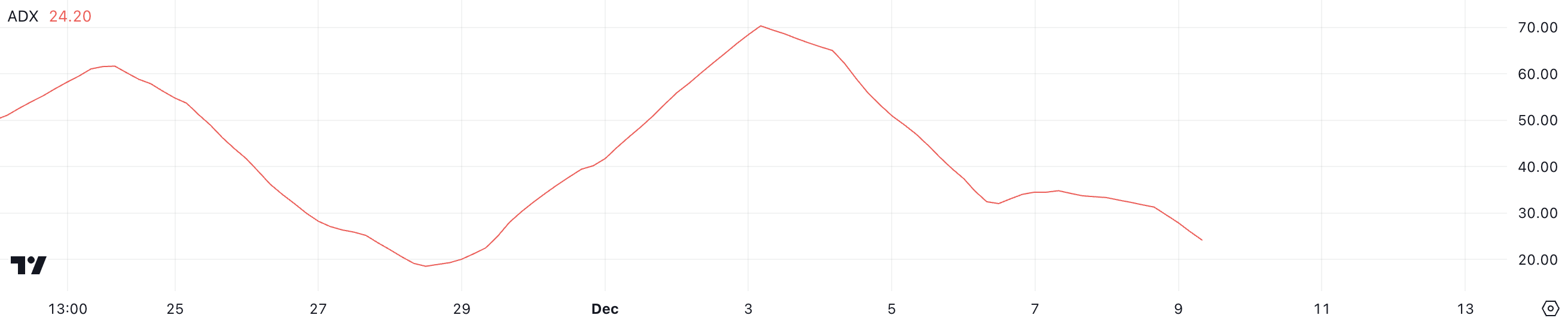

Hedera (HBAR) price has surged more than 506% in the last 30 days, reaching a market capitalization of almost $12 billion. However, despite this impressive rally, the uptrend appears to be losing steam. Currently, HBAR’s ADX stands at 24.2, indicating a weakening trend, with the price declining after peaking at $0.39 on December 3.

While the coin remains above the Ichimoku Cloud, suggesting a bullish sentiment, the market may be entering a phase of consolidation as the strength of the trend diminishes.

HBAR Uptrend Is Losing Its Steam

Hedera has experienced an impressive rise of 506.83% over the last 30 days, but its uptrend seems to be losing momentum. Currently, its ADX stands at 24.2, indicating a weakening trend.

The coin’s price peaked at $0.39 on December 3, but since then, both the price and the ADX have been declining.

ADX, or Average Directional Index, is a technical indicator used to measure the strength of a trend, regardless of its direction. It ranges from 0 to 100, with values above 25 indicating a strong trend and values below 20 suggesting a weak trend. HBAR ADX was near 70 on December 3 when its price surged, signaling a strong uptrend.

However, as the ADX has dropped from over 30 to 24.2, it suggests that the strength of the uptrend is diminishing, and the market may be losing conviction in the price movement. This would potentially signal a slowdown or consolidation phase.

Ichimoku Cloud Shows HBAR Is Still Bullish

Hedera price has recently been in a strong uptrend, reaching its highest levels since November 2021. That is clearly indicated by its movement above the Ichimoku Cloud. The coin surged sharply and reached a peak around $0.39, with the price remaining above the cloud, signaling bullish momentum.

However, as the price starts to consolidate and move closer to the upper boundary of the cloud, there are signs of weakening momentum. The slight pullback seen in the chart suggests that HBAR price may be facing resistance at this level.

The Ichimoku Cloud’s green zone represents support, while the red zone above indicates potential resistance. Since the price is still above the cloud, the overall trend remains bullish.

However, if HBAR price breaks below the cloud, it would suggest a potential shift to a neutral or bearish trend. In such a case, the next key support could be found at the lower edge of the cloud.

HBAR Price Prediction: Can Hedera Test $0.40 In December?

Hedera reached a 3-year high on December 3 but has since entered a period of consolidation. If the uptrend reverses and the price enters a downtrend, the first support level at $0.27 could be tested.

If this support fails to hold, HBAR price may experience further declines, with potential support at $0.17 or even as low as $0.12.

On the other hand, if HBAR price uptrend regains momentum, it could rise again, testing the $0.40 resistance level. A successful break above this could lead to further gains, with the next target at $0.45.

This would represent a potential 45% surge from its current levels, signaling a strong continuation of the bullish trend.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Leave a Comment