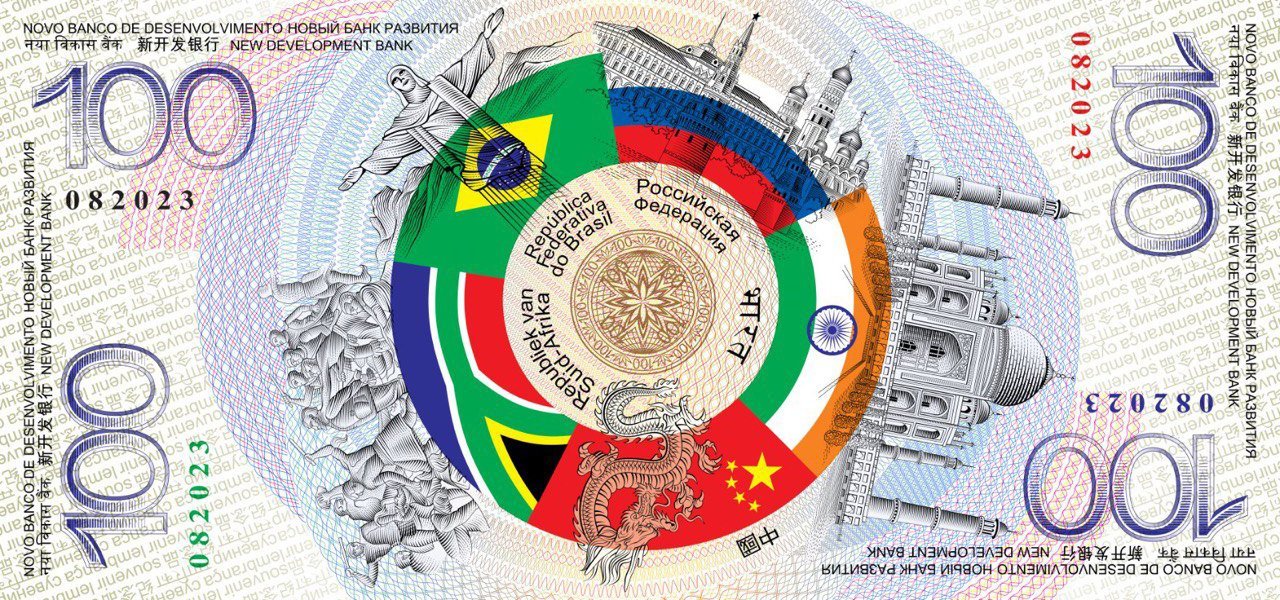

Vladimir Putin is making a new warning from BRICS to the United States: a NEW central-backed digital currency or CBDC sponsored by Russia and China aimed to take down the US dollar.

With the US presidential inauguration only days away, Putin and Chinese President Xi Jinping are directly challenging the dollar.

Today, we want to focus on the new BRICS CBDC, the Unit+, and answer the question: Is the dollar’s power fading? Is Putin grinning from ear to ear? Buckle up—we’re diving in.

How Will a New BRICS Currency Affect the US Dollar?

A quick reminder: BRICS stands for Brazil, Russia, India, China, and South Africa, which now represent the most powerful economic bloc in the world. BRICS now also includes potential WW3 participants Egypt, and Iran.

Two things happened at the BRICS meeting late last year:

1) BRICS announced their NEW CBDC called the Unit+. The idea is to create a neutral currency for outside trade between countries inside BRICS.

2) BRICS countries announced they will use the Yuan for global trade instead of the US dollar. As they argue, the Yuan is backed by Chinese exports, while the American dollar is backed by the Air Force and Navy bomb planes.

BRICS touts their new CBDC system as a potential $15 billion annual saver, though places like JP Morgan say it could save $100 billion.

The jury is out on what blockchain they will use to create the new BRICS system, though it could be XRP or XLM, the top two payment network cryptocurrencies.

This should spell out to you that globalization is dying.

There’s one more way that BRICS discussed weakening the US dollar at this year’s summit: this…

The Biggest Threat Ever to the USD as the Reserve Currency

In addition to the new BRICS CBDC and Project MBridge for cross-border settlements (something we covered a few months ago; check it out here), Russia and China used the Kazan summit to push for a new denomination for oil – the Petroyuan. And once again, the Saudis are the biggest cheerleaders for this new system.

It is true that the US dollar was no longer pegged to gold after 1971. It’s pegged to something better: OIL aka fossil fuels

“The root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust.”

– Satoshi Nakamoto

— Bitcoin (@Bitcoin) March 29, 2020

For decades, Saudi Arabia only sold oil in U.S. dollars, and we sold them in US treasury bills before they were auctioned. That’s what we call the Petrodollar.

Now, for the first time ever, the Saudis are cozying up to China and Russia, agreeing to sell oil in Chinese currency.

In many ways, the Petrodollar system put America in a Catch-22. To use an analogy, imagine you’re the kid at school bringing candy daily. The reason you’re able to do that – and score all the hot chicks – is because your dad owns the freaking chocolate factory (i.e., the Fed).

As long as everyone needs the US dollar, “or the candy,” you’re the king. And you get diabetes, and you get diabetes! However, rival candy stores will eventually set up their own factory, creating rules that better suit them than the ones they play now. That’s what BRICS is doing, relying on the Petroyuan and leaving the US dollar.

Final Thought on BRICS and the Petrodollar

Nobody owns the chocolate factory forever. As the old saying goes, power corrupts, and absolute power corrupts absolutely.

We’ll see if Trump can stave off US dollar challengers like BRICS… because, after all, the US dollar isn’t going anywhere anytime soon.

According to IMF data, 2.48% of the world’s reserves are held in yuan, compared to 55% for the dollar.

So the dollar isn’t leaving. But the slow decline has begun.

EXPLORE: Dust Settles Over XRP Price Crash: Best Presale to Buy in 2024?

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The post BRICS Summit 2025: Russia’s New CBDC Just Broke the US Dollar appeared first on 99Bitcoins.

Leave a Comment