It is clear that price stability and liquidity management got precedence over economic growth in the Monetary Policy Committee resolution of December 6, 2024, and attendant statements from the RBI. Even though real growth measured in terms of GDP at constant prices has slowed substantially in Q2 of 2024-25 to 5.4 per cent as against 8.1 per cent in Q2 of 2023-24, the MPC has refrained from a policy repo rate cut with a 4:2 voting by the members. In the words of the outgoing RBI Governor: “… only with durable price stability can a strong foundation be secured for high growth.”

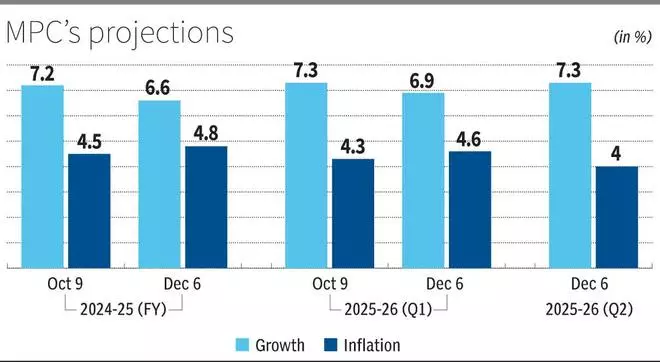

MPC has revised the real growth rate downwards and the CPI-combined growth rate upwards in its December 6 position as compared with the October 9 resolution (see Table).

The slowdown in real growth in Q2 to 5.4 per cent and the increase in CPI-combined inflation rate to 6.2 per cent in October (which was highest since 2023) have been termed as an “aberration” by the governor. To prove this point, as set out in the Table, the growth rate has been projected higher as 7.3 per cent and inflation rate has been reduced to 4 per cent in Q2 of 2025-26.

Given the potential uncertainty arising out of the subdued performance of the manufacturing sector, the slowdown in urban demand coupled with weak investment sentiments, there are doubts about the optimistic growth forecast. Geopolitical tension and geo-economic fragmentation could be a potential threat to commodity prices and a potential threat to continuing fuel group deflation for the 14th consecutive month till October 2024. In addition, clarity on monsoon and climate change has not unfolded. Therefore, there is a big question mark in bringing down the inflation rate forecast to the average of 4 per cent in Q2 as mandated in flexible inflation targeting (FIT).

As alluded to earlier, when price stability is the priority and the RBI is focused on controlling inflation and anchoring inflation expectations, the economy must then see a “disinflation glide path” which would come at the cost of growth. However, in marked contrast to this, the inflation and growth estimates have not explicitly recognised this. Estimates show inflation as coming down from 4.6 per cent in Q1 to 4 per cent in Q2 of 2025-26, and growth as going up to 7.3 per cent from 6.1 per cent in the same period. How will this work? The projection is inherently contradictory.

The debate on policy repo rate cut and inflation management in the MPC resolution is not new. Both the old and new MPC members have been differing with the monetary stance and policy repo rate cut. Since the October 2024 MPC resolution, the stance has been neutral to provide “flexibility to monitor the progress and outlook on disinflation and growth and to act appropriately.” However, the MPC has kept the policy repo rate unchanged at 6.5 per cent for the past 12 MPC cycles or past 24 months.

The October 2024 print of higher inflation (6.2 per cent) accompanied by slowdown of growth to 5.4 per cent in Q2 of 2024-25 have raised doubts whether India is facing “stagflation”. However, such a view is erroneous, given that it is based on limited data point, of October 2024 inflation rate and Q2 real growth rate.

In the above context, it is important to flag the outgoing Governor’s remark that price stability is essential for sustained growth, and if growth slowdown lingers beyond a point, it may need policy support. The Governor has also emphasised the criticality of the timing of a decision. However, given that two members have voted for a rate cut, forward guidance on the policy repo rate cut would have been appropriate at this time. This was missing.

Liquidity management

Now let us turn to liquidity management by the RBI and the decision on cash reserve ratio (CRR) and raising interest rate on Foreign Currency Non-Resident Bank [FCNR(B)] deposits. The RBI Governor announced a reduction in CRR by 50 basis point in two equal tranches of 25 bps with effect from the fortnight beginning December 14 and December 28, respectively. This will restore CRR to 4 per cent and would release primary liquidity of about ₹1.16 lakh crore to the banking system. The second announcement related to FCNR(B) deposits where the interest rates has been raised for maturity of one year to less than three years (Overnight Alternative Reference Rate or ARR plus 400 bps as against ARR plus 250 bps currently) and for maturity of three to five years (ARR plus 500 bps as against ARR plus 300 bps currently). This is a temporary measure available till March 21, 2025.

These two measures have been taken by the RBI to manage the potential adverse impact of tightening system liquidity in the coming months due to tax outflows, increase in currency circulation, and volatility in capital flows. Per Weekly Statistical Supplement (WSS) data, forex reserves declined by $17.76 billion during the week ended November 15. This implies that the RBI has sold these dollars to address the volatility in the foreign exchange market as the rupee depreciated against the dollar due to capital outflows.

While the reduction in CRR is a welcome move, encouraging capital flows through debt instruments like NRI deposits is a matter of concern as external debt will increase, as also the interest payment on external debt. As on June 2024 — the latest date for which data available — the outstanding NRI deposits stood at $194.1 billion, accounting for 28.4 per cent of total external debt. Further, an increase in NRI deposits as a debt instrument will be a burden as it will be repaid from the forex reserves.

To conclude, the RBI is not quite sure about the movement of inflation. In addition, it is concerned about the tightening of rupee and dollar liquidity but is somewhat comfortable with the growth trajectory. Therefore, in the December 2024 monetary policy statement, managing inflation and liquidity management gets precedence over growth.

The writer is a former central banker and Professor at Gokhale Institute of Politics and Economics, Pune. Views are personal. Through The Billion Press

Leave a Comment