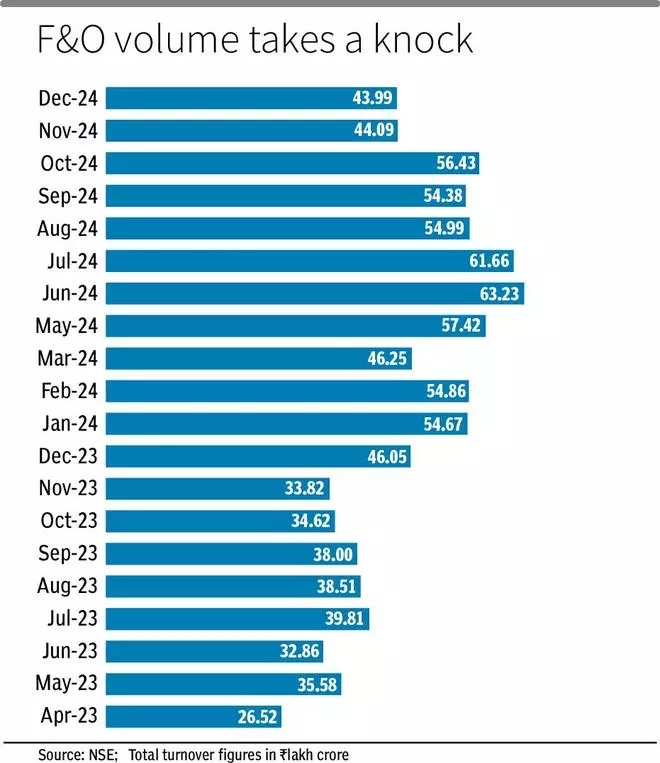

The total turnover in the equity derivatives segment fell to a 13-month low in December with regulatory curbs kicking in from November.

Total F&O turnover for December stood at ₹43.99 crore, a 22 per cent decline over October. Index options premium turnover has dipped 30 per cent to ₹9.6 trillion in the same period. The figures for December are the lowest since November last year that saw a total turnover and index options premium turnover of ₹33.8 trillion and ₹8.8 trillion, respectively.

Total turnover as well as index options turnover hit a peak last year in June totalling ₹63.2 trillion and ₹14.9 trillion, respectively.

Changes in norms

The regulator introduced a host of changes in derivatives norms to curb retail frenzy in the segment. Exchanges shifted to one weekly expiry from November 20. The NSE now has a weekly expiry for the Nifty 50 index, and has discontinued it for the Nifty Bank, Nifty Financial Services and Nifty Midcap Select indices. BSE has a weekly expiry for Sensex and has discontinued it for Bankex and Sensex 50 indices.

An additional extreme loss margin (ELM) of 2 per cent was made applicable on the expiry day starting November 20 to cover the tail risk in short option contracts. This means the margin on expiry day contracts has gone up by 2 per cent.

The increase in contract size for index derivatives to ₹15-20 lakh from ₹5-10 lakh is being currently implemented. Upfront collection of options premium and removal of calendar spread on last day of expiry will get implemented in February, while intraday monitoring of limits will take effect from April 1.

In FY24, about 60 per cent of traders made net losses in futures, compared to 91.5 per cent in options, according to a SEBI study. What’s more, 93 per cent of Individual F&O traders lost money from FY22-24. In this period, 1.13 crore unique Individual traders incurred a combined net loss of ₹1.81 lakh crore in F&O. More than 1 crore loss-making traders lost, on an average, about ₹2 lakh per person in the F&O over the period of three years.

Leave a Comment