The Electronics and Computer Software Export Promotion Council (ESC) has urged Finance Minister Nirmala Sitharaman to introduce a range of tax incentives in the upcoming 2025-26 Budget to boost investments in R&D by the domestic hardware sector, enabling it to compete globally.

In their recent exclusive interaction with Sitharaman and other senior officials of the Finance Ministry, the ESC top brass highlighted that several incentives are needed to promote R&D, Innovation, and Disruption in the capital-intensive electronics hardware sector to address the challenges and emerge as a strong global tech player.

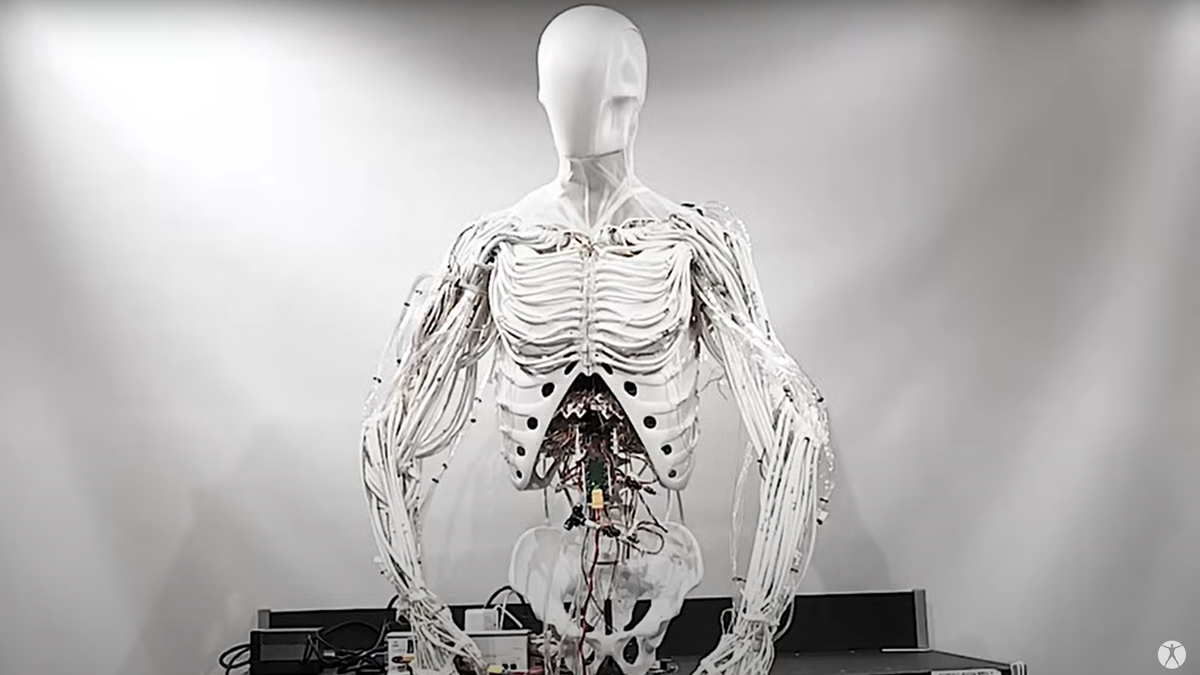

A well-calibrated incentive system designed to empower industry players could motivate nascent industry units to move in the R&D value chain in cutting-edge technology domains like AI, IoT, telecom, and embedded technologies in sectors like semiconductors, consumer electronics, and defence equipment, ESC submitted.

“Significant amount of expenses incurred towards R&D enables the tech-driven companies to compete in the highly complex and cutthroat international market effectively;” said Sandeep Narula, Chairman – Global Outreach, ESC. “Investment in R&D can ensure electronics products to align with the unique needs of India’s diverse population, rapidly growing economy, imperatives for achieving quantum jumps in exports and employment.”

ESC said that the current level of R&D in the electronics sector remains relatively modest, with limited investments compared to global leaders.

While India’s electronics market is significant, valued at $155 billion in 2022 and expected to grow to $300 billion by 2025- 26, its R&D expenditure in the sector is far behind its competitors.

This is even as investment in R&D had continuously increased over the years and more than doubled in the last 10 years.

However, the country’s R&D expenditure as a percentage of GDP remained between 0.6 – 0.7 per cent as against China’s 2.4 per cent, US 3.5 per cent and Israel 5.4 per cent.

ESC’s wish list for the upcoming Budget includes the demand for an additional 5 percent Income Tax reduction for corporates spending over 3 per cent of their turnover on R&D and filing patents/designs in India. Such a tax break is justified as it aligns with the national goal of fostering innovation, self-reliance, and global competitiveness. “By introducing tax reduction, India can create a compelling incentive for companies to prioritise R&D, leading to technological advancements, the creation of intellectual property, and a reduction in dependence on imports;” Narula added.

ESC noted that similar incentives are given to tech giants in countries like the US, South Korea, Vietnam, Malaysia, and China to foster a culture of R&D and innovation.

For the capital-intensive electronics hardware sector which is facing intense competition from global supply chains, comfort should be accorded to stay strong, ESC has said.

Broad base DLI

ESC also pitched for further calibration of the Design Linked Incentive (DLI) Scheme to make it more broad-based and impact-oriented. It suggests extending the scheme’s duration for an additional 10 years, i.e., until January 1, 2035.

Given the long gestation period and complexity involved in electronics and semiconductor design, sustained support over the next decade is critical to fostering innovation, building intellectual property, and reducing reliance on imports, ESC said.

ESC is of the view that a long-term commitment will provide the necessary stability and confidence for companies to undertake high-risk, high-reward R&D projects.

Coupled with this, there should be a provision for the rollover of unutilized funds from the current allocation to subsequent years under the extended scheme.

This will ensure optimal utilisation of resources, facilitate continuous support for ongoing projects, and maximize the impact of the scheme without leaving allocated budgets underutilised.

Gurmeet Singh, Executive Director, ESC called for additional funding to the tune of $20 billion under the DLI scheme to meet the rising demand for R&D in emerging quantum technologies like AI and internet products. “Happily, we have a large number of small MSMEs gearing up to invest in R&D, innovation, and product innovation, which should be encouraged by helping them to access adequate funds, which will be paid off once they become active players domestically and globally;” he added.

10-Year Tax Holiday

ESC also pitched for providing a 10-year Tax Holiday on Sales of Products with Intellectual Property (IP) such as patents and designs, developed through in-house R&D efforts. This would incentivise companies, particularly those not utilising the DLI scheme, to invest in the creation of innovative products and technologies.

By providing tax relief on revenues generated from these IP-driven products, the government can encourage the development of proprietary technologies, foster innovation, and reduce the reliance on foreign patents or designs, ESC said.

Leave a Comment