Bitcoin price is once again showing strength as it bounced back almost 2% eyeing a move past $100K levels very soon. With more than 6% weekly gains, analysts predict that the BTC correction could finally be behind us. Moreover, investors can expect greater volatility moving ahead with Donald Trump swearing in just 15 days from now. Other macro factors like the US CPI release and FOMC could play a key role in driving volatility.

Where Is Bitcoin Price Moving Next?

Starting Monday, Bitcoin is entering week 10 of its price discovery phase with analysts closely monitoring the market’s ability to confirm the end of the corrective phase. As per Rekt Capital, BTC has effectively navigated the challenging Week 7 and Week 8 with only a modest -15% pullback, which is much less than the 30% decline seen during a similar phase in 2017.

The analyst added that the weekly BTC close above the blue support zone around $97,907 could probably market the end of the downtrend. However, to confirm the uptrend, Bitcoin price must give a close $100,970 level, as shown in the below image. In a message on the X platform, the analyst noted:

“Bitcoin is now back at the previously lost support area that is the blue Order Block ($97k-$98k). If Bitcoin Weekly Closes inside this blue area, there’ll be a good chance of reclaiming that previously lost support into support once again”.

Will BTC Break Past $100K Soon?

Bitcoin price closing above $100K is essential to confirm the uptrend for new highs in 2025. Some market analysts believe that this won’t be a linear path and could come with some volatility ahead. Popular crypto analyst Benjamin Cowen stated:

“BTC still looking similar to what it did exactly one year ago. Basically it first spiked up in early January, then down in late January, before picking back up more durably in February”.

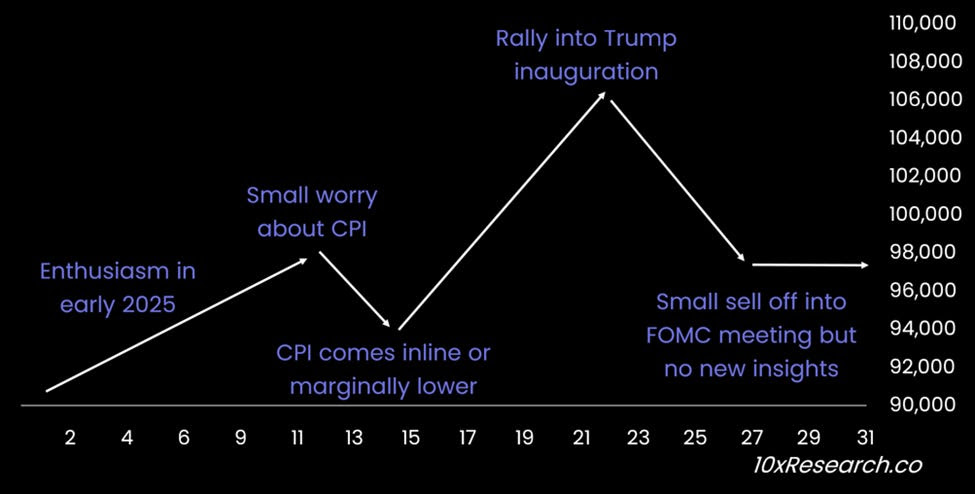

Similarly, 10x Research Founder Markus Thielen hinted at a positive start in early January but added that it could soon meet pullback ahead of the CPI inflation data release on January 15. The analyst believes that Bitcoin price can rally again by Donald Trump’s inauguration and then see a correction again by the FOMC meeting. In the 10x Research report, Thielen wrote:

“A favorable inflation print could reignite optimism, fueling a rally into the Trump inauguration. However, this momentum may wane, with the market likely retreating somewhat ahead of the FOMC meeting on January 29”.

As of press time, the BTC price is trading 1.12% up at $99,790. As per the Coinglass data, the open interest is up just 2.7% to $57.84 billion which shows that derivatives market interest and futures interest are still not much. Also, the 24-hour liquidations have shot up to $25.5 million.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Leave a Comment