As India’s top IT firms conclude their third quarter for fiscal year 2025, they are cautiously optimistic about a likely rise in discretionary spending in key markets like the US and Europe. For the first time in months, management of the country’s tier-I IT firms has offered a positive outlook on the return of discretionary spending.

According to brokerage firm BNP Paribas, Infosys might be a key beneficiary of discretionary demand pick-up and GenAI adoption. During Q3, the IT giant reported a resurgence in discretionary spending across sectors like Retail, EU, and Financial Services, which could drive volume growth in the coming quarters. This prompted it to revise its FY25 revenue guidance upward, projecting further growth in the coming quarters.

K Krithivasan, CEO and MD of TCS, underlined early signs of a revival in discretionary spending in the BFSI and retail sectors during the company’s Q3 FY25 earnings call. He added manufacturing and life sciences verticals could witness growth in the medium term, as near-term challenges appear to have bottomed out during the quarter.

Reduction in the interest rates

“With the reduction in the interest rates, easing of inflation, and reduced uncertainty with the new US administration taking over, we expect the discretionary demand to strengthen.” The company is confident about CY25 being better than CY24 due to these early signs of discretionary spending, he added.

HCLTech joined this optimism, confirming an overall improvement in the discretionary spending environment. CEO and MD C. Vijayakumar said, “In 2025, we expect companies to increase their IT investments. We have seen improvements over the last two quarters and an overall improvement in the discretionary spending environment. Our clients are investing to drive innovation and efficiency with Gen AI and data at the center of such initiatives.”

- Also read: Fingers crossed for India as Trump readies for second innings as US Prez

Wipro’s CEO and MD Srini Pallia echoed similar sentiments saying that discretionary spending-wise, in the Americas, the company sees a positive sign in the BFSI segment and some level of up-ticking from certain sectors.

“January is when most customers are in the process of budgeting, and we are working with them to understand where the spending will be,” he added.

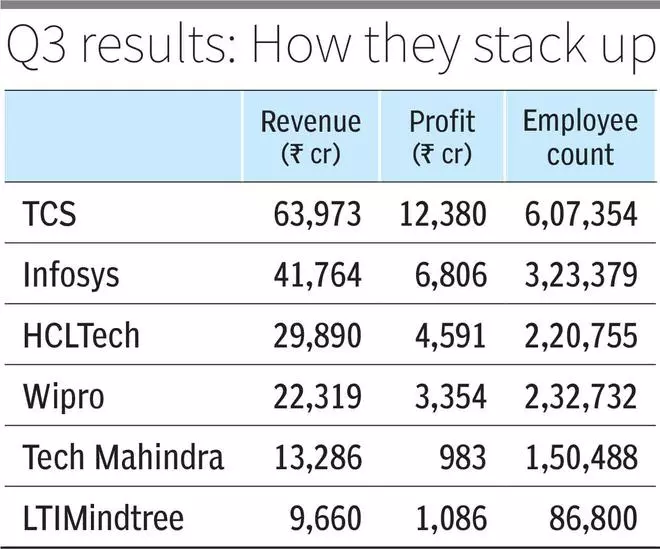

However, LTIMindtree, whose profits during the quarter fell, did not reflect discretionary tilt in its deal wins during the quarter, said another brokerage Motilal Oswal Financial Services (MOFSL). The company, whose business has historically tilted toward discretionary spending, saw a lack of discretionary deal wins in the quarter despite a 30 per cent q-o-q increase in TCV. MOFSL said it expects a recovery in spending and anticipates LTIMindtree to deliver double-digit growth in FY26.

Leave a Comment