The Indian benchmark indices remained calm and stable until Thursday last week. But on Friday some wild swings caused jitters in the market. Sensex, Nifty 50 and the Nifty Bank index tumbled about 1.5 per cent each in the initial trades on Friday. However, the indices made a strong recovery from their lows and closed higher for the week. This swift rise back indicates the presence of strong buyers at lower levels. That continues to keep the broader bullish view intact. Indeed, the price action last week signals that we are going to see the Santa Claus rally much early this year.

Among the sectors, the BSE IT index outperformed last week. The index was up 2.62 per cent. The BSE Healthcare and BSE FMCG indices underperformed. The indices were down 1.03 per cent and 1.45 per cent respectively.

FPIs sell

The Foreign Portfolio Investors (FPIs) were net sellers of Indian equities last week. They sold about $199 million in the equity segment. However, for the month of December they have pumped in about $2.68 billion so far. So, broadly if they continue to buy again, then it can support the Nifty and Sensex to go up from here.

Video Credit: Businessline

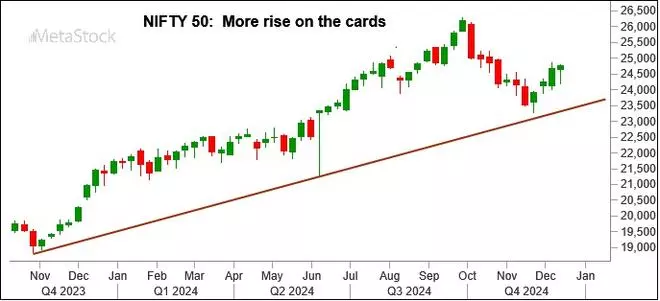

Nifty 50 (24,768.30)

Nifty was holding well above 24,500 and remained stable until Thursday. A sudden and sharp fall below this support on Friday, though seemed to be threatening initially, did not sustain. Nifty rose back sharply from the low of 24,180.80 and closed at 24,768.30, up 0.37 per cent for the week.

Short-term view: The outlook is bullish. The 21-day moving average at 24,182 has held very well last week and has triggered a strong bounce. Supports will now be at 24,600, 24,500 and then around 24,200.

We can now expect the Nifty to sustain above 24,500 itself. A rise to 25,100 first and then to 25,500 eventually are possible in the short term. A decisive break above 24,800 will clear the way for this rise.

Nifty will have to decline below 24,200 to become bearish for a fall to 24,000 and lower. But such a fall looks unlikely in the absence of any strong negative trigger.

Chart Source: MetaStock

Medium-term view: The stable movement till Thursday indicates lack of strong sellers. On the other hand, the strong bounce on Friday shows the presence of strong buyers. These, together keep the broader bullish view intact.

So, the inverted head and shoulder reversal pattern remains valid. From a big picture, clusters of support in the 24,000-23,000 region make it a strong support zone.

We retain our bullish view of seeing a rise to 26,000 in the coming months. As mentioned last week, if the momentum remains strong, then Nifty can touch 28,000 in the first half next year.

Nifty has to break 23,000 decisively to negate or delay the aforementioned rise.

Sensex (82,133.12)

The support at 80,000 held very well last week. Sensex touched a low of 80,082.82 and then rose back sharply to close the week at 82,133.12. The index was up 0.52 per cent for the week.

Short-term view: The strong bounce from the psychological support level of 80,000 is a positive. That keeps the overall bullish view intact. Immediate resistance is at around 82,350. A break above it can take the Sensex up to 83,100 initially. A further break above 83,100 will see an extended rise to 83,500-83,600, and even 84,000 in the coming weeks.

Sensex has to decline below 80,000 to come under pressure for a fall to 78,000 and lower. But that looks unlikely at the moment.

Chart Source: MetaStock

Medium-term view: The big picture is bullish. Strong supports are at 80,000 and 78,000. Sensex can target 87,000-87,500 in the coming months.

To negate this rise, Sensex has to break 80,000 first and then 78,000 subsequently. Looking at the sharp rise last week from around 80,000, we see that even a break below 80,000 might be difficult going forward.

Nifty Bank (53,583.80)

Nifty Bank index fell back into the previous range of 49,800-52,600 on Friday but did not sustain. The index reversed sharply higher from a low of 52,264.55 and closed the week at 53,583.80, up 0.14 per cent.

Short-term view: The range breakout mentioned last week remains valid. That keeps the bullish view intact. Supports are at 53,000 and 52,500. Some resistance is in the 53,800-54,000 range. But the chances are high for the index to breach 54,000 in the coming days. Such a break can take the Nifty Bank index up to 55,500 in the short term.

Nifty Bank will have to see a sustained fall below 52,500 in order to turn the outlook negative. If that happens, we can see a fall to 51,000 and 50,000 again. But such a fall looks unlikely.

Chart Source: MetaStock

Medium-term view: The broader bullish view is intact. The region around 52,000 itself will act as a good support now. Below that, 50,000 and then the 49,000-48,000 region are the next strong supports. We continue to retain our bullish view of the index, targeting 57,000-58,000 in the coming months.

A fall below 48,000 is needed to turn the outlook negative.

Dow Jones (43,828.06)

The resistance at 45,000 has held very well and the expected corrective fall has started. The Dow Jones fell breaking below the support at 44,500 in line with our expectation. The index made a low of 43,790.48 before closing the week at 43,828.06, down 1.82 per cent.

Chart Source: MetaStock

Outlook: The bearish view is intact. Intermediate support is at around 43,650. A corrective bounce from this support to 44,000 or 44,250 is a possibility in the near term. But thereafter, the corrective fall can resume towards 43,300-43,000.

The price action around 43,000 will need a very close watch. The Dow Jones will come under danger for a steeper fall to 42,000 if it declines below 43,000 decisively.

The US Federal Reserve meeting’s outcome on Wednesday will be an important event to watch this week.

Leave a Comment