-

As Bitcoin’s year-end volatility raises eyebrows, market analysts anticipate potential declines into 2025 based on historical trends.

-

Recent fluctuations indicate a concerning pattern, with Bitcoin witnessing a 6.01% drop since Christmas, reflecting mounting investor skepticism.

-

“Bitcoin could see a sharp decline as we approach the new year,” states Alphractal, highlighting the importance of historical price movements.

Bitcoin’s historical patterns suggest potential declines as the new year approaches, with analysts weighing market fluctuations amidst investor skepticism.

Examining Bitcoin’s Year-End Price Dynamics

As outlined in the Alphractal analysis, historical data shows that Bitcoin exhibits mixed behavior in price trends between Christmas and New Year’s Eve. This inconsistent performance can lead to important insights for investors navigating potential downturns.

Source: Alphractal

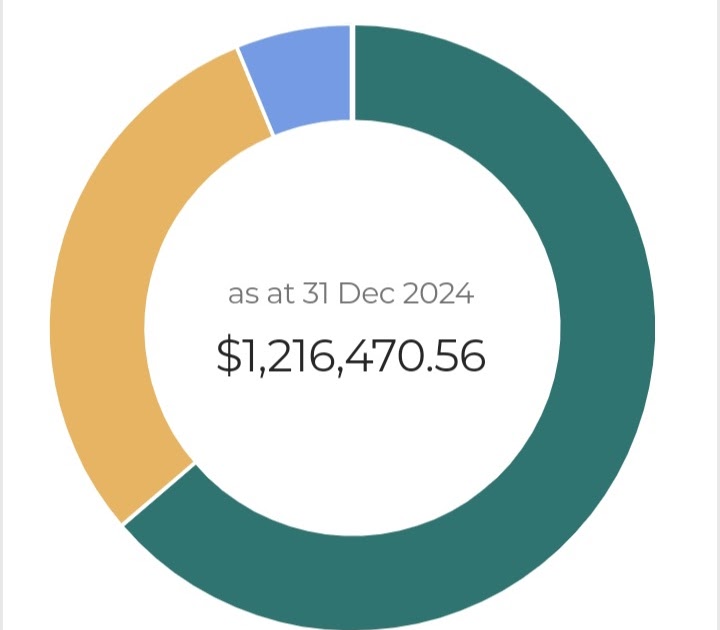

Recent data shows that Bitcoin has dropped from approximately $99,881 to $93,879 since December 25. This 6.01% decrease forms the backdrop for a cautious outlook into the new year, as historical price trends have often mirrored similar patterns observed in years past.

Notably, the declines that occurred during previous cycles—specifically, the years 2012, 2014, 2017-2018, 2019-2020, and 2021-2022—reflect significant price drops around similar periods. Investors keen on Bitcoin’s potential trajectory should tread carefully, as the evidence suggests that the end of 2024 may lead to a negative trend entering the new year.

Future Projections for Bitcoin: What Investors Should Consider

Moving forward, it is crucial for investors to analyze not just historical trends but also the current market indicators influencing Bitcoin price action. Analysts have noted that Bitcoin is currently experiencing a consolidation phase. This condition showcases a broader market hesitation, as many investors remain uncertain about a potential reversal.

According to COINOTAG’s analysis, investor sentiment appears to be tilting towards bearish as the lack of a clear price direction looms. Long-term holder sentiment, indicated by the SOPR metric, has significantly decreased, reflecting growing concerns amidst the current price volatility.

Source: CryptoQuant

As further evidence of the bearish sentiment, Bitcoin’s Price Daily Active Addresses (DAA) have displayed a negative trend recently, indicating a decrease in active participants within the network. This shift could suggest that the current market activity is not sustainable and may be subject to adjustments based on actual demand dynamics.

Source: Santiment

Overall, the landscape heading into the new year is precarious for Bitcoin. Historical evidence suggests a likelihood of price declines, potentially heading towards $91,500. Conversely, should market dynamics shift positively with new buyers entering the fray, there remains the possibility of reclaiming levels around $95,400, thereby averting a sustained downturn.

Conclusion

In summary, Bitcoin is at a critical juncture as it transitions into 2025. With historical data suggesting a possible continuation of the downtrend and bearish indicators prevalent in the market, investors are advised to remain vigilant. Understanding these dynamics will be essential for navigating the potential volatility that awaits in the early months of the new year.

Source: https://en.coinotag.com/bitcoins-historical-trends-suggest-possible-decline-into-the-new-year-after-notable-christmas-drop/

Leave a Comment