Grayscale Investments, a leading asset management firm in the cryptocurrency space, has launched two new investment trusts.

Grayscale Lido DAO Trust and Grayscale Optimism Trust are new products that let institutional investors buy into the Lido DAO governance tokens (LDO) and Optimism (OP) protocol.

Eligible individual and corporate investors can now subscribe to these trusts.

Grayscale Expands Portfolio with New Crypto Trusts

Two of the new trusts consist of packages offering institutional investors implicit exposure to two major Ethereum projects.

Lido DAO protocol is about liquid staking solutions for Ethereum, while Optimism is a layer2 scaling solution for Ethereum transactions.

Both protocols improve the Ethereum ecosystem, scalability, transaction costs, and network congestion.

– Advertisement –

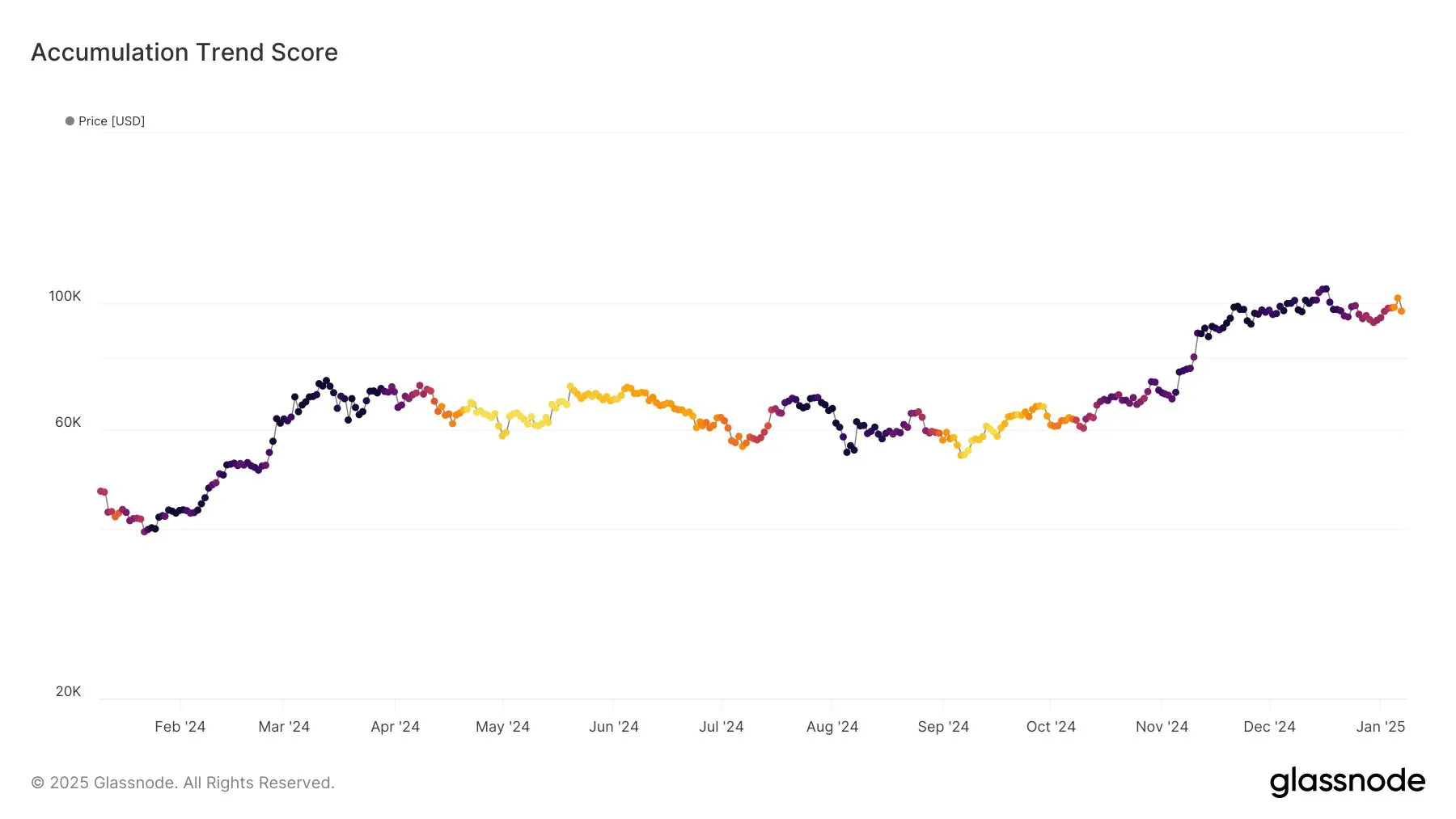

The demand for structured crypto investment products from institutions is still rising, and Grayscale’s new offerings come at a helpful time.

The new trusts offer a simple way to get involved with LDO and OP tokens without getting buried in the complexities of direct involvement in those sorts of projects.

Investors can subscribe to these trusts according to their financial criteria, which include a minimum net worth of $1 million or an annual household income of $300,000.

New Trusts Offer Exposure to Key Blockchain Solutions

These new trusts align with Grayscale’s ongoing work establishing more exposure to decentralized finance (DeFi) protocols and Ethereum-based solutions.

Grayscale has integrated Lido and Optimism crypto assets to facilitate financial services into its financials crypto sector, including crypto assets.

These additions illustrate the company’s ongoing efforts to expand the range of products that address the needs of institutional investors looking for indirect exposure to important blockchain technologies.

The firm expands its product offering to include new assets in the growing Ethereum ecosystem with the launch of the Grayscale Lido DAO Trust and Grayscale Optimism Trust.

Ethereum’s continued evolution wouldn’t have been possible without Lido and Optimism, which would have enabled higher scalability and liquidity.

These new trusts will give investors an easy, regulated vehicle to gain exposure to quickly growing projects.

Grayscale Enhances Offerings for Institutional Investors

The launch comes a day after Grayscale announced that it reopened private placements for 19 other trusts.

These trusts include trusts for assets such as Solana, XRP, AAVE, Chainlink, or Avalanche. The move is part of Grayscale’s bigger picture of better serving institutional investors with a wider range of crypto projects.

In the crypto investment landscape, Grayscale continues to increase its offerings.

The company’s decision to add Lido and Optimism trusts signals its commitment to developing new digital asset investment solutions.

With these new products, we now have access to two important Ethereum ecosystem projects for institutional investors.

Source: https://www.thecoinrepublic.com/2024/12/13/grayscale-launches-new-trusts-for-optimism-and-lido-tokens/

Leave a Comment