Indian stock markets are expected to remain sensitive to the market triggers such as corporate earnings, key macroeconomic data, including CPI and WPI inflation, and foreign fund outflows amid the ongoing corrective phase, according to market experts.

Market experts believe that market participants will keenly watch India’s CPI data for December 2024, which is scheduled for release on January 13. The data is expected to guide market expectations for interest rate decisions and economic sentiment ahead of the RBI’s February policy review, as per market experts.

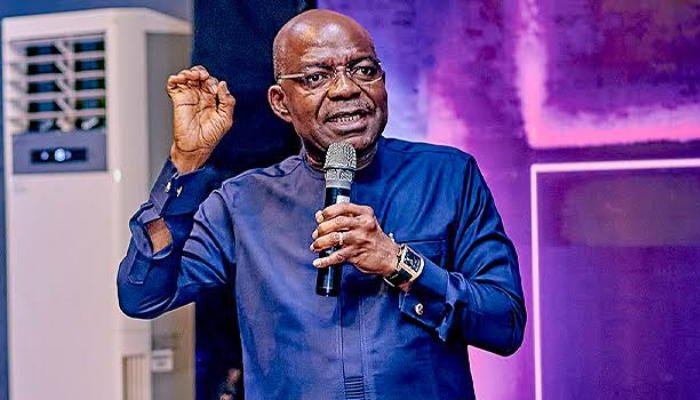

Observing the investors sentiment for the upcoming week, Ajit Mishra, SVP, Research, Religare Broking Ltd, stated that the market focus will shift to corporate earnings, with key players like HCL Tech, Reliance, Infosys, Axis Bank, and Wipro set to announce results.

“Key macroeconomic data, including CPI and WPI inflation, will also be closely watched. Moreover, ongoing foreign fund outflows and cues from US markets are expected to impact sentiment,” said Mishra.

- Also read: FPIs offload ₹22,194 crore in Indian equities ahead of Trump inauguration

Manish Goel, Founder and Director, Equentis Wealth Advisory Services Pvt Limited, stated, “The December WPI data, set for release on January 14, 2025, will provide critical insights into price movements in food, fuel, and manufacturing, following November’s moderation to 1.89 percent.”

As per Goel, key sectors such as FMCG, agriculture, and energy could witness notable impacts as inflation shapes consumer behaviour, input costs, and corporate profitability.

He further added that the market participants are now closely watching the RBI’s upcoming monetary policy decision in February, as any rate cuts could help revive demand by making borrowing cheaper, potentially boosting spending and investment to stabilise economic growth in the coming months.

According to the experts, IT, FMCG, and select pharma sectors appear relatively resilient, while broader markets and other sectors are likely to remain under pressure.

After two weeks of consolidation, the stock markets saw a roughly 2.5 per cent loss, prolonging the current corrective period.

Sentiment was tempered by poor quarterly updates and mounting worries about HMPV virus outbreaks in India.

Although indices attempted to recover mid-week, late-session selling dragged the Nifty and Sensex to weekly lows of 23,431.5 and 77,378.91, respectively.

Most sectors, except IT, came under significant pressure, with realty, energy, and metals being the hardest hit. Broader markets fared even worse, as midcap and smallcap indices fell sharply by 5.8 per cent-7.3 per cent.

Leave a Comment