The much-awaited demerger of the hotel business from the multi-sector diversified conglomerate, ITC, is in the final act now. The demerger is effective January 1, 2025. More importantly, the record date for determining the eligible shareholders who are entitled to the shares of the demerged entity is January 6.

The structure of demerger remains constant, in line with the initial announcement in July 2023. ITC retains 40 per cent of ownership in the demerged entity, ITC Hotels, and the remaining 60 per cent will be equally divided amongst the other shareholders in the ratio of 1:10, meaning one share of ITC Hotels for every 10 shares of ITC. It is important to understand here that post the demerger, existing shareholders of ITC will now directly own 60 per cent of ITC Hotels. The 1:10 ratio does not change anything in terms of ownership, but only reflects the fact that ITC Hotels will have a lower number of outstanding shares than ITC.

ITC Hotels will be operating as an independent entity, while leveraging the brand equity and strong parentage of ITC. Though ITC Hotels is only a fraction of the conglomerate, contributing around 4 per cent of its revenue and EBITDA, the demerger is nevertheless expected to aid ITC’s financial case.

With enough noise about the potential market-cap and price, let us deep dive into how ITC Hotels compares against its competitors and importantly, the market leader.

ITC Hotels vs competition

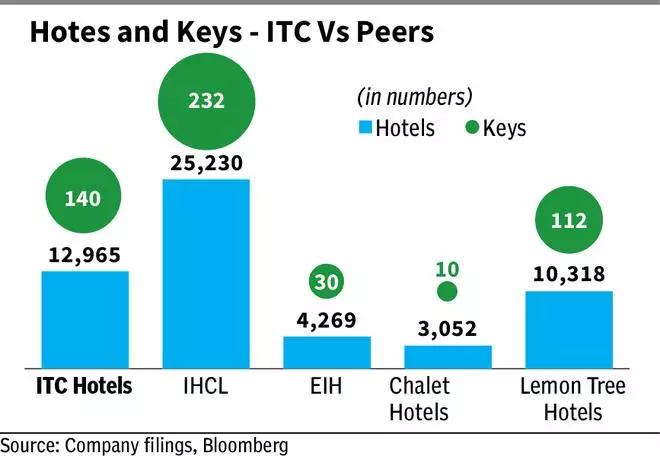

ITC Hotels is currently operating around 140 hotels and 13,000 keys across 90-plus destinations, and considering the pipeline for the next four years, this number is estimated to rise to 186 hotels and 17,200 keys. The owned assets to managed assets mix for ITC stands at 45:55 now. Managed assets are where ITC is responsible for renovation and operations, while lending its brand value to the asset owners. With focus on asset-light expansion with a tilt towards premium segment, this ratio is estimated to look like 35:65 by 2030, while the ratio of premium keys within the managed assets is expected to be at 42 per cent by FY30 from 29 per cent in FY22.

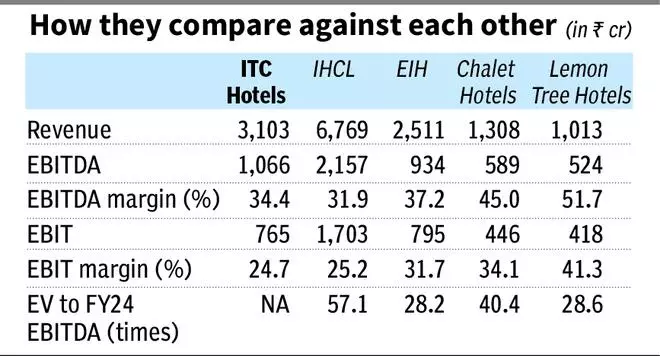

Revenue, EBITDA and EBIT have jumped 15.4 per cent, 25.1 per cent and 37.3 per cent respectively year on year in FY24. H1 FY25 also saw strong performance continue, already achieving around 45 per cent of FY24 figures, despite H2 typically being the stronger half. PAT figures were not made available by the company.

Revenue per available room (RevPAR) showed solid growth of 18 per cent and 14 per cent, in FY24, across its owned assets and managed assets respectively. Average room rate (ARR) also showed similar growth rates across 20 per cent and 15 per cent in the respective segments, which was largely in line with the industry average.

With around 28 managed hotels opened in the last 24 months, there is scope for operational leverage to kick in. And with focus on improving the share of managed assets, management fee, which grew at 21 per cent CAGR in the last five years, could grow at a faster pace going forward.

ITC Hotels is second largest in India, next only to the Tata Group-owned Indian Hotel Company (IHCL), with the latter operating a portfolio of 232 hotels and 25,230 keys.

Post the demerger, ITC Hotels will be a zero-debt entity with a cash reserve of ₹1,500 crore, which bodes well for its expansion plans.

The entire sector has been generously valued with IHCL leading the pack, being the most expensive at 57.1 times its EV to FY24 EBITDA. Chalet Hotels follows with 40.4 times, EIH with 28.2 times and Lemon Tree at 28.6 times. Basis the valuation of its peers, ITC Hotels is expected to command a market-cap in the wide range of around ₹30,000-60,000 crore. But it could be anybody’s guess!

Leave a Comment