Shares in C3.ai Inc. were up over 15% in late trading today after the artificial intelligence software maker reported strong earnings and revenue beats in its 2025 fiscal second quarter and revised its outlook upwards for its third quarter.

For the quarter that ended on Oct. 31, C3 AI reported an adjusted net loss per share of six cents, down from a loss of 16 cents per share in the same quarter of the previous year, on revenue of $94.3 million, up 29% year-over-year. Both headline figures were better than a loss of 16 cents per share and revenue of $91 million forecast by analysts.

C3 AI saw subscription revenue in the quarter of $81.2 million, up 22% year-over-year, with the subscriptions now accounting for 86% of the company’s revenue. Subscription and prioritized engineering services revenue combined came in at $90.8 million, up 27% year-over-year.

The company saw continuing momentum with customer acquisition, closing 58 engagements, including 36 pilots in the quarter. C3 AI entered into new and expanded agreements in the quarter with ExxonMobil Corp., Koch Industries Inc., Dow Inc., Holcim Ltd., Shell plc, Duke Energy Corp., Boston Scientific Corp., Rolls-Royce Holdings plc, Cameco Corp., Mars Inc., ESAB Group Inc., Flex Ltd., Worley Ltd., the Defense Logistics Agency and the U.S. Department of Defense.

Other business highlights in the quarter included C3 AI signing a new global alliance agreement with Microsoft Corp. on Sept. 30 for an initial five-and-a-half-year term to accelerate growth in enterprise artificial intelligence.

Under this strategic alliance, all C3 AI Enterprise AI and Generative AI solutions are now available on the Azure Price List and Marketplace, fully sellable by Azure’s global sales organization, with sales personnel earning commissions, quota credits and bonuses. Additionally, C3 AI products have been integrated into Microsoft’s enterprise licensing agreements to streamline sales processes and Microsoft will subsidize pilots and production deployments throughout the agreement’s term.

“We had an outstanding quarter with strong top- and bottom-line performance to mark our seventh consecutive quarter of accelerating revenue growth,” Thomas M. Siebel, chairman and chief executive officer C3 AI, said in the company’s earnings release.

Siebel went on to address the new Microsoft alliance, noting that “it is difficult to overstate the potential of the Microsoft–C3 AI strategic alliance” and that “by establishing C3 AI as a preferred AI application provider on Azure and creating a Microsoft-scale go-to-market engine, we’re making it easy for businesses to adopt and deploy C3 AI applications… this is an inflection point for Enterprise AI, driving growth.”

For its fiscal third quarter, C3 AI expects revenue of $95.5 million to $100.5 million and for the full year, revenue of $378 million to $398 million. The full-year outlook was ahead of the $370 million to $395 million previously forecast by the company, adding further positive momentum to C3 AI stock in after-hours trading.

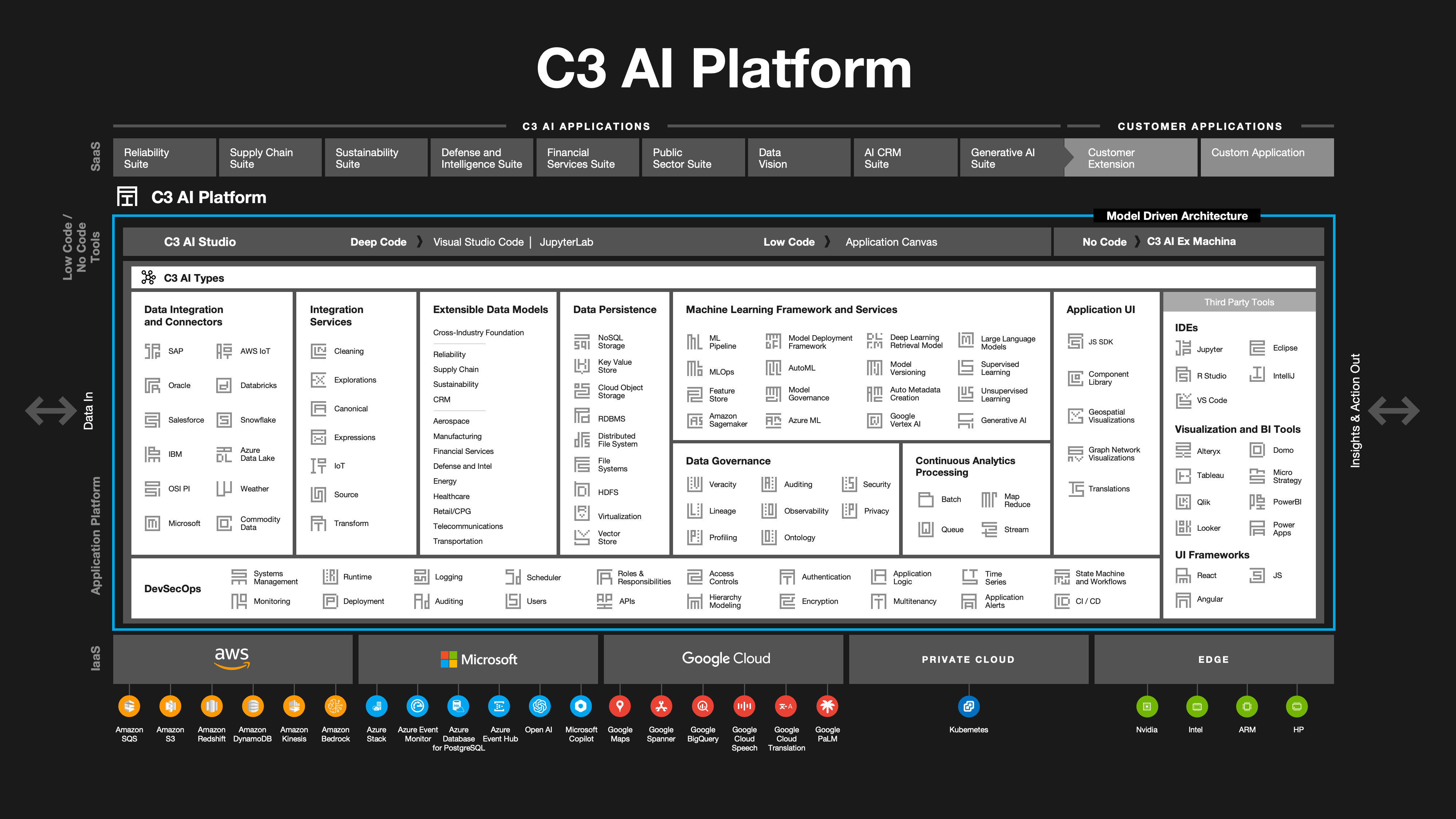

Image: C3 AI

Your vote of support is important to us and it helps us keep the content FREE.

One click below supports our mission to provide free, deep, and relevant content.

Join our community on YouTube

Join the community that includes more than 15,000 #CubeAlumni experts, including Amazon.com CEO Andy Jassy, Dell Technologies founder and CEO Michael Dell, Intel CEO Pat Gelsinger, and many more luminaries and experts.

THANK YOU

Leave a Comment