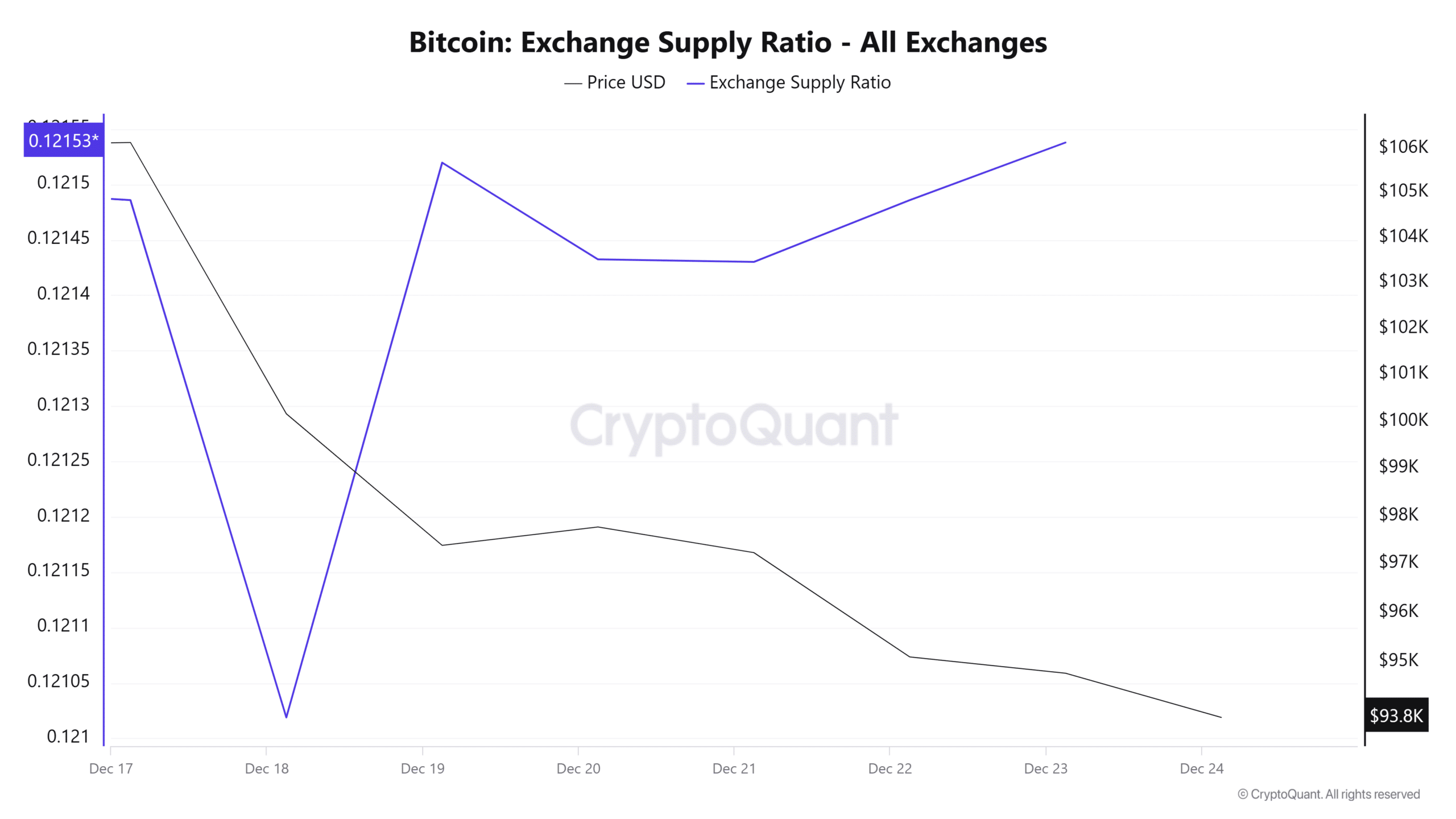

As such, the past week has experienced a spike in the exchange supply ratio. A surge in exchange supply suggests that these spent coins are going to exchanges, thus traders are transferring more Bitcoin tokens into exchanges either to sell or preparing to do so.

This implies that there’s high speculative trading among STH traders and are even selling at a loss to acquire at lower rates.

Implications on BTC?

As observed above, Short-term holders are holding the market. As such, BTC risks facing higher selling pressure from this cohort, which could in turn drive prices down.

Read Bitcoin (BTC) Price Prediction 2024-25

With STH actively selling their tokens, it shows their lack of market confidence and turns to buy at lower levels after selling at a loss. If their net position changes and turns negative like Long-term holders, Bitcoin could drop further.

Therefore, if this bearish sentiment persists, BTC could drop to $92130. However, if the demand from STH continues, BTC will attempt recovery towards $95800.

Source: https://ambcrypto.com/is-bitcoins-92k-support-under-threat-sth-selling-points-to/

Leave a Comment