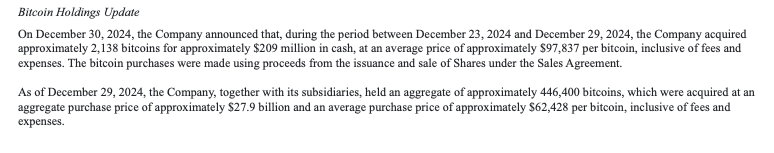

As 2025 Bitcoin predictions juice up, Michael Saylor is doubling-down after Microstrategy (MSTR) defied the crypto crash to buy 2,138 more Bitcoin at $97.83k.

According to an 8-K form from MicroStrategy to the SEC, this recent purchase, completed at an average price of $97,837 per Bitcoin, totals approximately $209 million.

(Source)

MicroStrategy Elevates Its Crypto Game, Adding Significant Bitcoin Holdings. A Strategic Move?

MicroStrategy’s latest

.cwp-coin-chart svg path {

stroke: ;

stroke-width: ;

}

Price

Trading volume in 24h

<!–

?

–>

Last 7d price movement

acquisition, carried out between December 23 and December 29, 2024, reflects the company’s ongoing strategy to diversify its treasury reserve assets with cryptocurrency.

This move isn’t just about investing; it’s a bold statement of confidence in Bitcoin’s long-term value proposition. Under the guidance of Michael Saylor, MicroStrategy’s executive chairman, the company has been aggressively accumulating Bitcoin since 2020, viewing it as a hedge against inflation and a cornerstone for its corporate treasury strategy.

#Bitcoin is a swarm of cyber hornets serving the goddess of wisdom, feeding on the fire of truth, exponentially growing ever smarter, faster, and stronger behind a wall of encrypted energy.

— Michael Saylor

(@saylor) September 18, 2020

With this acquisition, MicroStrategy now holds 446,400 Bitcoins, which, at current market prices, values their stash at around $41.8 billion.

This latest purchase was funded by selling MicroStrategy shares, showcasing how the company leverages its equity to expand its Bitcoin holdings.

The average purchase price of their entire Bitcoin portfolio now stands at approximately $62,428 per coin, indicating a significant unrealized gain if we compare it with the current Bitcoin price.

DISCOVER: 11 Best AI Crypto Coins to Invest in 2024

MicroStrategy’s Latest Buying period during 23rd trough 29th of December, 2024

MicroStrategy aims to protect against currency devaluation and benefit from Bitcoin’s potential for appreciation. This approach has redefined how corporations view digital assets and influenced other companies to consider similar strategies.

Moreover, MicroStrategy has introduced the concept of “Bitcoin Yield,” a key performance indicator that measures the change in its Bitcoin holdings relative to its diluted shares.

This metric showcases how effectively the company uses equity to acquire Bitcoin, providing a new lens through which investors can view the company’s performance.

My recent discussion with @MaddiReidy includes an elaborate review of MicroStrategy, #Bitcoin strategy, BTC yield, fixed income opportunities, and digital capital. pic.twitter.com/XceN8nlV48

— Michael Saylor

(@saylor) October 17, 2024

MicroStrategy Bets on Bitcoin and Its Market Influence

This latest purchase signals that MicroStrategy is not slowing down on its Bitcoin acquisition journey. With plans to continue this strategy, the company might soon approach or even surpass the 500,000 Bitcoin mark.

This would represent nearly 2.5% of the total supply of Bitcoin that will ever exist. This move could potentially influence Bitcoin’s market dynamics and its perception as a viable corporate asset.

MicroStrategy’s actions have ripple effects across the crypto market. By publicly backing Bitcoin, they provide a form of validation that can attract more institutional investors.

Their strategy has been a talking point for how businesses can integrate cryptocurrencies into their financial strategies. Furthermore, it drives the potential of Bitcoin as a reserve asset in corporate treasuries.

MicroStrategy’s acquisition of 2,138 Bitcoins underscores a continuing trend of corporate adoption of cryptocurrencies. This step highlights MicroStrategy’s commitment to Bitcoin and influences market sentiment, making Bitcoin increasingly relevant in mainstream finance.

EXPLORE: Ukraine deems Bitcoin illegal, Coinbase fights for new $50 million founding round and more

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The post MicroStrategy Bold Moves: Doubles Down by Acquiring 2,138 More Bitcoins at $97,837 Each appeared first on 99Bitcoins.

Leave a Comment