Bitcoin price is trading above $100,000. As sentiment shifts to “risk-on,” bulls could take over and push BTC price even higher.

Bitcoin

.cwp-coin-chart svg path {

stroke: ;

stroke-width: ;

}

Price

Trading volume in 24h

<!–

?

–>

Last 7d price movement

is trading above $100,000, roughly three weeks after plunging below the psychological level in mid-December. As the coin holds firmly at press time, market sentiment remains bullish, with multiple indicators suggesting that the world’s most valuable coin could be primed for even more gains in the days ahead.

Of note, observers point to broader global financial market trends, specifically the tightening corporate credit spreads and shifts in equities, as some of the key drivers behind the coin’s impressive resilience and possible upside trend.

Credit Spreads Falling: Time To Load Up on BTC?

Taking to X, the founder of Capriole Investments, Charles Edwards, pointed out the importance of falling credit spreads over the past few years. Edwards observes that as of early January 2025, BBB corporate bond spreads are down and tight, suggesting that the bond market is in “risk-on” mode.

Usually, whenever credit spreads widen, it signals higher perceived risks in corporate bonds relative to United States treasures.

(Source)

Accordingly, investors tend to demand greater yields to cover the uncertainty. However, as credit spreads narrow, as is currently the case, it reflects growing confidence among investors.

In turn, they can plunge and get exposure to risk assets, a trend that often bodes well with crypto, especially Bitcoin.

EXPLORE: Buying and Using Bitcoin Anonymously / Without ID

Hints From The Equity Markets For Bitcoin Price

Besides shrinking credit spreads, Capriole Investments notes that the Value (VTV) to Growth (VUG) stocks ratio fell sharply in Q4 2024.

Typically, the falling VTV-VUG ratio is considered bullish for equities, which is currently dominated by growth and technology sectors.

(VTG/VUG)

Therefore, if history guides, there is a high probability of shifting, favoring equities and crypto.

This metric rose during the “risk-off” periods in the early days of COVID-19 in 2020. Although it shrunk as governments intervened, the ratio spiked again when the Federal Reserve turned hawkish, aggressively hiking rates in 2021 to curb rising inflation.

As the VTV-VUG ratio falls, it could suggest that market participants favor risk and growth-oriented investment, a backdrop that’s net bullish for Bitcoin.

EXPLORE: 10 Coins with High Returns: Crypto Forecast 2025

BTC Price Ready To Take Off in Q1, 2025?

There are signs that momentum is building up.

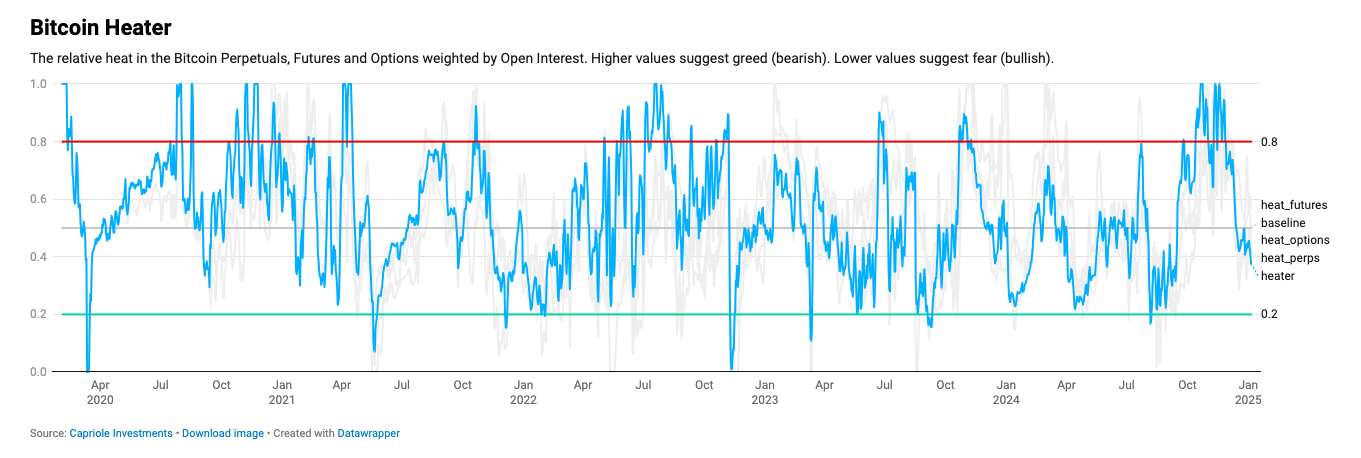

For example, the Bitcoin Heater, a tracker developed by Capriole, shows that prices are moving closer to the “buy zone” after it reset this week.

Coincidentally, the reset and a possible switch to “buying” is when miners are slowing down on their liquidation. When prices peaked at over $108,000 in December, the miner sell pressure ratio rose above 1.

(Source)

Currently, it has cooled off, dropping to around 0.55, pointing to dropping selling pressure and, thus, a healthier market structure.

As momentum builds up, one analyst on X said over 90% of all BTC in circulation is in green territory. He projects even more gains in the coming weeks, comparing the current state of price action to the 2017 cycle.

(Source)

Bullish as this may be, it will be critical to monitor how macro events, primarily regulatory and monetary policy developments in the United States, will influence crypto prices going forward.

At press time, Coingecko data shows that Bitcoin is up 10% in seven days, trading above $101,700.

DISCOVER: Crypto Trading In South Korea Surpasses Stock Market With $18 Billion In 24 Hour

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The post Bitcoin Reclaims $100,000, Corporate Credit Spreads Falling: Here’s Why You Should Stack Some More appeared first on 99Bitcoins.

Leave a Comment