ONDO, the token powering Ondo Finance, ranks among the top performers in the top 50 cryptos by market cap. Not only is the token rebounding, erasing last week’s losses, but it also surged double digits in the past trading day, adding 15% in 24 hours. At this pace, it is one of the best cryptos to buy in March 2025.

EXPLORE: Best New Cryptocurrencies to Invest in 2025

Will ONDO Break $2?

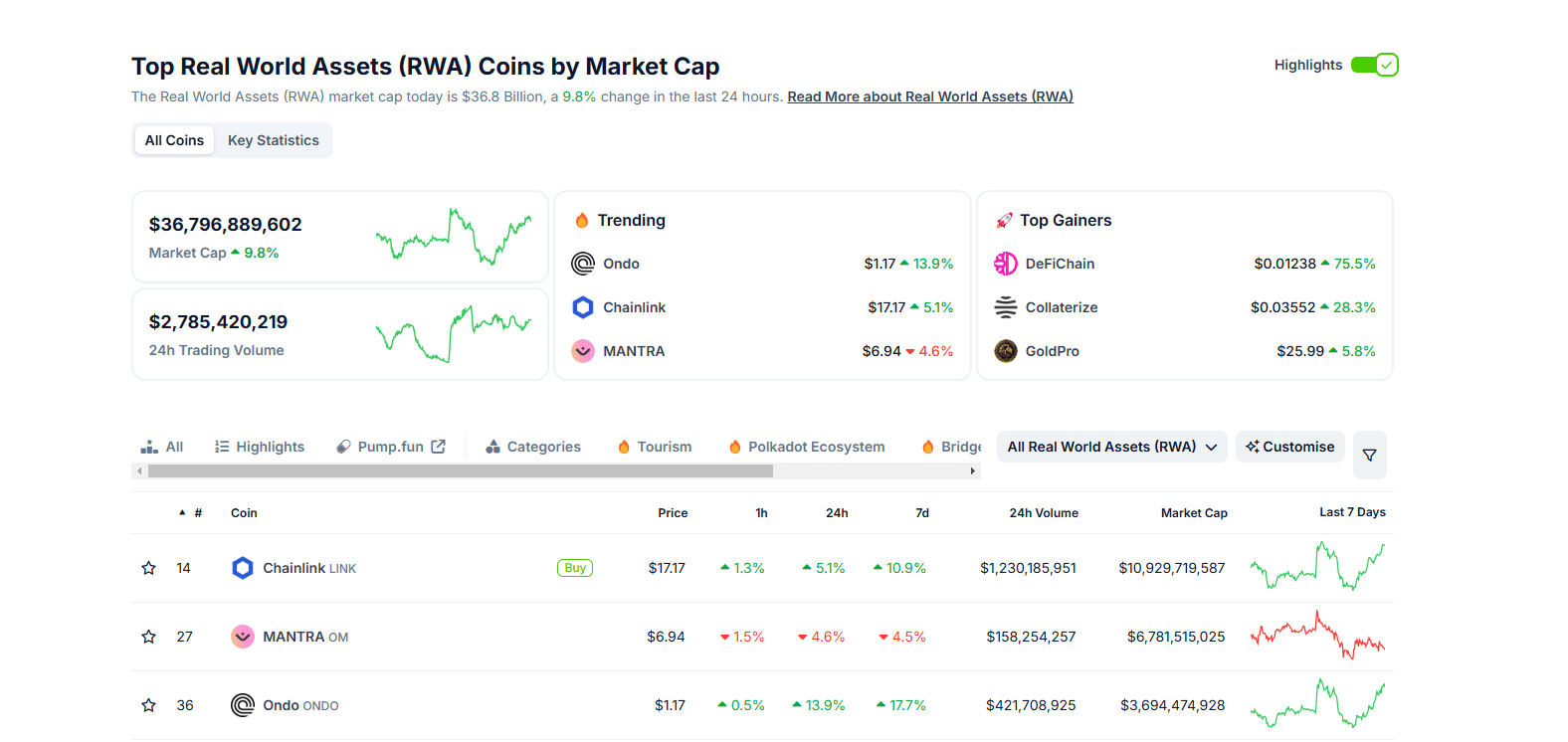

According to Coingecko, Ondo Finance is the third-largest real-world asset (RWA) tokenization project by valuation, trailing only Chainlink and Mantra.

However, based on its price growth over the last day and week, investors appear eager to gain exposure to it.

It’s the top-performing RWA token at spot rates. At this pace, it may be among the top 20 next cryptos to explode in 2025, judging by recent trends.

Technically, holders are confident that ONDO will shake off last week’s weakness and trend higher, building on Q4 2024 gains. After days of sideways movement, ONDO is forming higher highs, with resistance at $1.20.

If bulls break this level—ideally with rising trading volume—the odds of ONDO spiking to $2 increases. Such a breakout would not only confirm Q4 2024 gains but also reinforce confidence among holders that buyers remain in control after a 60% drop in January and February 2025.

Analysts on X are bullish, expecting prices to surge past immediate resistance levels.

Been heavily deep into RWA, so I can’t ignore $ONDO.

The falling wedge is as clear as it gets, and it is screaming reversal. The breakout is loading and the next leg up looks inevitable.

I am patiently watching out for the next move! pic.twitter.com/iSeV7hVSr6

— Froggy 🐸 (@GemBooster) March 5, 2025

Ondo Finance Targets the $90 Trillion Bonds and Equities Market

While technical patterns support this outlook, fundamental factors could provide additional tailwinds.

Ondo Finance aims to lead RWA tokenization, with a specific focus on bringing the $90 trillion U.S. bonds and equities markets on-chain. This ambitious goal would allow institutions to gain exposure while maintaining full transparency.

To achieve this, Ondo Finance has Ondo Nexus, which plays a critical role in connecting key components of its ecosystem once released.

Meanwhile, the recently launched Ondo Global Markets is a vital piece of this puzzle.

The trading platform tokenizes stocks, bonds, and other traditional derivatives, making them available for 24/7 trading on the blockchain.

The RWA tokenization platform also introduced the Ondo Chain in early February 2025. Unlike generic competitors, this Layer-1 blockchain is purpose-built for institutional-grade RWA tokenization while remaining interoperable.

The Chain relies on vetted, permissioned validators to ensure compliance with existing laws and reduce risks like front-running.

Additionally, it supports the staking of RWA assets—such as US Treasuries—rather than volatile native tokens.

EXPLORE: 10 Coins with High Returns: Crypto Forecast 2025

Is Tokenization the Future?

Last year, BlackRock Chairman Larry Fink predicted that tokenization would become a trillion-dollar market by 2030.

This view aligns with the rapid rise of tokenized USD. According to Coingecko, Tether alone has tokenized over $142 billion of USD, bringing it on-chain across networks like Tron and Ethereum.

Given this trend, the crypto community will closely watch the Crypto Summit hosted by Donald Trump on March 7, 2025.

The Trump administration is keen on regulating cryptocurrency and is prioritizing new laws around stablecoins—one of the key drivers of RWA tokenization.

EXPLORE: Best Monero Wallets in 2025

Ondo Finance is up double digits in 24 hours. Will it spearhead the RWA tokenization drive?

-

ONDO up 15% in 24 hours -

Ondo Finance among the top RWA tokenization projects -

BlackRock chair expects tokenization to be a trillion-dollar market by 2030

Leave a Comment