International Gemmological Institute (IGI), a certification and accreditation company, grades and certifies diamonds, coloured stones and studded jewellery. A leading player in business globally, the company is one of the three players to provide a full stack of services related to certifying across different types of stones.

The company intends to raise ₹4,225 crore through the initial public offering (IPO), which closes on December 17. As of close on December 13, the IPO saw 17 per cent subscription. Out of the total issue, ₹2,750 crore will be offer-for-sale (OFS), and ₹1,475 crore will be fresh issue. The price band is ₹397-417. The company is valued at around 38 times its annualised CY24 earnings. The closest listed peer, Goldiam International, which manufactures and sells diamond jewellery, is currently trading at 48 PE.

IGI India will use an estimated ₹1,300 crore from the proceeds for acquisition of IGI Netherlands Group and IGI Belgium Group from the promoter, Blackstone – one of the largest asset management companies in the world. A part of the funds raised will also go towards general corporate purposes. The promoter stake post issuing will be 76.5 per cent. Post the acquisition, IGI India will own the entire business, giving exposure to the global certification market.

The company is involved in a niche business and holds good market share in India as well as the global market. Margins are higher and sales growth and profitability have also been good. Overall, prospects for the company appear good. However we would also like to bring investors’ attention to the change in valuation of the company in just around 18 months. In May 2023, Blackstone acquired 100 per cent of IGI India which is valued in the IPO at a market cap of ₹18,000 crore, for just ₹3,228 crore. The 5.5x jump in value in such a short span may make some fresh IPO investors think twice. Hence we recommend long-term investors only with a high risk appetite to consider applying to the offer.

Business

There are four key areas of business. One, comprehensive grading of both natural and laboratory-grown diamonds. Two, evaluating the quality and authenticity of coloured stones such as rubies, emeralds, sapphires etc. Three, grading and assessment of finished jewellery. Four, conducting educational programmes and courses in gemology, diamond grading, jewellery design etc.

The company, first established in Belgium in 1975, currently operates through a network of 31 branches with laboratories across 10 countries and 18 schools of gemology across six countries. These are the largest among the peers. Of the total branches, 19 are in India, the largest centre for cutting and polishing diamonds, accounting for about 95 per cent of the world’s total polished diamonds in volume terms in CY23.

IGI is present in strategically important locations such as Surat and Mumbai in India and Antwerp in Belgium, which are key places with respect to the diamond market.

The company also has mobile laboratories and in-factory facilities for on-site certification to reduce the downtime. Setting up a lab within the premises of key IGI’s customers means the chances of losing the business is lower.

Globally, IGI has 7,500 customers spread over 10 countries. Laboratory-grown diamond growers, natural diamonds and coloured stone wholesalers, jewellery manufacturers and retailers are the typical customers.

IGI India serves over five Indian laboratory-grown diamonds with over ₹100-crore revenue for FY23. The company also served nine out of 10 top 10 jewellery chains in India by revenue.

Within diamonds, laboratory-grown diamonds, being a cheaper alternative to the natural diamond by 70-80 per cent on per-carat basis, are the key driver of growth. IGI is the global leader with 65 per cent market share in terms of number of certifications issued for laboratory-grown diamonds and 42 per cent market share in studded jewellery certifications. Based on overall certifications issued, IGI has 33 per cent market share globally and 50 per cent market share in India.

As of now, the company structure is that Blackstone owns IGI India, IGI Belgium Group and IGI Netherlands Group, which are three different entities. Using IPO proceeds, IGI India will buy the other two groups and therefore will be responsible for the global operations.

Financials

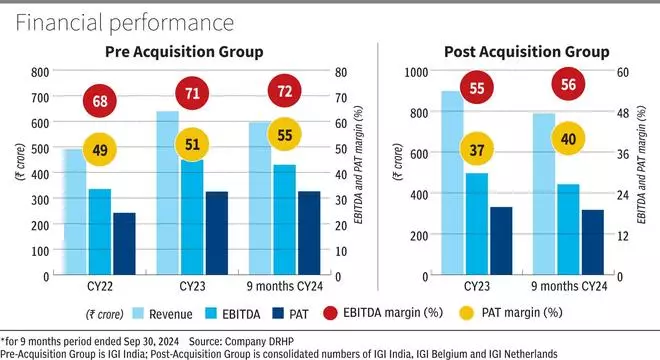

Revenue for IGI India grew at a CAGR of 32 per cent between CY21 and CY23. For the nine months ended September 30, 2024 (9MCY24), the topline grew 31 per cent to ₹596 crore compared with ₹454 crore of the same period last year.

The margins, too, have stayed strong. EBITDA margin for 9MCY24 stood at 72 per cent compared with 71 per cent in 9MCY23. For CY21 and CY22, it stood at 66 and 68 per cent respectively.

Similarly, PAT margin for 9MCY24 stood at 55 per cent compared to 53 per cent in 9MCY23. For CY21 and CY22, it stood at 47 and 49 per cent respectively.

Notably, the revenue per certification of the IGI has seen an increase. It stood at ₹854 in 9MCY24 compared with ₹833 in CY21.

Risks

Price movements in diamonds and coloured stones is an important factor. Certification charges are dependent on the prices of diamonds and coloured stones as per the company report. A drop in price can impact the margins of IGI’s customers (diamond wholesalers, jewellery manufacturers etc.), which in turn can lead to pressures to reduce charges of certifications.

On the other hand, a sharp increase in price can also be detrimental. Because higher prices can weigh on the demand for diamonds and coloured stones and consequently, on the requirement for certification services.

Also, IGI does not typically enter into long-term contractual agreements with their customers, opening themselves to the risk of losing them to competitors.

Revenue-wise, there is concentration risk. For instance, for IGI India, top 15 customers contributed to nearly 52 per cent of the revenue for nine months ended September 30, 2024. This has increased from 29 per cent in CY21.

Should you subscribe?

Although the company faces the risks discussed above, there are some advantages.

One, IGI is a market leader in the industry and has established a relationship with customers. They are able to maintain high margins.

Two, in the business, they have a 33 per cent market share globally and a 50 per cent market share in India.

Three, IGI’s share in certifying laboratory-grown diamonds is 65 per cent. This is the fastest-growing subsegment and its demand is expected to grow 15 per cent CAGR between 2023 and 2028. Comparatively, demand for natural diamonds is forecasted to grow 5 per cent. Lab-growns have been popular as they are 70-80 per cent cheaper than natural diamonds.

Four, the share of certified laboratory-grown diamonds is expected to increase from 70 per cent in 2023 to 85 per cent in 2028.

Five, high barrier to entry because of the cost in setting up labs and the time it takes to build trust with customers, a key factor in the industry which deals with high-value goods.

Broadly, we recommend long-term investors only with a high risk appetite to consider applying to the offer.

Leave a Comment