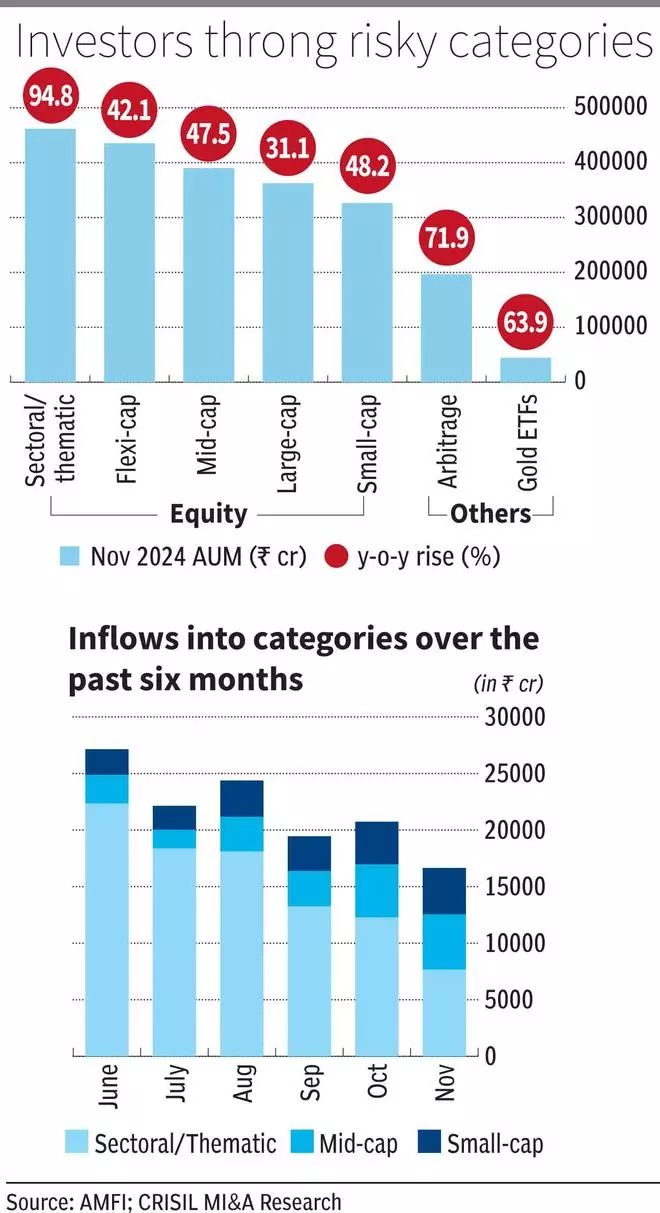

Investors seem to be going full throttle on buying the riskier categories of mutual funds, going by the inflows over the last six months as well as the year-on-year (YoY) rise in assets under management (AUM) in November. Sectoral/ thematic funds top the preference list, followed by the mid- and small-cap categories. They also seem to be chasing categories where the performance has been strong, such as in the case of gold and arbitrage funds.

Risky categories rake in more

When the top five equity fund categories are taken, sectoral/ thematic funds saw their AUM rise by a robust 94.8 per cent YoY to ₹4.61 lakh crore in November 2024. Mid- and small-cap funds saw their assets swell by 47.5 per cent and 48.2 per cent YoY, respectively. For perspective, the large-cap fund category witnessed only a 31.1 per cent increase in AUM in November 2024 on a YoY basis.

Given the wide range of themes on offer, investors took these funds via NFOs and regular buying. Defence, manufacturing, infrastructure, digital India, consumption, services, capital markets and the like offered investors much to choose from, with many of these themes recording strong performances in recent months and years.

- Also read: Active investing fares well in small-cap space

The AUM swell in the mid and small-cap spaces also stems from their performance in recent years, and investors have been chasing these for potentially high returns, irrespective of the underlying risks.

In terms of monthly flows, too, sectoral funds top the equity category. In the last six months, this category has seen the maximum inflows in every single month. Though flows have declined from ₹22,232 crore in June 2024 to ₹7,658 crore in November 2024, it is still the highest among all equity fund categories.

Mid- and small-cap funds witnessed a rise in inflows over the past few months despite choppy markets, with investors using the declines to buy more units. In fact, November 2024 saw mid-cap funds receive the highest ever monthly inflows at ₹4,883 crore, while small-cap funds witnessed the highest inflows in the last 13-month period.

These data points indicate that mutual fund investors have raised their risk tolerance when evaluating investment options.

- Also read: Leveraging equity taxation with arbitrage funds

Performance driven selection

Arbitrage funds have seen a 71.9 per cent rise in AUM YoY to ₹1.97 lakh crore in November 2024. Most of the funds delivered 8-8.5 per cent in the last one year. Since arbitrage funds enjoy the added advantage of equity taxation, investors seem to have taken a liking to the category, though there are clear risks.

Finally, gold ETFs also seem to have interested investors greatly, what with the yellow metal delivering nearly 27 per cent returns this calendar year. Assets rose by 63.9 per cent for the category.

Ideally, thematic/ sector funds and other riskier categories as well as commodity schemes (gold, etc) must not account for more than 10-15 per cent of a retail investor’s portfolio. But investor preferences seem more driven by recent performances and desire for higher returns without taking cognizance of the underlying risks.

Leave a Comment