Ethereum’s (ETH) dominance has seen a sharp decline this year, driven by broader market consolidation that has kept the altcoin’s price below $3,800 since January.

At present, Ethereum’s market share remains low, with its daily chart showing no clear signs of an imminent recovery.

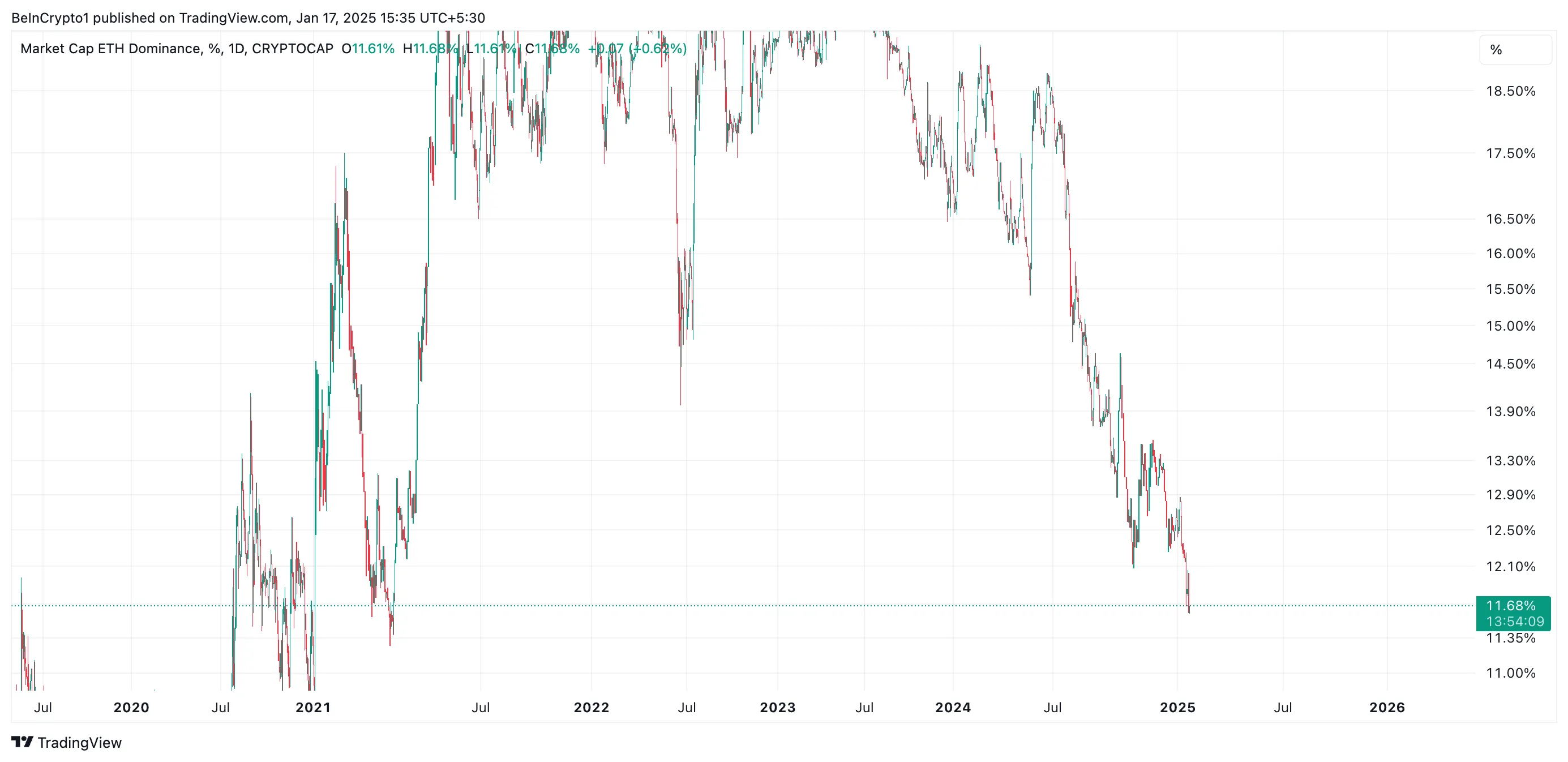

Ethereum’s Market Share Plunges

Ethereum dominance (ETH.D), which tracks the relative value of ETH compared to other cryptocurrencies, has been on a downward trend since the beginning of the year. It now sits at a four-year low of 11.68%, having declined 6% since January 1.

This decline indicates that ETH’s overall value is shrinking relative to the broader cryptocurrency market. Readings from its technical indicators further confirm the bearish outlook, suggesting that the coin’s price could continue to plummet.

For instance, ETH is currently trading below the dots of its Parabolic Stop and Reverse (SAR) indicator.

The Parabolic SAR monitors price trends and highlights potential reversal points. When the price falls below the indicator’s dots, it signals a bearish trend, suggesting that downward momentum is active and the market could see further declines.

Furthermore, the setup of ETH’s Super Trend indicator reinforces this bearish outlook. At press time, it rests above the coin’s price, forming resistance at $3,677.

This indicator tracks the direction and strength of an asset’s price trend. It is displayed as a line on the price chart, changing color to signify the current market trend: green for an uptrend and red for a downtrend.

When an asset’s price trades below the Super Trend indicator, it is in a bearish trend. This signals that selling pressure outweighs buying activity among market participants.

ETH Price Prediction: Will $3,182 Hold?

With broader market consolidation and the waning demand for ETH, the coin’s price decline could extend in the short term. In this scenario, the coin’s price could plummet to $3,182. If the bulls fail to defend this level, its price could drop further to $2,944.

On the other hand, if market sentiment improves and ETH accumulation resurges, it could drive its price past the dynamic resistance at $3,677 and toward $4,096.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Leave a Comment