You get immediate access to the Google Sheets so you can get started with your new budget. It includes:

-

5 video tutorials to walk you through the customization process.

-

Detailed “how to” instructions so you can effortlessly use the spreadsheets.

-

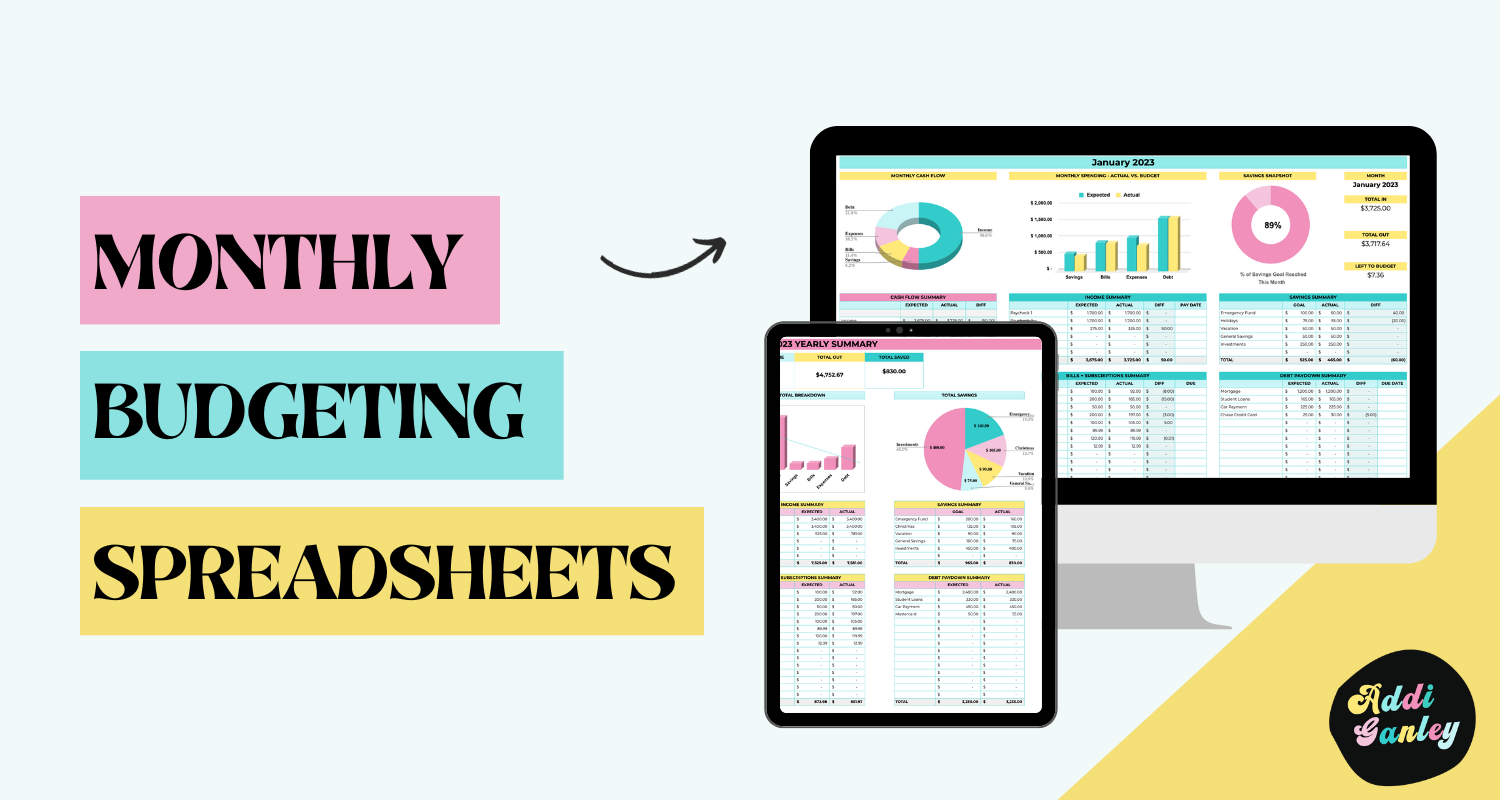

13 tabs in total, including one for each month and a yearly summary.

-

Customizable categories to fit your unique income and expenses.

-

Monthly snapshot so you can see the big picture of your finances.

-

Graphical insights to visualize your progress with graphs and charts.

-

Savings tracker so you can watch your savings grow and see how much to add to hit your goals.

Budgeting is like the secret sauce of financial success.

It provides a roadmap for your money, ensuring it’s allocated to the right places. However, the mere mention of budgeting often sends shivers down people’s spines. It’s seen as restrictive, complicated, and just plain tedious.

That’s where the Monthly Budgeting Spreadsheets come in.

They’re not your typical budgeting tool. They’re a financial ally, designed to simplify the budgeting process, give you control over your finances, and, most importantly, help you save money.

The Power of Monthly Budgeting Spreadsheets

1. Easy Customization:

The Monthly Budgeting Spreadsheets are like a tailored suit for your finances. They come with preset categories, but here’s the magic – they’re fully customizable.

You can adapt them to match your unique income streams and spending patterns. It’s budgeting made personal. They are made in Google Sheets so you can access them anytime, anywhere.

2. Monthly Snapshot:

Ever wished you could see your entire financial picture at a glance?

These spreadsheets provide a monthly summary of your income, expenses, and savings. It’s like having a financial GPS that tells you exactly where you stand. No more surprises or guessing games.

3. Debt Demolisher:

Debt can feel like a heavy anchor holding you back from your financial goals. The Monthly Budgeting Spreadsheets include a dedicated debt paydown plan. It helps you strategize, prioritize, and systematically reduce your debt. It’s your path to financial liberation.

4. Savings Booster:

Saving money often takes a backseat to immediate expenses. These spreadsheets change that. They include a savings tracker that lets you watch your savings grow month by month. It’s a visual reminder of your progress towards your financial dreams.

You can add individual savings goals that you want to achieve for the month and then watch your progress.

For example, if you want to save for a vacation or a holiday, you can add that category to your goal amount such as $50/month. Then, as you add money you will see the savings snapshot increase.

5. Graphical Insights:

Numbers can be overwhelming. That’s why these spreadsheets use graphs and charts to make your financial data crystal clear.

You’ll have a cash flow pie chart, expected vs. actual expenses graph, monthly savings summary, and actual expenses chart. It’s financial data, decoded.

6. Financial Confidence:

Imagine the confidence that comes from knowing exactly where your money is going, having a plan for your financial future, and watching your savings flourish. It’s not just about numbers; it’s about peace of mind.

Why the Frustration Ends Here

The frustration of feeling financially stuck, of not being able to save, ends here. The Monthly Budgeting Spreadsheets simplify the entire process. They turn budgeting into a tool of empowerment, not restriction.

No more wondering where your money went.

No more sleepless nights worrying about bills. No more debt dictating your life choices.

Instead, picture yourself:

-

Knowing Your Money: You’ll have a clear understanding of your financial inflow and outflow.

-

Confident Decisions: You’ll make financial decisions with confidence and foresight.

-

Peace of Mind: You’ll sleep better knowing your finances are under control.

-

Debt Reduction: You’ll have a structured plan to systematically pay off your debts.

-

Savings Growth: You’ll watch your savings flourish and financial goals become attainable.

-

Financial Freedom: You’ll be on the path to financial freedom, where your money works for you, not the other way around.

Your Financial Transformation

When you invest in the Monthly Budgeting Spreadsheets, you’re not just buying a product; you’re investing in your financial future.

You’ll walk away with more than just a tool; you’ll have a newfound sense of financial control, confidence, and peace.

Leave a Comment