Safe haven bets such as gold and silver have outperformed riskier investments in equities by a significant margin last year.

The demand for yellow metal and silver was strong in most parts of the year due to geopolitical tensions across the globe and uncertainty over the US interest rate cut. Gold and silver have registered impressive returns of 21 per cent and 17 per cent in 2024, respectively.

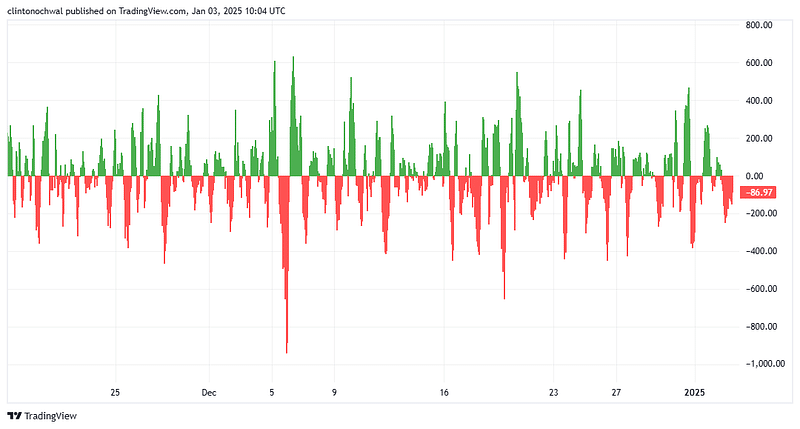

By comparison, equity benchmarks BSE Sensex and NSE Nifty50 have risen 8 per cent and 9 per cent amid huge volatility and consistent foreign outflows, especially towards the end of the year.

The stock markets, though, have given very good returns to investors in most parts of 2024, except for the volatility seen during the last quarter of the calendar year. The volatility was driven by selling by foreign portfolio investors and a few concerns about high valuations. The benchmark index, the Sensex, touched a record high of 85,978, and the Nifty reached a peak of 26,277 in September.

- Also watch: Gold and silver see significant price rise in 2024; analysts predict continued growth in 2025

In 2024, commodity-based ETFs—gold and silver—provided average returns of 20 per cent each.

Prithviraj Kothari, Managing Director of RiddiSiddhi Bullions, said gold started last year on a strong note at about $2,070 (₹63,000 per 10 grams) an ounce, dipped to $2,000 (₹61,000) in mid-February, and touched a record high of $2,800 (₹80,000) in October.

Saiyam Mehra, Chairman of the All India Gem and Jewellery Domestic Council, said India’s gems and jewellery industry is set for substantial growth this year, driven by a combination of domestic demand, export potential, and strategic initiatives.

India’s gems and jewellery market is expected to grow to $100 billion in 2025 as the country continues to be one of the largest global hubs for the production, export, and consumption of jewellery.

Vaibhav Agrawal, CIO – Alternates (Public equity), Motilal Oswal AMC, said equity markets last year were influenced by a consumption slowdown, the peak of global interest rates, geopolitical uncertainties, and rich valuations in certain pockets of mid and small caps.

However, most of the concerns are likely to moderate this year, especially regarding government spending and interest rates. One-year forward multiples for broader markets, at about 20 times, are a tad below the long-term averages, while the broader markets are expected to register earnings growth of 12-13 per cent next fiscal, he added.

Leave a Comment