Michael Saylor, the MicroStrategy chief and Bitcoin evangelist, is stepping into the White House Crypto Summit hand in hand with friends at XRP.

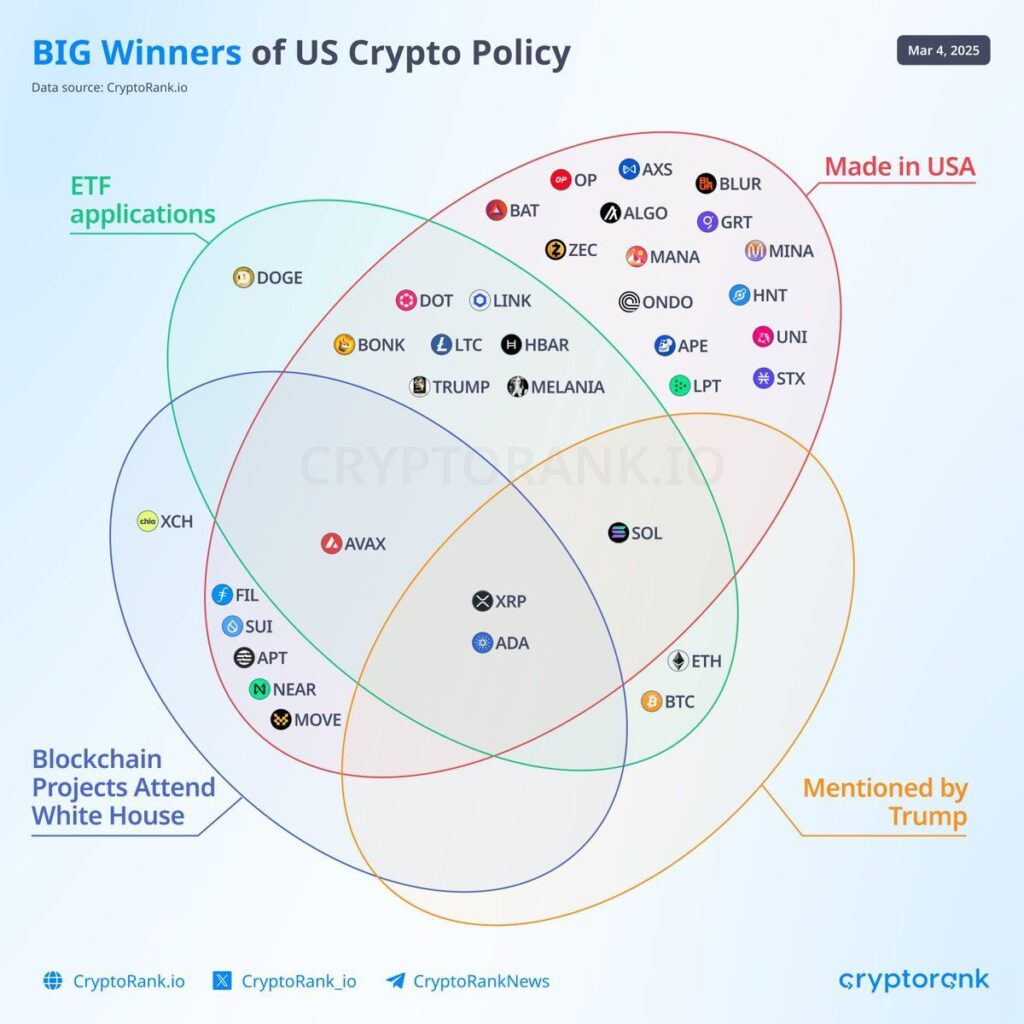

Hosted by Trump and presided over by crypto czar David Sacks, the summit is expected to chart the future of digital assets in America. Central to the agenda are plans for a US Bitcoin reserve and the contentious debate over altcoin endorsements, setting the stage for a battle over which coins deserve the spotlight.

–

Price

Market Cap

–

–

–

DISCOVER: 20+ Next Crypto to Explode in 2025

Bitcoin or XRP at the Core of the Reserve?

Ahead of the summit, Saylor doubled down on his belief that Bitcoin should lead the way. He told Fox News that BTC is decentralization and issuer-free nature makes it unmatched as a reserve asset.

“The important thing to keep in mind is Bitcoin is the one universally agreed upon foundational asset in the entire crypto economy because it’s the asset without an issuer,” Saylor said. “It’s neutral. 99% of the energy and the capital has flown into that one.”

Saylor has championed Bitcoin as “cyberspace property.” Furthermore, he noted that it offers a secure asset that could solidify America’s position as a global financial leader. He believes Bitcoin’s scarcity and lack of centralized control uniquely positioned it to serve as the backbone of a US digital asset reserve.

Discover: The 12+ Hottest Crypto Presales to Buy Right Now

Debate Over Altcoins Like XRP and ADA Sparks Controversy

What began as a reserve featuring XRP, Solana, and Cardano quickly turned divisive, as critics like Michael Saylor pushed back on the inclusion of altcoins, calling them high-risk distractions. Ripple’s Brad Garlinghouse took to X to defend the choices, touting cooperation over “maximalism.” Even so, skeptics argue betting on assets like XRP risks undermining the initiative’s credibility.

Donald Trump posted two articles about ripple on TruthSocial back to back 🇺🇸🇺🇸🇺🇸🇺🇸🇺🇸🇺🇸

👀 Link https://t.co/oLJ6alv3Qd pic.twitter.com/cxulCNRiQ8

— 𝗕𝗮𝗻𝗸XRP (@BankXRP) February 19, 2025

Yet Saylor appears to have softened his view on XRP. “I think that digital XRP is attached to a company, Ripple. Those are tokens,” Saylor explained. “We should have a regulatory framework to allow them to be issued.”

The White House Crypto Summit has a stacked roster—Coinbase’s Brian Armstrong, Crypto.com’s Kris Marszalek, Robinhood’s Vlad Tenev, and Paradigm’s Matt Huang are all slated to join.

Saylor highlighted the importance of clarity and transparency during the summit. “The administration must define a clear regulatory framework before making any large purchases,” he asserted. He also discussed the Alumnus Bill, which proposes a four-year plan to acquire one million Bitcoin for the reserve in a deliberate, progressive manner.

Questions Linger Over US Crypto Policy

While the summit generates plenty of hype, controversy surrounds the decision to include tokens like XRP, SOL, and ADA. Detractors argue it’s more about propping up token insiders than shaping a serious reserve.

Commerce Secretary Howard Lutnick offered a vague explanation, emphasizing Bitcoin’s role in a strategic reserve while leaving the treatment of other tokens ambiguous.

The White House Crypto Summit could be a gamechanger or just another talk shop, but either way, it’s a tipping point for U.S. crypto policy. Furthermore, Saylor sees the moment as a chance to legitimize Bitcoin. On the other side, Ripple and its allies are angling for a broader, more collaborative system. It’s sure to be a real knife fight.

EXPLORE: XRP Price Jumps 11% After SEC Crypto Unit Tease XRP ETF Progress

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

-

Michael Saylor, the MicroStrategy chief, is stepping into the White House Crypto Summit hand in hand with friends at XRP. -

Ahead of the summit, Michael Saylor doubled down on his belief that Bitcoin should lead the way. -

Yet Saylor does argue that XRP deserves a seat at the table.

Leave a Comment