The central government is considering significant amendments to the Companies Act, 2013, to streamline and simplify the merger, amalgamation, and demerger process. The focus is on reducing procedural bottlenecks and expediting corporate restructuring.

A communication from the Cabinet Secretary T V Somanathan to various ministries has sought comments on proposed changes aimed at enhancing efficiency, particularly for listed companies and unlisted entities seeking mergers or demergers, official sources said.

The proposals, put forward in response to industry feedback, specifically look at mergers between two listed entities, mergers between a listed entity, and an unlisted entity and extending the scope of the Fast Track Merger (FTR) route.

They also seek to rationalise the jurisdiction of the National Company Law Tribunal (NCLT), de-clog the Tribunal and ensure a more seamless approval process for mergers involving listed and unlisted entities.

- Read: CCI’s Green Channel: Transforming India’s M&A landscape

Indian business houses see M&As as a critical tool of business strategy and use them as instruments of growth.

Unlike the Court-free merger process in the UK or Singapore, in India the process of mergers is mainly court-driven and hence takes a long time.

If two companies want to merge or amalgamate, the law requires both entities to draw a Scheme of arrangement and get it approved by the jurisdictional NCLT. Also, if a listed entity is one of the parties to such a scheme, then a No Objection Certificate has to be obtained from a stock exchange.

Key Proposed Amendments

Expansion of the Fast Track Route (FTR) Scope

Currently, the FTR, under Section 233 of the Companies Act, 2013, is limited to mergers involving two or more small companies, wholly-owned subsidiaries and their holding companies, two or more Start-up companies, and one or more start-ups with one or more small companies.

- Read more: India enforces mandatory CCI approval for M&As over ₹2,000 crore under new regulations

The proposal suggests broadening the FTR ambit to cover mergers between any two unlisted entities. Also, it is proposed to extend the scope of FTR to cover ‘mirror demergers’

Simplification of Mergers Between Two Listed Entities

For mergers involving two listed entities, the government is considering a jurisdictional change to streamline the approval process. Under the proposed framework, once shareholders and creditors approve the merger, the jurisdiction would rest solely with the NCLT of the Transferor Company. This move aims to eliminate redundant approvals and expedite the legal clearance process.

By limiting transactional jurisdiction to a single NCLT, the government aims to decongest the tribunal system and ensure faster resolution of merger-related approvals.

The proposal also retains the Central Government’s (Regional Director) authority to refer schemes to the NCLT if deemed not in the public interest. This safeguard is expected to balance efficiency with shareholder and creditor protection.

Mergers Involving Listed and Unlisted Companies

The current legal requirement mandates separate approvals from NCLTs, where both the listed and unlisted companies operate. The proposal suggests that in such cases, the approval of the NCLT overseeing the listed company should suffice. By reducing the number of tribunals involved, the government aims to cut down on delays and legal complexities while maintaining regulatory oversight.

- Read also:M&As can drive India’s growth further

Corporate Restructuring at ‘Digital Speed’

The Cabinet Secretary has urged ministries to assess the feasibility and desirability of these amendments and provide their comments by January 22, sources said. The move aligns with the government’s broader push to create a more business-friendly regulatory environment and ensure that corporate restructuring happens at ‘digital speed’ to keep pace with rapidly evolving market dynamics.

Analysts believe that if these changes are implemented, they could enhance corporate agility, reduce compliance burdens, and improve the overall ease of doing business in the country.

Other changes to the FTR

Further, in line with the recommendation of the Company Law Committee Report 2022,

Instead of the present onerous obligation (under the FTR) requiring approval of shareholders holding 90 perc ent in value, a modified twin test requiring approval by (i) a majority of persons present and voting at the meeting accounting for 75 per cent in value of the shareholding of persons present and voting; and i) representing more than 50 per cent, in value, of the total number of shares of the company, should be introduced.

The introduction of a twin test for shareholder approval instead of the present 90 per cent norm, would make the process more robust and continue to protect minority shareholders.

Demerger Delays and the Need for Reform

Listed entities in India face significant delays in demergers, with an average approval time of 15 months extending up to 26 months in some cases. This is followed by an additional 2-3 months for listing and trading approvals. This prolonged process, driven by NCLT intervention, contrasts sharply with the UK’s faster, court-free demerger framework, leading to value erosion during the interim period.

To streamline this process, it is proposed that the fast-track route (FTR) be extended to ‘mirror’ demergers for listed entities.

These involve splitting a division into a new listed company, with shareholders receiving proportional shares in the new entity. This approach unlocks shareholder value through focused management, better governance, and ensured liquidity. Speedy execution is critical for maximising these benefits, but currently, FTR is limited to small companies, start-ups, and wholly owned unlisted subsidiaries, leaving listed entities at a disadvantage.

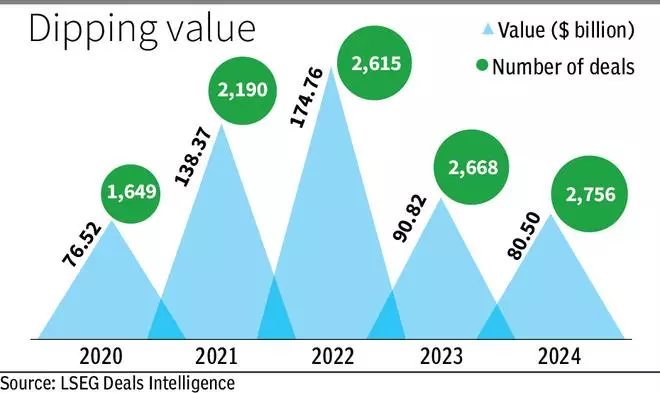

This planned overhaul of the M&A framework comes at a time when India’s involvement announced that M&A activity fell to a four-year low in deal value in 2024, at $80.5 billion, down 11.4 per cent from a year ago as more deals were done in small-to-mid market sizes, latest data from LSEG Deals Intelligence showed.

However, in 2024, deal-making activity in India witnessed the busiest year on record, with at least 2,756 transactions announced, up 3.3 per cent from a year ago. The deal count has risen steadily each year from 2020 to 2024.

Expansion of the Fast Track Route (FTR)

Broaden the scope of FTR under Section 233 of the Companies Act, 2013, to include mergers between any two unlisted entities

Extend FTR applicability to ‘mirror demergers’ for listed entities, enabling faster corporate restructuring

Simplification of Mergers Between Listed Entities

Restrict merger jurisdiction to the NCLT of the Transferor Company once shareholders and creditors approve

Eliminate redundant approvals to expedite the legal process while retaining safeguards for public interest.

Streamlining Mergers of Listed and Unlisted Companies

Allow NCLT approval for the listed company to suffice, reducing tribunal involvement and speeding up approvals while ensuring regulatory oversight

Corporate Restructuring at ‘Digital Speed’

Encourage ministries to support amendments that enable faster, business-friendly corporate restructuring

Enhance agility, reduce compliance burdens, and align restructuring timelines with market dynamics.

Revised Shareholder Approval Framework for FTR

Replace the current 90 percent shareholder approval requirement with a twin test:

Approval by 75% in value of those present and voting

Approval by over 50 percent in value of total shares

Addressing demerger delays

Extend FTR to ‘mirror demergers’ to reduce the average 15-26 month timeline for demerger approvals

Leave a Comment