- Fidelity contributed to the weekly sell pressure by offloading $213 million worth of ETH

- A short term bullish relief may already be playing out

Ethereum [ETH] might be about to recover after its latest rally, but a major sale has cast some doubt on that possibility. In fact, an address belonging to Fidelity has reportedly offloaded a significant amount of ETH.

A recent Lookonchain analysis revealed that Fidelity transferred 64,997 ETH to Coinbase. This occurred on Friday and the transferred ETH was reportedly worth over $213 million. This transfer occurred after a bearish week and after the cryptocurrency had already gone through a major pullback during the week.

The transfer from a private wallet on to an exchange suggests that Fidelity is offloading ETH. This occurred on the same day as when Ethereum ETFs registered a total of $159.4 million in net outflows. Unsurprisingly, Fidelity’s FETH ETF had the highest amount of outflows out of all Ethereum ETFs on Thursday at $147.7 million.

Is Fidelity’s ETH sale a reflection of market sentiment?

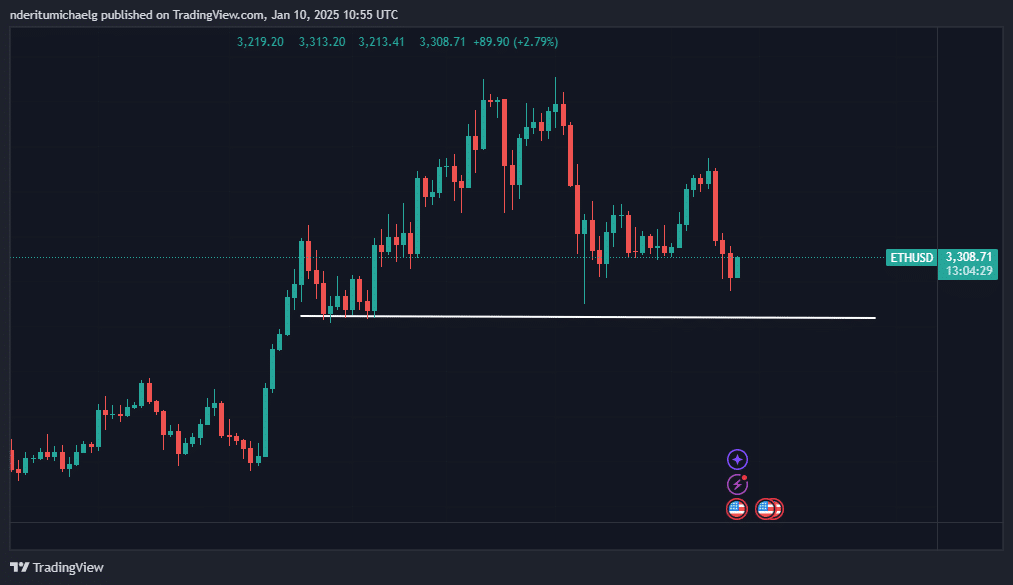

ETH has maintained net sell pressure since Tuesday, and it maintained this trend on Friday – Same day as when Fidelity transferred the aforementioned coins. This resulted in a 15.54% dip from its weekly high to a weekly low.

source: TradingView

ETH was valued at $3,308 at press time, courtesy of a 2.89% uptick in the last 16 hours. This slight recovery suggested that demand made a comeback after Friday’s close. Hence, there was some accumulation after the weekly dip.

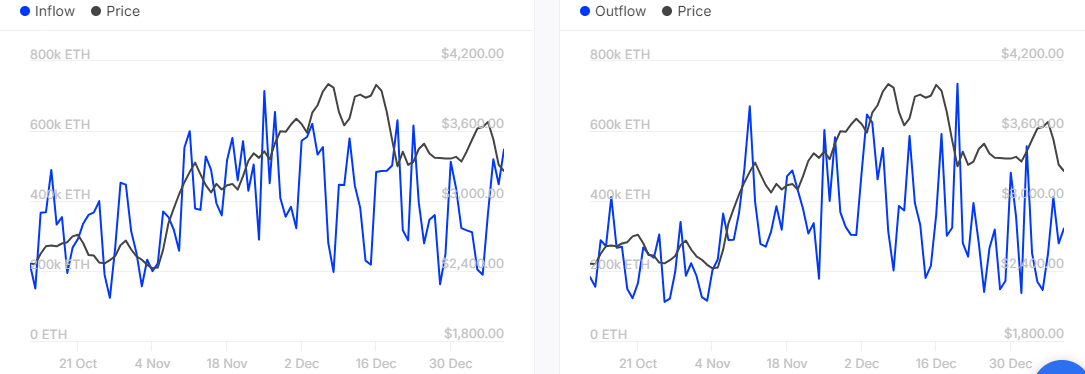

However, can the cryptocurrency sustain this hike? That would depend on the level of demand and who is buying. Onchain data confirmed that whales have been buying the latest dip. For example, large holder inflows clocked in at 547,230 ETH while large holder outflows amounted to 321,650 ETH on 9 January.

Source: IntoTheBlock

The surge in whale demand could set ETH up for a bit of a weekend recovery. Even the exchange flows suggested that the cryptocurrency may be in a position where demand likely makes a comeback.

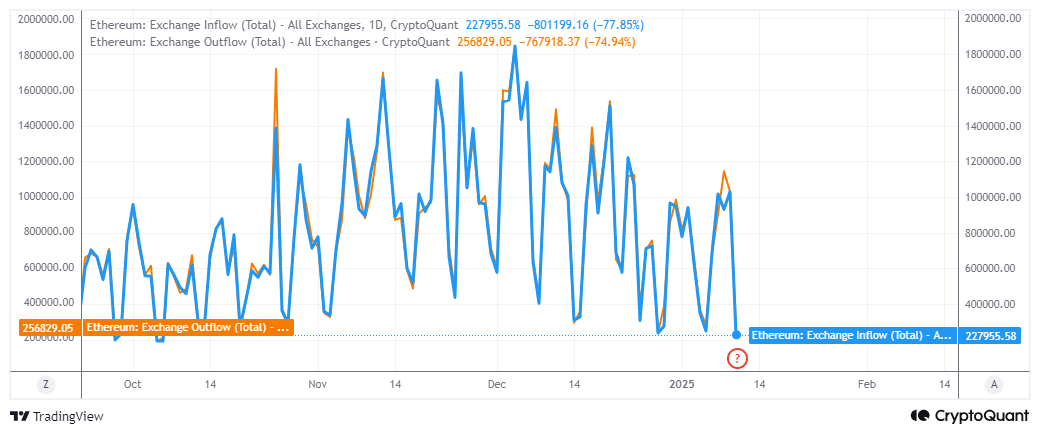

Exchange flows recently dipped to levels last seen in early November. According to CryptoQuant, exchange outflows were slightly higher at 256,829.05 ETH, compared to 227,955.58 ETH, at the time of writing.

source: CryptoQuant

Exchange flow data seemed to be in line with the recent uptick and pointed towards the possibility of a recovery rally. However, investors should be weary of the possibility of more downside.

In fact, ETH’s daily chart placed the next major support level at the $3,033-price level. Failure to secure enough demand at its press time level would mean that ETH could potentially capitulate to the aforementioned support level.

Source: https://ambcrypto.com/fidelitys-64-9k-eth-dump-worth-213-million-assessing-its-impact/

Leave a Comment