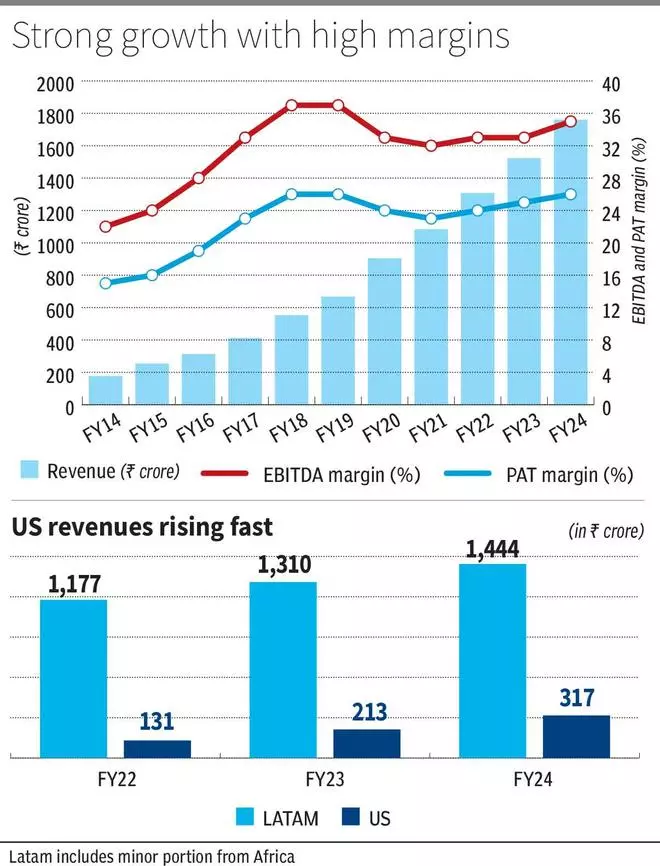

Caplin Point has delivered strong returns in the last three years. The stock has returned 260 per cent since our first accumulate call in bl.portfolio edition dated July 3, 2022.. The company boasts a stellar 26 per cent revenue CAGR in the last decade, all the while maintaining an industry-leading EBITDA and PAT margins of 34 per cent/27 per cent in FY24.

From the current juncture, we expect the company to sustain its growth momentum. At the same time, there are three factors that investors need to consider. One, from April 2024 to now, the stock’s one-year forward PE has increased from 18 times to 34 times, inching above sector valuations. Two, Caplin Point sources a significant portion from China and the impact of impending global trade volatility can be an overhang on the stock. Three, the company’s foray into the US, Mexico and Brazil with a differentiated model and a portfolio of sterile generics (vs normal generics) is expected to weigh on short-term growth. Considering all the above factors, we recommend existing investors to hold on to the stock, and not add any fresh positions.

Business model

The company has a unique business model, which it intends to replicate in the US markets as well. It is essentially focused in distribution, while it manufactures 55 per cent of its sales, and outsourcing the rest (FY24). Though it has manufacturing facilities, Caplin Point also relies on contract manufacturing from India and even China to develop its portfolio. It has a firm presence in the Latin America (LATAM) markets of Guatemala, El Salvador, Honduras, Nicaragua and others. In these markets, the company trades products with its own warehouse, reaching the last mile of doctors and pharmacists on its own. This has primarily delivered a strong margin profile, customer stickiness and better market intelligence to expand its product profile.

Now, it is expanding into the remaining major markets of LATAM — Mexico, Brazil and Chile with its own registrations. For the US as well, the company plans on largely avoiding the three large distributors there and reaching out to its clientele — doctors, clinics, hospitals and pharmacists — which it plans to develop in the next one year.

Growth drivers

Caplin Point is now expanding its product profile from standard generics to sterile generics, which includes peptides, injectables, biosimilars, ready-to-use bags and soft gels. This extends to oncology oral solid dosages (OSDs) and steriles adding necessary capacity.

Oncology solid dosage bioequivalence studies are ongoing for LATAM markets, which may extend to the US too. The company is converting solid medicines to soft gels, injectables and pre-filled syringes as per requirement with its newly-minted sterile facilities. Sourced from Chinese facilities with experience, Caplin Point will leverage its LATAM presence for biosimilars. With a strong base, the US markets can follow.

About 23 registrations are under process for the Mexico market and the first registration for Brazil has been filed after facility inspection recently. Chile is further along with 70-plus registrations under review. Caplin Point has 24 approved ANDAs in the US and will include five ophthalmic products expected to be commercialised in the next one year; the company targets more than 30 approvals in the next one year.

It has invested ₹800 crore in adding capacity and is in the last leg of completion of the current expansion in Tamil Nadu and Andhra Pradesh.. It has completed an Oncology OSD facility and expanded its sterile facility (for the US markets) which are the leading projects. An injectables facility each for the LATAM and the US markets is in the works along with an API facility for backward integration, which are the other big projects for the next two years.

Financials, valuation

The company has no debt and has managed to expand with its internal accruals, making for a stronger balance sheet.

Caplin Point is trading at 34 times one-year forward EPS, which is the highest valuation for the stock. The primary headwind for investors could be from stretched valuations despite continued growth runway for the company.

The next leg of growth will be driven by steriles in larger markets, which should involve longer approval cycles and slower ramp, even though the quality of growth should be stronger in the long run.

The company is also sourcing from China for biosimilars, injectables and other complex molecules along with own capacity for some of the segments. With global trade expected to be restructured with Trump’s second innings, this could be play either ways for the company.

Leave a Comment